While higher gas prices may be welcome news to the oil industry, the rest of us should be concerned as it is a glaring recession warning. Over the last 40 years, higher gas prices have been linked to economic stagnation and recession.

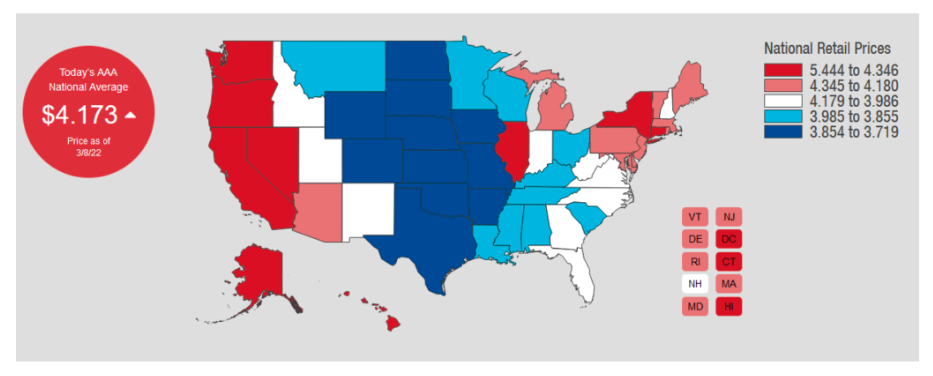

The Ford F-150 is the most popular car in America, per Edmunds. It gets on average about 21 miles to the gallon. The U.S. Department of Transportation claims Americans drive 13,500 miles a year. According to AAA, the average price for regular gas was $2.76 a year ago. Today the average is $4.17. The average U.S. consumer spent $1,774 on gasoline a year ago. At current prices, the average consumer is spending nearly $1,000 more.

The current spike in oil and gas prices is primarily due to two factors. The elephant in the room is Russia and its invasion of Ukraine. Second, and behind the scenes, is the global push toward greener energy sources.

We explore these considerations and the relationship of high gas prices to economic activity to help better appreciate the recessionary omen staring us in the face.

We use the terms oil and gas interchangeably throughout this article. Please understand gas is a byproduct of oil, and therefore its price is a function of oil prices and other factors.

High Gas Prices and Recessions

Before a broader discussion of why oil prices are increasing, we explain the extensive role that oil plays in the economy and why the price of oil can have such a significant impact on economic activity.

Micro Perspective

Personal consumption accounts for about two-thirds of economic activity. That is a very important consideration when thinking about gas prices and economic activity.

In economics, gasoline is considered an inelastic good. Regardless of how high the gas price is, consumer demand does not vary much.

Without gas, we can’t get to work, go shopping, or do many of the things we enjoy. Accordingly, the price of oil and specifically gasoline play a prominent role in budgeting our money. Given the difficulty in reducing gas usage, many consumers must spend less on other items or borrow to offset higher gas prices.

The less obvious but equally important role gas prices play is with our consumer psyche. Gas prices are better advertised than any other good or service. Gas stations are everywhere we drive, and every one of them has a billboard flashing gas prices. The price of gas is one of a select few items in which most consumers can regularly quote a price with great accuracy.

As gas prices rise, consumers tend to associate it with broader inflation, whether true or not. Energy goods and services only account for 7.5% of CPI, but it plays a much bigger role in many people’s minds. As such, higher gas prices drive a greater fear of inflation which often causes consumers to pull back on other purchases.

Macro Perspective

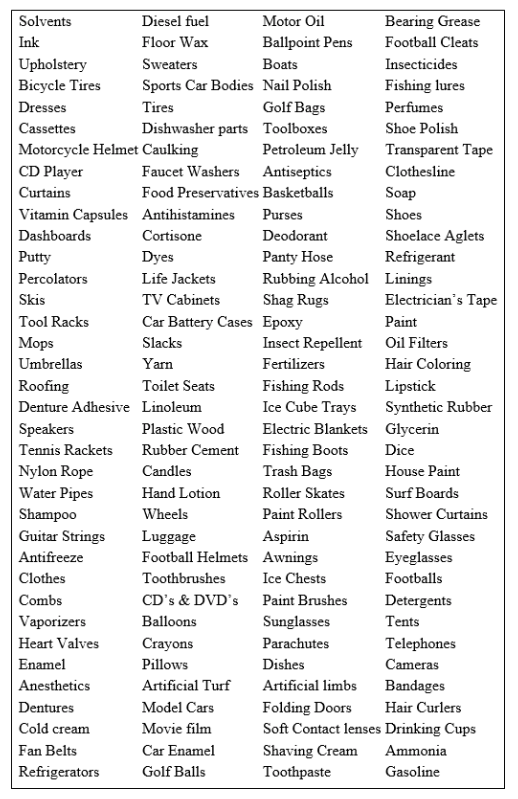

Oil is not just used to fuel our engines, but it is a component in a considerable number of products. Even if oil or an oil byproduct is not a product component, it plays a role in producing and shipping that product to the consumer. The list below from Ranken Energy scratches the surface of everyday products made from petroleum.

Given the widespread reliance on oil in almost every good, there is a strong correlation between oil prices and economic activity.

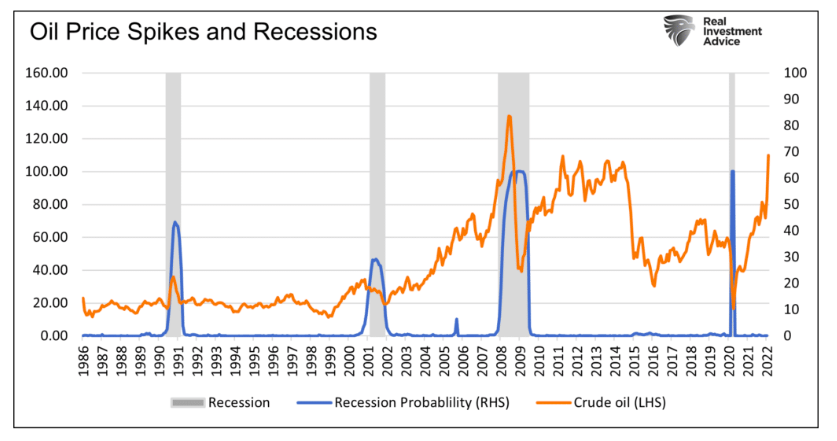

The graph below shows spikes in oil prices (orange) correspond well with recessions (gray) and recession probabilities (blue). The St. Louis Federal Reserve furnishes recession probabilities data. Data. Jeremy Piger’s website contains more information on the calculation behind the data.

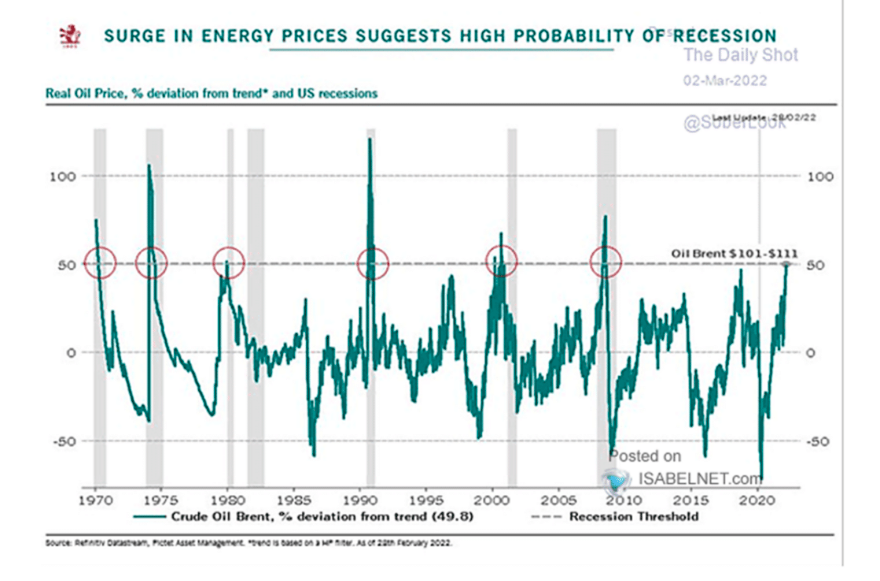

The graph below, courtesy of Pictet Asset Management, goes back a little further in time and affirms the relationship between oil price spikes and economic activity.

Russia – The Elephant in The Room

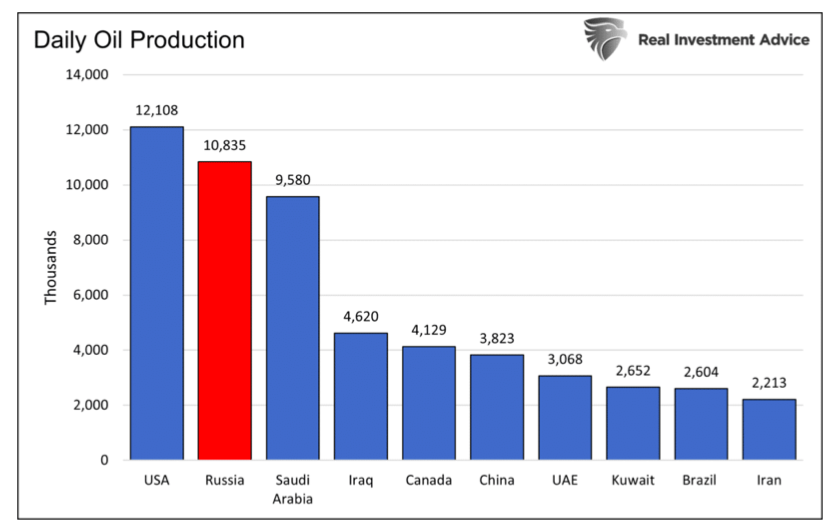

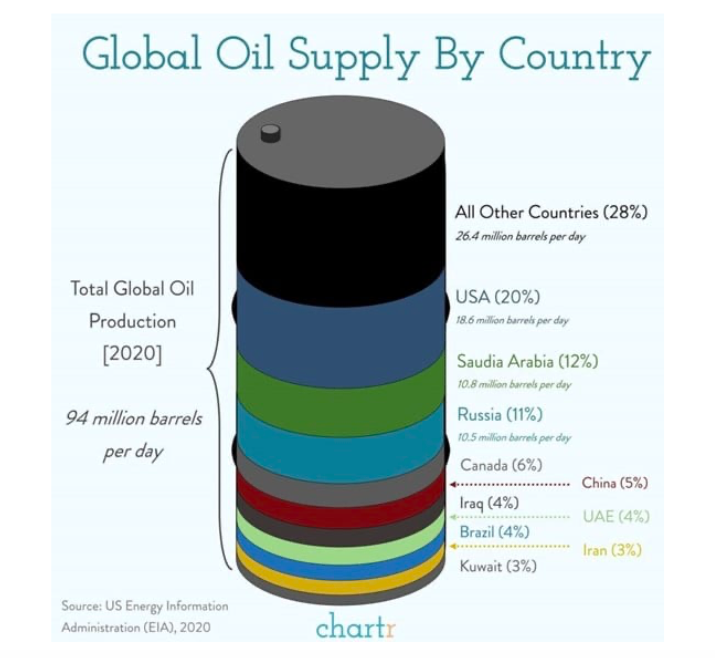

Russia is the world’s largest natural gas producer and edges out Saudi Arabia behind the U.S. in oil production. It accounts for about an eighth of global oil production.

Sanctions on Russia and the ramifications of the invasion are beginning to significantly impact the oil price. However, the flow of oil from Russia has not yet been materially curtailed. A further ratcheting of sanctions, especially any directed directly at their ability to sell oil, will push gas prices higher.

Crude oil traders do not wait for sanctions to be levied. They put odds on such sanctions. As such, the price of oil today reflects the market’s collective mindset on what may or may not happen with Russia.

The longer the conflict carries on and the more intense the fighting, the higher the likelihood that oil prices will stay elevated and possibly rise further.

On March 2nd, OPEC elected to stick with its current plan of gradual production increases. They had an opportunity to increase production considering the crisis but didn’t.

Many nations are releasing oil from their reserves. Thus far, these actions have had a limited ability to counteract rising prices. Barring an immediate sharp decline in demand, which is not probable, or cessation of Russian activities, oil prices will weigh on economic activity.

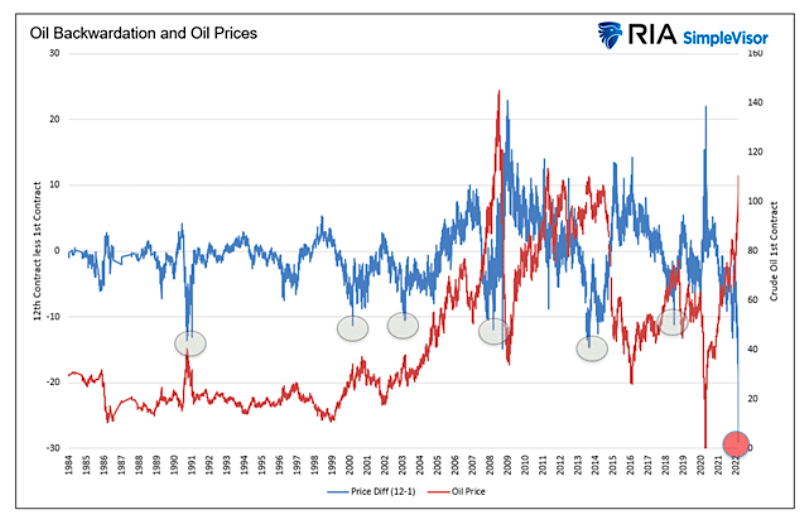

The graph below shows that the backwardation of oil futures prices is extreme. Without going into detail, the chart below shows that oil prices are between $20 and $40 a barrel above what fundamentals justify. For more information on the graph, please read our Daily Commentary from 3/8/2022.

Green Energy

Higher gas prices are a result of the Russian crisis and a function of the macro trend toward disinvestment from carbon-based energy sources. Per CNBC, “investment in new wells has dropped 60%, causing U.S. crude oil production to plummet by more than 3 million barrels per day, or nearly 25%.”

Instead of investing in new wells and exploration, oil companies are giving precious capital back to their shareholders and executives. Per Accountable U.S.:

- 12 oil and gas corporations buying back over $8 billion worth of stock by the end of the year with plans to buy even more in future quarters

- 16 oil and gas corporations raised their dividend at least once in 2021

- 11 oil and gas companies gave payouts to shareholders totaling north of $36.5 billion

- The same corporations paid their CEOs massive salary and compensation packages- most over $10 million, and as high as $33 million for Chevron CEO Michael Wirth.

At first blush, many are angry at such profit-motivated actions. However, put yourself in management’s shoes. Energy companies and their customers are increasingly under heat to reduce their carbon footprint. Assuming the push toward green energy continues, executives must carefully consider new long-lived projects not only from an environmental perspective but from a profit perspective. Higher taxes on oil and oil exploration and increasing sources of green energy will potentially make future drilling less profitable. Unknowns such as these result in a lack of investment into the oil infrastructure.

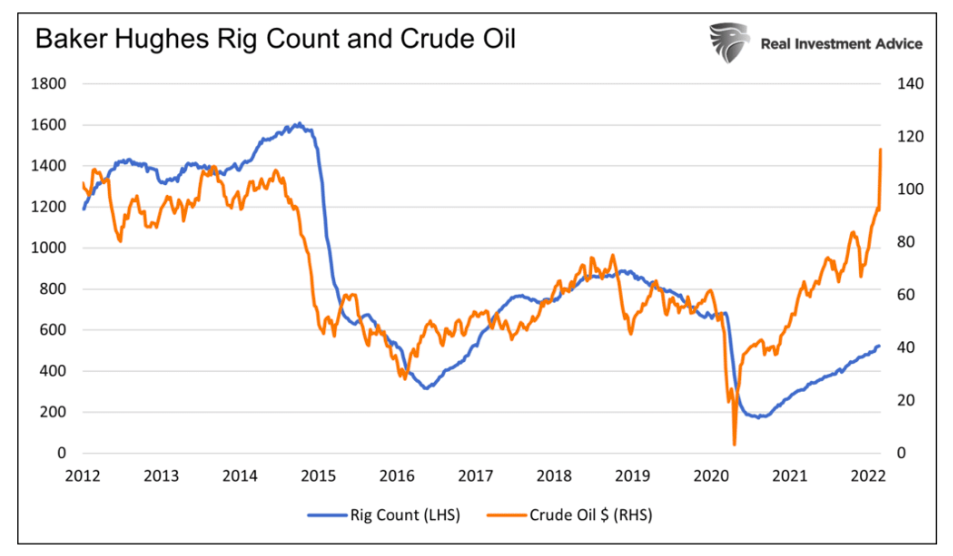

To this end, U.S. oil rig counts have woefully kept up with prices as they have in the past. Based on the current oil price, we should see more than twice as many oil rigs in operation.

Summary

As if declining production and the Russian invasion of Ukraine weren’t enough of a problem, oil prices are also being boosted by rising demand. As the global economy normalizes from the pandemic, demand is steadily increasing. Higher gas prices are a tax on consumers and corporations. They will slow economic growth and eventually reduce the oil demand.

It’s too early to say if higher oil prices and other economic factors will ultimately cause a recession. However, economic activity is already weak this quarter. The Atlanta Fed GDPNow model forecasts 0.0% GDP growth for the first quarter. The effect of $4 or $5 gas has yet to factor into their forecast.

We will begin to get a better idea of how current gas prices impact consumption in mid-April when the next round of economic data is released. Until then, we can track consumer sentiment gauges to foreshadow what the spring months have in store.

Twitter: @michaellebowitz

The author or his firm may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.