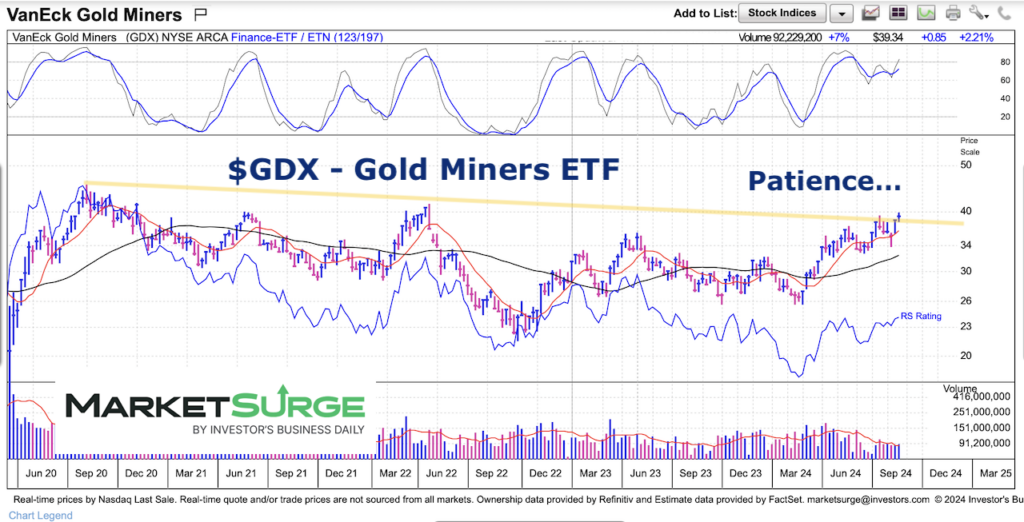

Gold has been a market leader and top performing asset in 2024.

We recently highlighted this while pointing to two bullish gold mining stocks (Agnico-Eagle Mines and Barrick Gold).

Today, the Gold Miners ETF (GDX) is testing important breakout resistance. And the fate of many gold mining stocks may hinge on if/when GDX breaks out over this price resistance level.

Check out today’s chart below.

Note that the following MarketSurge charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of tools, education, and technical and fundamental data.

$GDX – Gold Miners ETF “weekly” Chart

The Gold Miners ETF (GDX) is attempting to breakout over is declining trend line. If we see follow through buying over this level it will be an indication that gold stocks are ready to follow gold prices higher.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.