This week, inflation data provided some encouraging signs. Both the Consumer Price Index (CPI) and Producer Price Index (PPI) came in lower than expected.

Remember that CPI tends to follow PPI directionally, so we should expect more disinflation and therefore more fuel for rate cuts. This aligns with our long-held view that inflation will decline alongside economic slowdown, leading to interest rate cuts.

Today we look at why Zillow may be positioned well when rates are cut. We’ll explore this further below.

Here are 3 important data points we are following this week:

- Inflation Drop a Catalyst for Real Estate; Recent CPl ex Shelter falls below 2%.

- Zillow Has The Majority Market Share; 350m monthly active site visits, 3x peers.

- How Zillow Draws Its Traffic is Different; Homes.com 20% paid traffic vs 3% at Zillo

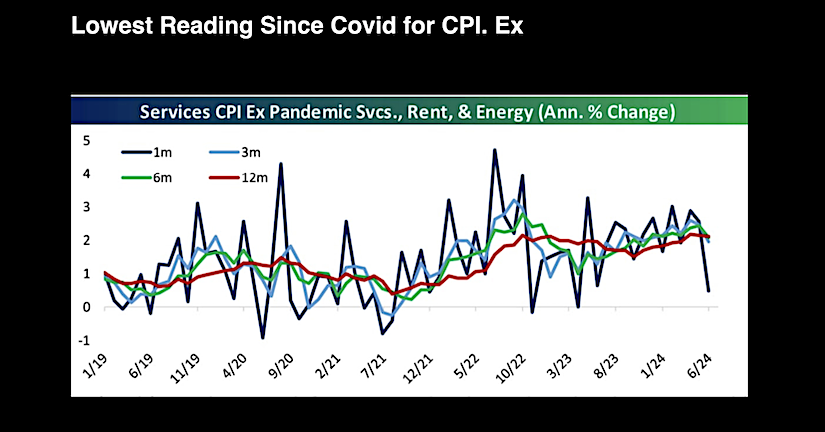

1. Lowest Reading Since Covid for CPI. Ex Pandemic Services, Rent, and Energy

Core CPI, which excludes volatile food and energy prices, slowed down significantly to its lowest monthly pace in nearly 3 years. This is a positive sign and policymakers are aware of the lag in rent data and are focusing on the bigger picture. Overall, this is the best inflation report we’ve seen since the pandemic. Here’s couple datapoints.

Core CPI excluding rent is actually decreasing month-to-month and is below 1% for the past 12 months, and 3 months annualized. Even services CPI, excluding housing and energy, which the Federal Reserve was worried about, has shown a significant drop. Net net, this data is supportive of rate cuts, and therefore investors should have their rate cut playbook. Zillow is at top of our list. (Investors).

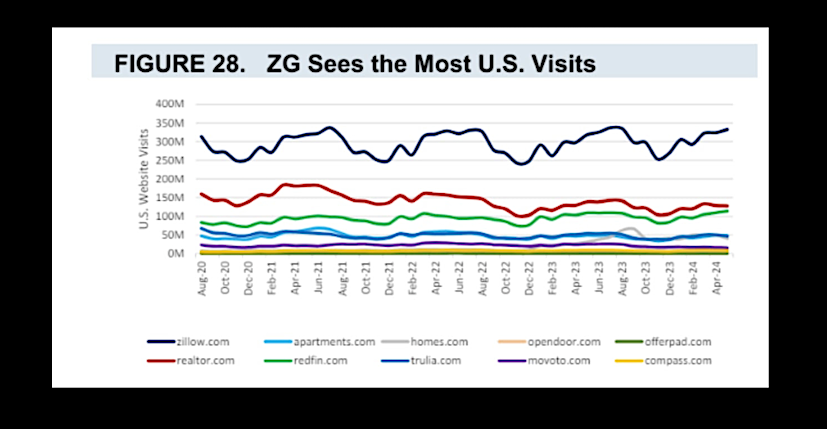

2. Zillow Well Positioned for Rate Drop with Healthy Market Position.

As inflation cools, investors should consider the 2nd and 3rd order effects. Real estate given the lack of supply and strong demand, will likely see a surge in activity with increased buying and selling. Who stands to gain from this dynamic? Real estate portals are prime candidates.

Zillow, for example, boasts 3x the web traffic of its closest competitor. They not only captured market share during the pandemic but have also managed to retain it over the past few years. The key, however, lies in understanding how they achieved this dominant position and whether is has been subsidized with ad dollars… See next data.

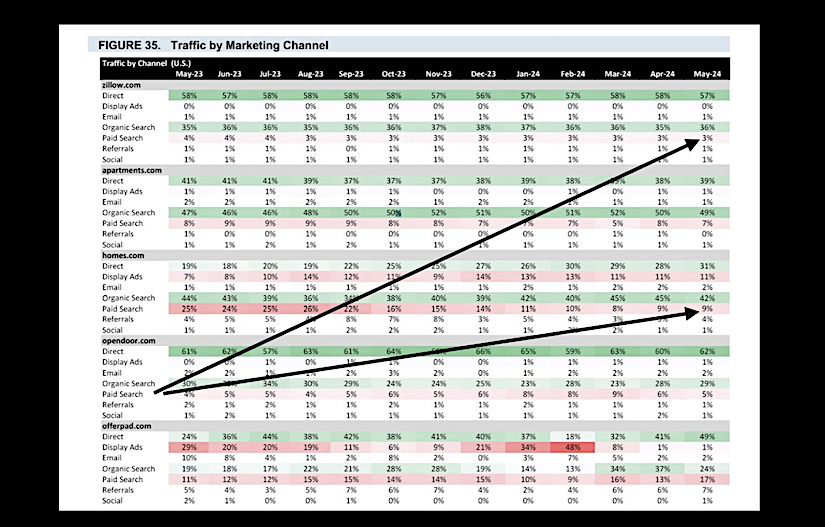

3. Zillow Doing it with Low Paid Marketing/Display Ads Versus Peers…

Zillow’s strength lies in its organic reach. Paid marketing, like display ads, contributes a minimal 3% to their website traffic. This stands in stark contrast to competitors like Homes.com and Apartments . com, where paid traffic makes up over 20% of their visitors.

This suggests two possibilities for Zillow when interest rates fall and the market heats up. Maintain their current strategy: Zillow’s organic traffic dominance allows them to continue focusing on free acquisition methods. Scale up with paid marketing: With a strong organic foundation, Zillow could leverage paid advertising even more effectively to drive even higher traffic volumes. This flexibility gives them significant growth potential.

Twitter: @_SeanDavid

The author and/or his firm have positions in the mentioned companies and underlying securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.