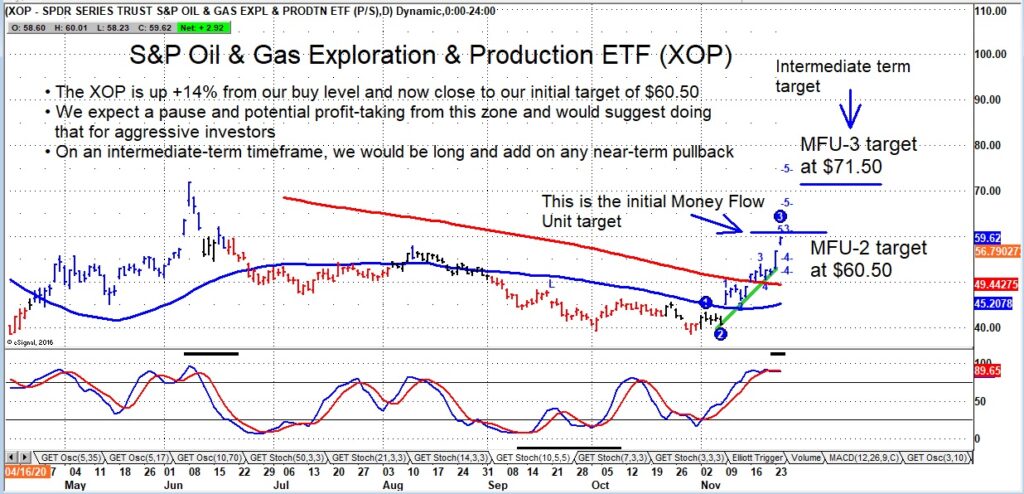

The Oil and Gas Exploration ETF (XOP) is up over 10 percent from our initial buy level and now close to our initial target of $60.50.

Aggressive investors can trim into this zone and buy a pullback if we do get it. That said, momentum remains firm and I think it’s wise to look for the intermediate-term price target of $71.50.

Oil and energy stocks are getting a boost from stronger crude oil prices.

Crude oil futures have rolled over to the January 2021 futures contract and its current price is at our MFU-3 price target level of $45.30. The price profile is slightly different from the December contract, but we still expect a pause into this zone. And, if we get it, we would be adding to long exposure.

The intermediate-term Money Flow Unit (MFU) work is bullish and we want to add to any weakness. Crude oil price strength will help keep a bid under the Oil and Gas Exploration stocks and ETF (XOP).

The author has a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.