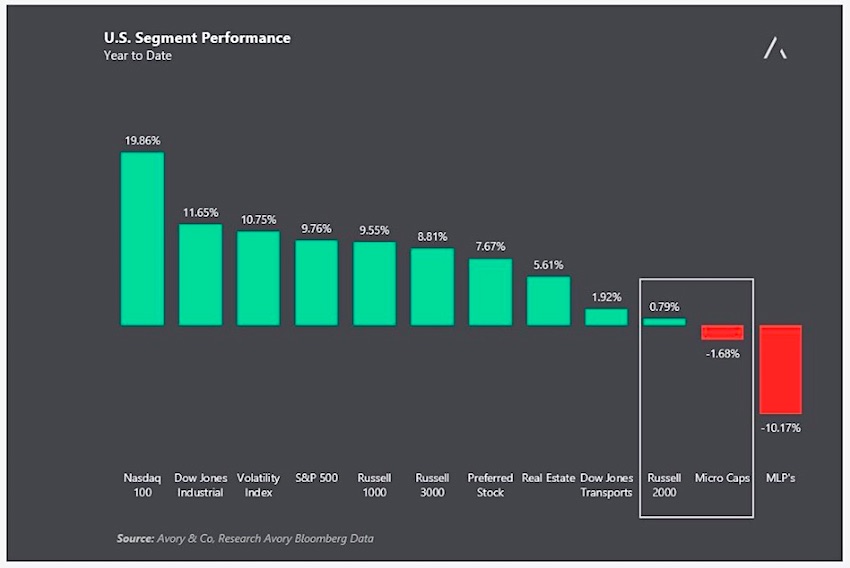

It’s been a good year for investors thus far in 2017. The S&P 500 Index is up nearly 10 percent and the Nasdaq Composite is up almost 20%.

But, if one digs a bit deeper, they’ll notice the glaring underperformance of small cap stocks (i.e. Russell 2000) vs large cap stocks (i.e the S&P 500).

Further, if the year is going to end on a high note, it may depend on how small caps and micro caps perform from here on out.

Small cap stocks as measured by the Russell 2000 Index (INDEXRUSSELL:RUT) and micro cap stocks (NYSEARCA:IWC) carry more risk and thus tend to be good indicators of investors risk tolerance. When the markets are in “risk-on” mode, it’s a good sign to see the higher beta small caps performing well.

On the flip side, when the market is in “risk-off” mode, small cap stocks tend to underperform… often getting hit the hardest in stock market corrections.

Over the last few weeks, small and micro cap stocks have been hit hard. The Russell 2000 is up just 0.79% on the year and the micro cap stock index is down -1.68%. If these trends continue, it could spell trouble for investors over the near-term.

U.S. Equities Segment Performance – Small & Micro Caps Underperformance

Thanks for reading.

Twitter: @_SeanDavid

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.