Over the past week, the financial blogosphere has been packed with articles about the tendency for SPY underperformance in June. From Ryan Detrick’s study of June entitled “Welcome To The Worst Month For Stocks Of The Past 10 Years” to SentimentTrader’s daily breakout of June’s daily woe’s, the odds don’t favor outperformance by the large caps. Which begs the question, how do small cap stocks tend to perform in June?

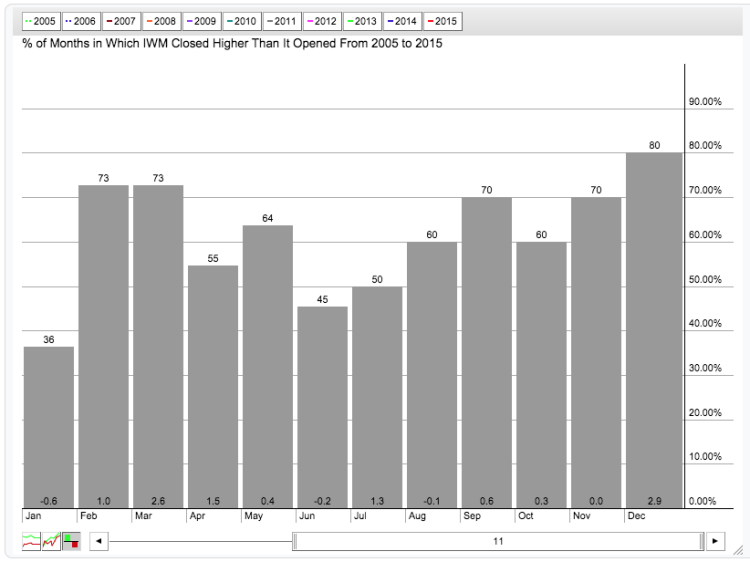

Short answer: not great. As you can see from the chart below, it’s slightly worse than a coin toss as to whether the small caps via the iShares Russell 2000 ETF (IWM) will be up by the end of June.

IWM – Small Cap Stocks

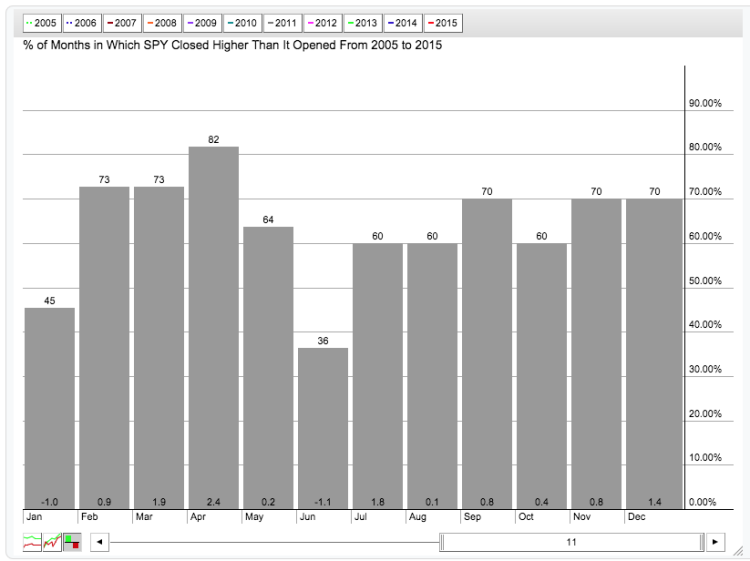

SPY – Large Cap Stocks

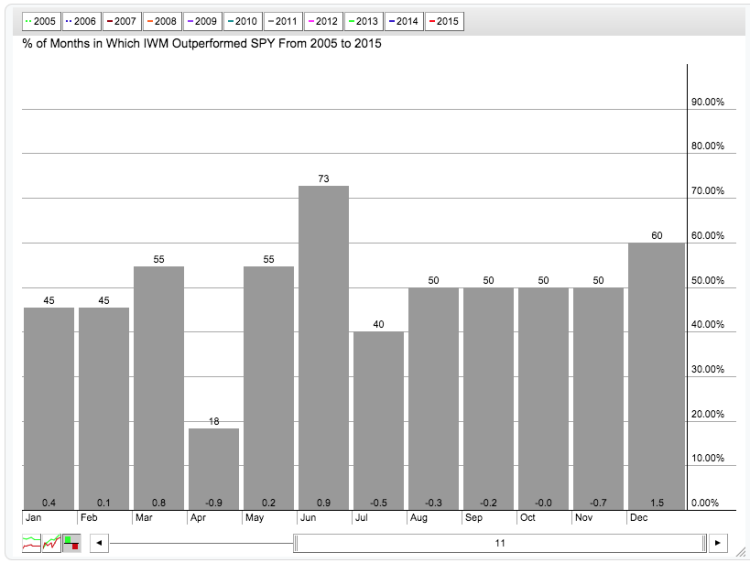

However, this 45% positive measure is considerably better than the SPDR S&P 500 ETF (SPY) at 36%. And when we compare the two ETFs, we can see that IWM has outperformed SPY 73% of the time – more than any other month since 2005.

So while we should not expect much from the small cap stocks this month, it is likely, if seasonal tendencies hold, that IWM will outperform the SPY. Perhaps this could be the start of a promising pairs trade for the month…

It’s important to note that we are already seeing SPY underperformance this month, with SPY down 0.6%. And Small cap stocks via IWM are bucking the trend currently, up 1.2% on the month after a week of trading.

Thanks for reading and have a great week.

The author holds a calendar spread in SPY with a slightly net bearish position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.