Russian economist Nikolai Kondratiev identified long-term growth cycles (50+ years) in market economies almost a century ago. And I believe the economic turbulence over the past several years is part of a global shift into the next Kondratiev Cycle. For developed nations, this has been a drawn out and painful transition. One byproduct of the current Kondratiev wave transition is the Great Rotation, a phrase highlighting the transition from long-term bonds to stocks. The Great Rotation really made its mark in 2012 when stocks roared ahead, overtaking long term bonds. But as we look around the global economy, not all stock markets have roared ahead. More specifically, I’m wondering where the second largest economy is in all this? Where’s China?

Sleeping Giants Wake Up

The dot.com bubble marked the peak of the last secular bull market in the US. And large cap tech companies responsible for producing the technological infrastructure the world runs on, went to sleep. The following decade-long secular bear saw China firmly establish itself as a great economic power, and by 2009, growth traders were familiar with the tickers of Chinese ADRs. However, the excitement was short lived and the Shanghai Composite Index (SSEC) peaked later that year. Then Europe imploded, the world teetered, and the Mayan calendar trended.

The dot.com bubble marked the peak of the last secular bull market in the US. And large cap tech companies responsible for producing the technological infrastructure the world runs on, went to sleep. The following decade-long secular bear saw China firmly establish itself as a great economic power, and by 2009, growth traders were familiar with the tickers of Chinese ADRs. However, the excitement was short lived and the Shanghai Composite Index (SSEC) peaked later that year. Then Europe imploded, the world teetered, and the Mayan calendar trended.

However, the world did not end, and those sleeping tech giants began to wake up (see breakout charts for HPQ, CSCO and INTC at the end of the post). The market was transitioning to a return to growth. And as fear abated, money moved from bonds back to stocks… fueling the Great Rotation.

The Chicken and the Egg

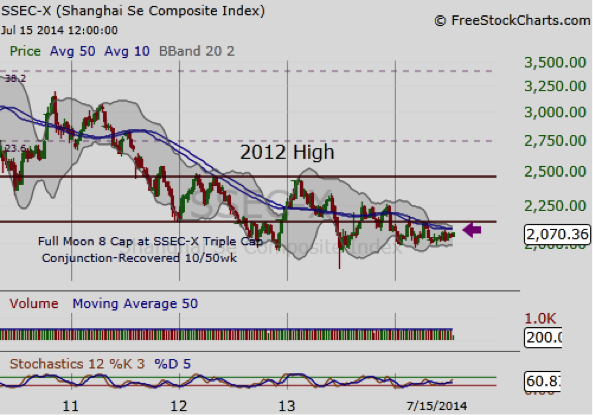

Signs that the developed economies are healing tell us to look for growth in China once again. However, almost two years after the beginning of the Great Rotation, the Shanghai Composite Index continues to trade in a sideways range. Last fall, the composite showed signs that China was ready to join the recovery, but the breakout attempt failed.

Today, the riddle of the Chicken and the Egg comes to mind. In 2013, sleeping tech giants broke out after an initial failed attempt (perhaps due to China failing to gain traction). This begs the question: were the Sleeping Giants waiting on China or is China waiting on the US? Perhaps Both.

Notice the SSEC broke out of its 10/50 week moving average last fall, only to falter and fall back through this support. This coincided with hiccups in retail (US consumer) and a disappointing holiday season. US consumers weren’t shopping and this had a negative effect on US retailers, which in turn hurt our trading partners. Since the breakout failure, the composite has traded in a tight range, neither breaking down nor breaking out, indicating it is still waiting. However, in recent weeks, we have seen strong bullish action by CSCO and INTC, and once again I ask, “Is it time for China?”

SSEC Shanghai Composite Index – Weekly Chart

EXTRA: Charts of Sleeping Giant Breakouts

HPQ Just Before its Breakout in December 2012

CSCO Breaks Out March 2013

INTC Second Breakout Attempt November 2013

For more on the Kondratiev Cycle and China:

Owen, Deborah; Griffiths, Robin (2006). Mapping the Markets: A Guide to Stockmarket Analysis. Bloomberg Press: New York.

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.