Trading momentum indicators slowed down several months ago for the precious metal industry.

And, as any investor might imagine, gold and silver stocks have struggled. Especially mining stocks.

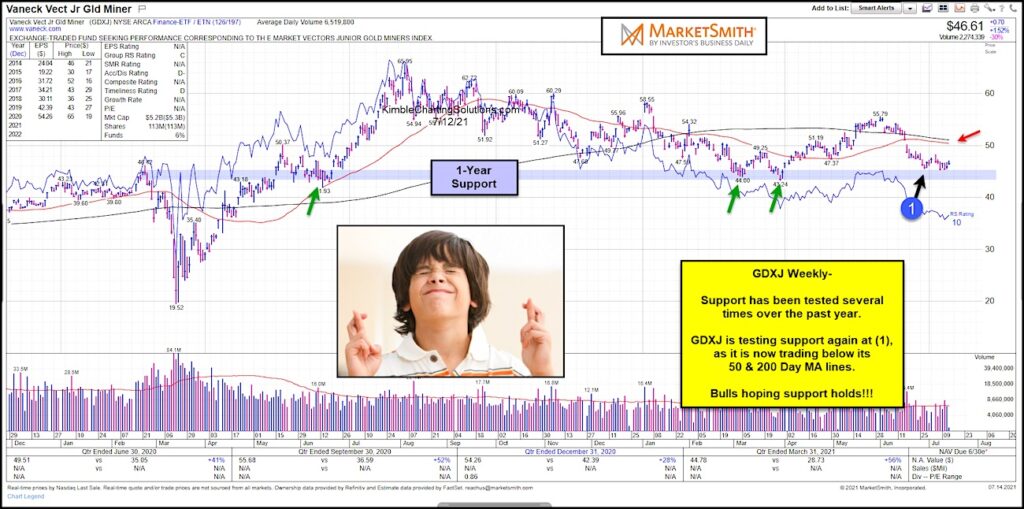

Today we take a look at the Junior Gold Miners ETF (GDXJ), highlighting some bearish indicators that traders should be aware of.

The first is that the price of GDXJ is below its 50 and 200 day moving averages… and it’s been this way for several days. The second is that GDXJ is testing important price support while its relative strength indicator is weak / lagging. This doesn’t mean that GDXJ is going to breakdown, but it does mean that traders should be concerned and aware.

Bulls are hoping support holds here! Will buyers emerge? Or will GDXJ breakdown? Stay tuned!

Junior Gold Miners ETF Chart

Note that KimbleCharting is offering a 2 week Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.