THE SAME NARRATIVE OVER AND OVER AGAIN

Jesse Livermore’s “there is nothing new on Wall Street” applies to the never-ending commentary about the impact of oil prices on the economy, earnings, and the stock market.

We are currently in a “rising oil prices will kill the economy and stock market” period. Therefore, it is prudent to ask:

“IS IT POSSIBLE FOR STOCKS AND THE ECONOMY TO PERFORM WELL DURING A PERIOD OF RISING OIL PRICES?”

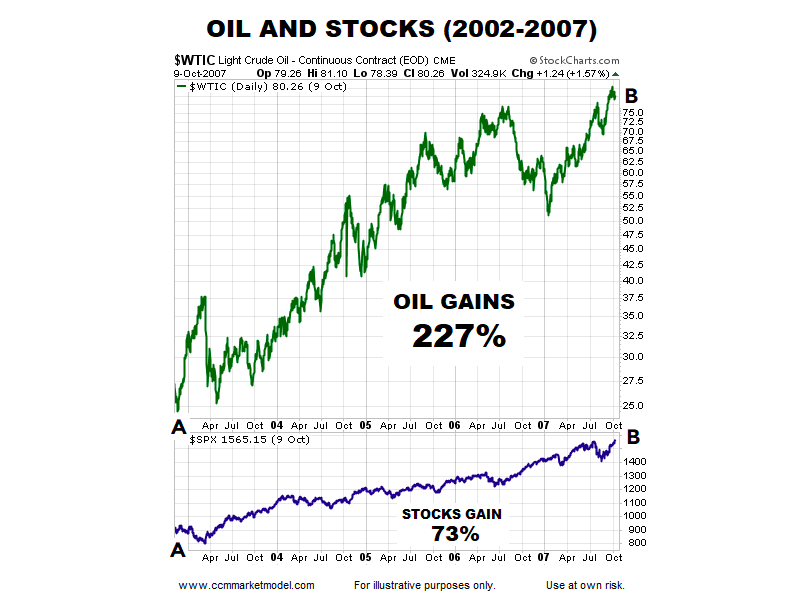

The chart below shows the price of crude oil and the S&P 500 between November 2002 and October 2007. As you can see, stocks gained 73% during a period that featured a 227% rise in the price of oil.

STOP WASTING ENERGY ON STOCKS AND THE PRICE OF OIL

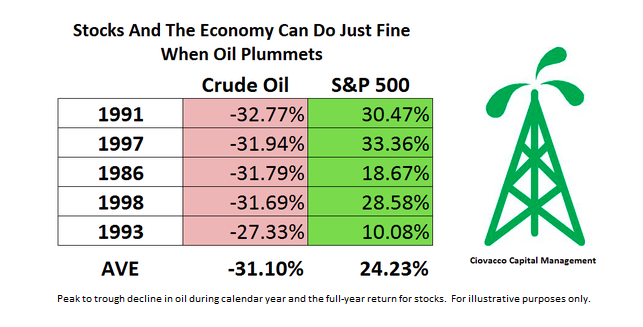

It was not long ago that we were in a “falling oil prices will kill earnings and the stock market” period. The table below shows calendar years that contained a significant peak to trough decline in the price of oil. As you can see, stocks can perform just fine in years that feature a significant decline in the price of oil.

MORAL OF THE STORY

The correlation between oil prices and stocks is all over the place:

- Sometimes oil rises and stocks rise

- Sometimes oil rises and stocks fall

- Sometimes oil falls and stocks fall

- Sometimes oil falls and stocks rise

If you are trading or investing in oil, then it is prudent to track the price of oil. If you are trading or investing in the stock market, following the price of oil will do nothing but confuse you. There is no consistent or meaningful correlation between the direction of oil prices and the direction of the stock market.

Twitter: @CiovaccoCapital

The author or his clients may hold positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.