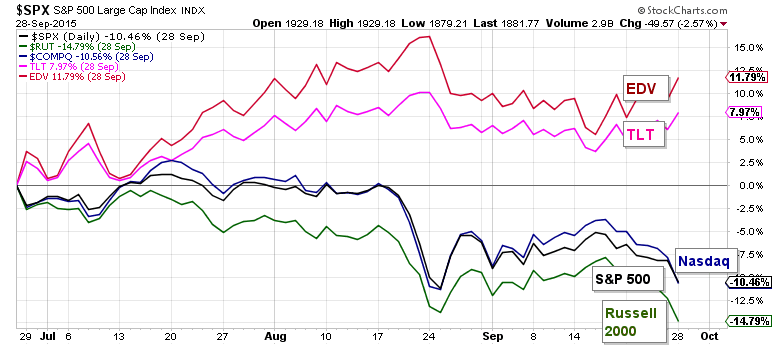

Monday marked yet another rough day in the markets. Here’s the damage for the major stock market indices yesterday: the S&P 500 was down 2.6%; the Nasdaq was down 3.0% and the Russell 2000 Index was down 2.9%.

Compare that to some of my favorite positions in this environment (Monday performance):

Cash: 0%

20+ Year US Treasury Bond ETF (TLT): up 1.7%

Long Duration Treasury Bond ETF (EDV): up 2.2%

As well, here’s a chart looking at each of these over the last 3 months:

To be fair, select treasury bonds had a very difficult second quarter this year and year-to-date bonds are near even (with dividends). Not great, but that performance is better than stocks year-to-date. Now for the real question I ask myself all the time: how should I be positioned going forward?

Here are a few more statistics that might help us figure that out:

- The IMF just cut it’s global growth forecast saying that a forecast of 3.3% global growth this year is no longer realistic.

- Analysts (the ones that were saying that the S&P 500 would be up 8% this year) are now cutting their Q3 earnings projections (i.e. lowering their forecasts).

- Japan’s Nikkei is down around -8% in the last month.

- The Indonesian stock market is down -25% since April.

- German stock market is down well over 20% since April.

- IBB (biotech index etf) is down over -20% since mid July.

- The S&P 500 and NASDAQ are down roughly 10% in the last 3 months.

- The Russell 2000 is down over -14% in the last 3 months.

- Healthcare (which had been the best performing sector of the year) is down over -12% in the last 3 months.

- Basic Materials is down nearly 20% in the last 3 months.

Here’s the main takeaway: Stock markets around the world are fighting the same problem: A LACK OF GROWTH. And the Central Bankers worldwide have yet to find an effective solution. Japan has been lowering their interest rates and debasing their currency for 30 years and they still can’t get growth or inflation. Why then should we expect what hasn’t worked in Japan to suddenly work in China or Germany or Canada or the USA?

So getting back to my main question above, how do I want to be positioned going forward?

I believe that US Treasury Bonds will continue to outperform stocks as long as the slow or no-growth situation continues. And it is likely to continue for several more months. Therefore, I expect to have large positions in US Treasury Bonds (spread across multiple maturities) and cash. I don’t expect to have significant amounts exposed to stocks but may have smaller positions as trades to capture some alpha on both the long and short side as opportunities present themselves.

There are two situations that would cause me to re-assess this viewpoint. First, if the Federal Reserve implements a new round of quantitative easing then it is likely that the stock market could resume an uptrend and even surpass its previous highs. (It is also possible, though, that the fact that our economy needs another round of stimulus combined with the fact that the last 3 rounds didn’t accomplish much could cause the stock market to lose confidence in the Fed and keep going down.) Secondly, if Congress is able to pass legislation that reduces taxes and/or regulations on businesses to help stimulate the economy. Again, just my view.

Until then, I believe we will continue to see gains on US Treasury bonds as it becomes more and more apparent the any interst rate increase is still months away.

Thanks for reading.

Twitter: @JeffVoudrie

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.