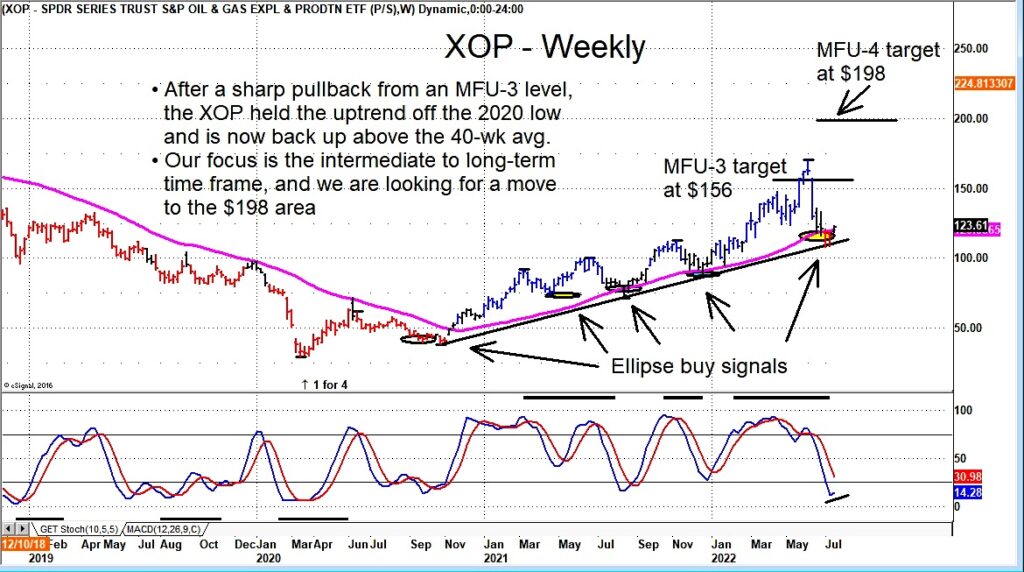

We felt like trapped bulls when the Oil & Gas Exploration ETF (XOP) got above our MFU-3 price target of $156 and then turned sharply lower in a short amount of time.

The entire energy sector corrected in very short order.

That said, this pullback has not changed the long-term bullish view in the sector and, if anything, it has provided an opportunity for active investors that missed the initial run with a chance to get in.

XOP is also showing a buy signal this week based on one of the mechanical systems we use. The last time this signal triggered was 8/23/21.

Though the markets are sure to be volatile, we think the energy sector is ripe with opportunity.

Twitter: @GuyCerundolo

The author or his firm have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.