One of my favorite posts from this year was a post that I wrote in late June before I was on Sirius-XM’s “Behind The Markets” show: Confusion Reigns: Separating What’s Bullish vs Bearish In The Markets. In that post (and on the show), I laid out compelling cases for both bulls and bears to highlight why so many participants are confused by the market action in 2015, and in turn, why the market action is so confusing!

I encourage you to read through that list – I think you will identify with many of the bullish and bearish arguments on stocks (and fellow asset classes). The cross currents are also a reason why the S&P 500 hasn’t been able to breakout this year.

Often times when markets go through a transitional stage, and especially after several years of stock market gains, they move sideways and/or correct while digesting a multitude of crosscurrents until a prevailing trend emerges. And in this case, we are still waiting.

Over the past several weeks, a new element has been injected into the confusion (and confirmed with today Jobs Report): The very real chance that the Federal Reserve raises rates by the end of the year. At first glance, a 25 basis point move, or even a couple of them doesn’t sound like a big deal… but, it the Fed is poised to raise rates, the larger question then becomes how fast will they raise rates and what are the consequences for other markets around the world, including the forex (i.e. the Euro and by extension the situation in Europe) and emerging market debt. We may be facing an interesting juncture heading into year end.

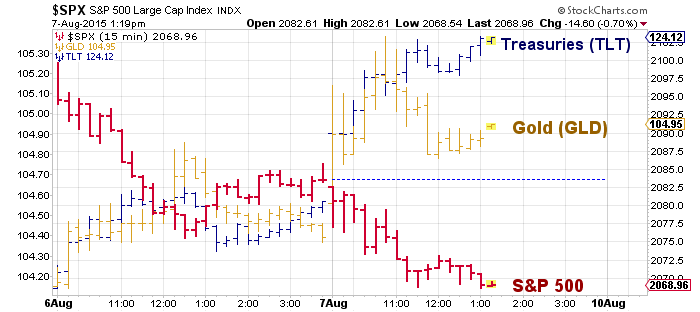

Below is a 15 minute bar chart showing the action of the past 2 days for the S&P 500, U.S. Treasuries (TLT), and Gold (GLD).

But one fact that has been shining through all the confusion this year is that U.S. equities have held up pretty well. I say this with two things in mind:

1) After big gains over 2013 and 2014, consolidation or a market correction shouldn’t be a “surprise”.

2) Commodities have collapsed and other major stock markets like Europe and China have declined since spring. European stock markets have been in correction mode since May (seeing the German DAX fall as much as 14 percent). And the Chinese stock market has been in crash mode, falling as much as 30 percent.

So with this in mind, perhaps a deeper pullback or market correction would create an opportunity in U.S. equities if other markets (and asset classes around the world) continue to struggle and capital looks for a new home.

The prospect of higher rates often brings turbulence, so I would not be surprised at all by a move lower in U.S. stocks over the coming weeks. For now, though, I’ll simply remain cautious. But as an active investor, the benefit is that I’m often very heavy in cash and simply looking for opportunities as they unfold. Patience is fine by me.

It’s also worth noting that Ryan Detrick’s post last month on why rising interest rates can be a positive sign for the stock market.

Be on the lookout for an S&P 500 technical update this weekend. Thanks for reading.

Twitter: @andrewnyquist

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.