As long as stocks are rising, bullish investors want their cake and to eat it too. Doesn’t matter what the concern is…

Until it does matter.

Today is a really short and easy read with little to no technical analysis. Just a macro observation that investors should be watching, in my opinion.

Interest rates have been rising in the face of the Federal Reserve cutting. This has some concerned that inflation and other market related forces like debt might be driving rates higher. So when do we get concerned?

Note that the following MarketSurge charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of tools, education, and technical and fundamental data.

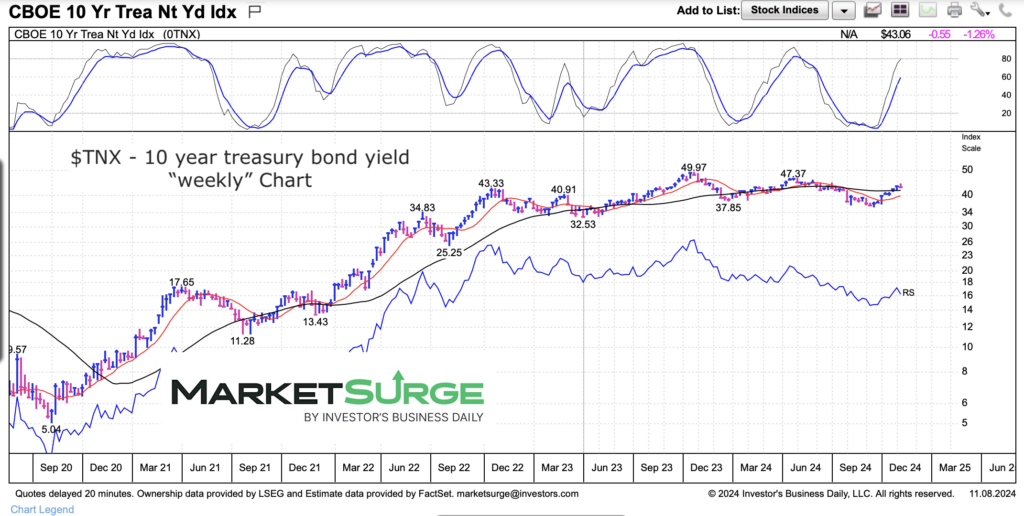

10-year US Treasury Bond Yield Chart

As you can see, bond yields (interest rates) have been on the rise post-Covid. And it seems to me that this move higher is part of a much larger reversal out of the low-interest rate environment.

The past two years has seen interest rates consolidate between 3.25% and 5.0%, while spending most of the time trading over 4%. While a break below 3.6% likely indicates more downside, I’d get concerned about another move higher if we trade back above 4.75% and confirm those concerns on a move over 5%. Though it may be an excuse for an overdue stock market correction, bulls definitely don’t want to see another move higher in rates.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.