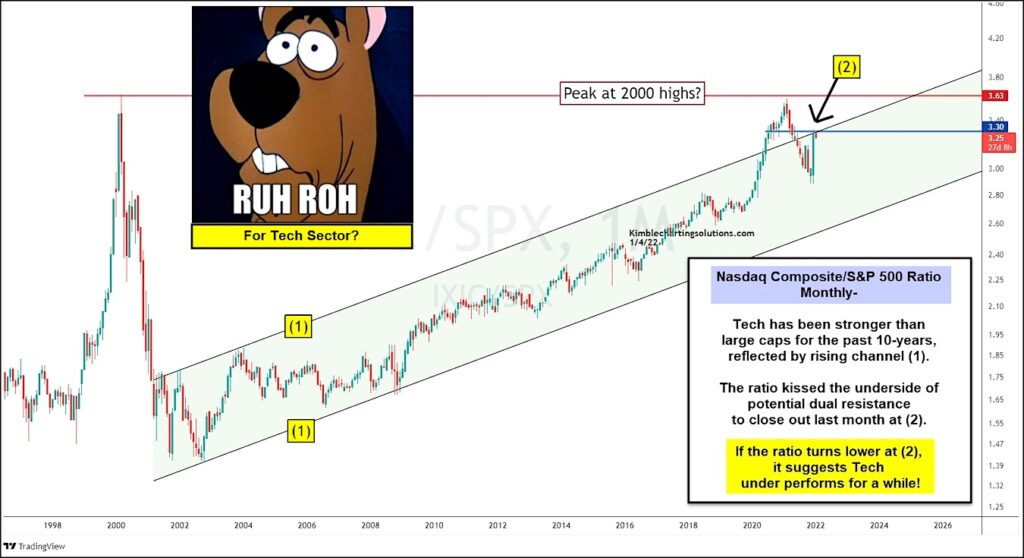

Tech stocks began under-performing the broader market several months ago when the ratio of the Nasdaq Composite to S&P 500 Index peaked out at the 2000 high.

This is worth noting because this tech ratio has been in a rising up-trend for the past two decades, highlighted by each (1) on today’s “monthly” chart.

While this suggests long-term strength, it doesn’t mean that strong pockets of under-performance (corrections) cannot emerge. This is exactly what we saw over the past year or so.

That said, tech stocks perked up into year-end, with the ratio kissing the underside of potential resistance to close out December at (2).

If the ratio turns lower at (2), it suggests that tech stock may under-perform for several more months. Stay tuned!

Note that KimbleCharting is offering a 2 week Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.