International equities have posted some excellent returns in 2024. But with such U.S. dominance, do many people know?

The allocation decision for many investors to overweight U.S. equities has been justified to the highest degree.

There has been an astronomical outperformance of U.S. equities to the world over the last 15+ years. You have to go back to the mid-2000s during China’s rapid expansion to see any sort of sustained international outperformance.

Looking forward, we believe there is a potential for mean reversion between the U.S. and international, albeit anyone saying this for the last 10 years has been quite wrong. However, some cycles take longer than others, and at this point in time, the setup for international, specifically emerging markets, looks particularly positive.

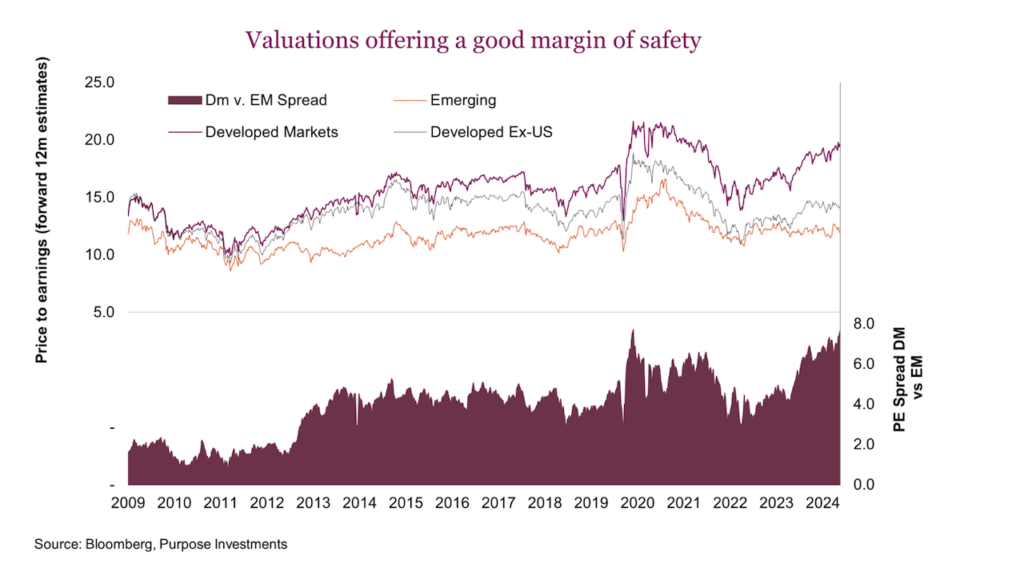

Valuations – Comparing valuations from one market with another is akin to apples and oranges, as different markets have differences in underlying compositions, sector weights and growth characteristics. But they do still matter. While valuations are at the high end globally, there is certainly a larger cushion within the international markets. The higher valuations in the U.S. have been justified as there has been higher growth, higher earnings, and certainly higher sentiment.

Looking ahead, two things can be true: Emerging markets (EM) are almost always cheaper than developed markets (DM), and valuation gaps tend to attract attention when they reach historic extremes. That is certainly the situation with the spread between Forward P/E ratios for developed and emerging markets. This spread has climbed to over 7.5 points, with a 1.5-point increase coming in the last few months.

The emerging markets are composed of more cyclical economies, and earnings can be highly variable; therefore, a cheaper market is justified, but the current valuation gap is at very extreme levels when compared to history, which has not lasted long. The spread provides a compelling valuation argument for emerging markets and developed ex-US markets to view them more favourably, or at the very least, temper fears about potential downsides.

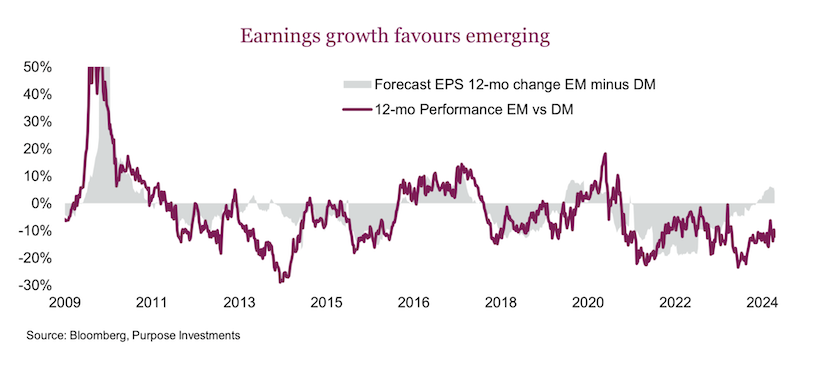

Earnings – In the middle of 2024, earnings growth forecasts were very high in the U.S. and low internationally. However, earnings estimates for 2025 have started to soften across the globe. The risk of this seems to be largely ignored; perhaps the ignorance of the U.S. earnings expectations falling is due to coming off such high highs. However, the risk is likely higher for U.S. equities, given how much the elevated valuations are supported by their earnings growth. The simple truth is if earnings growth falls short, markets trading at a low valuation will not be hurt as much compared to those at a high valuation. A resurgence in inflation, a slowing of top-line growth, and an increase in costs would not be supportive for a market with extended valuations, strengthening the case for international.

To no one’s surprise, if one market has stronger expected earnings growth than another, performance tends to trend in the same direction. This is the case for the correlation between EM & DM. It has been a challenging decade for EM, largely due to DM earnings dominance. However, forward earnings growth for EM is now meaningfully outpacing DM.

What’s surprising, though, is that this shift doesn’t seem to be reflected in the performance of EM just yet. If this trend continues, EM could be set for a much stronger run.

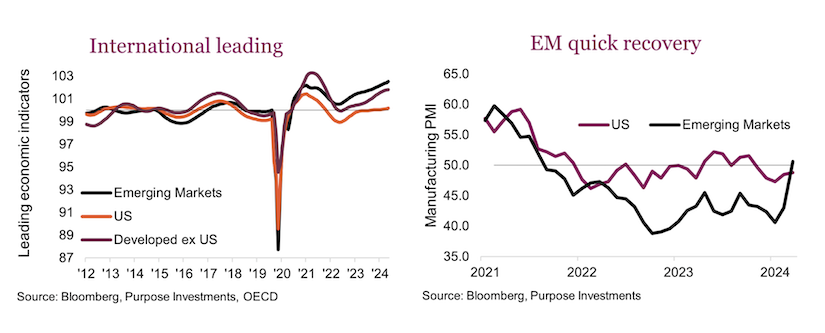

Economy & trade – Across the globe, we are seeing a broadening out of economic activity. Many central bank policies have begun their easing cycles (ex-Japan). This is favourable for international markets, specifically emerging markets, as many EM central banks started easing sooner than most nations. Additionally, if the Fed continues to cut rates, we could see US dollar weakness, easing financial conditions in EM and supporting economic growth. Internationally, the leading economic indicators look strong. International has been outperforming for quite a few years but has recently increased the spread against the U.S. Emerging markets have taken off, led by manufacturing, which has seen a quick recovery after trailing the U.S. for much of the 2020s.

Today, tariffs are certainly the talk of the town. It is too challenging to opine on whether tariffs will be implemented, their magnitude, when they will be implemented, and what reciprocal measures will be taken against them. If we focus on the economic trends, it is clear that global trade is turning higher, a strong historical indicator for the outperformance of international vs. U.S. – more specifically, EM vs. DM. The strength is encouraging, and if there is a continuance of improvement in global trade, this will likely prove to be better for international exposure.

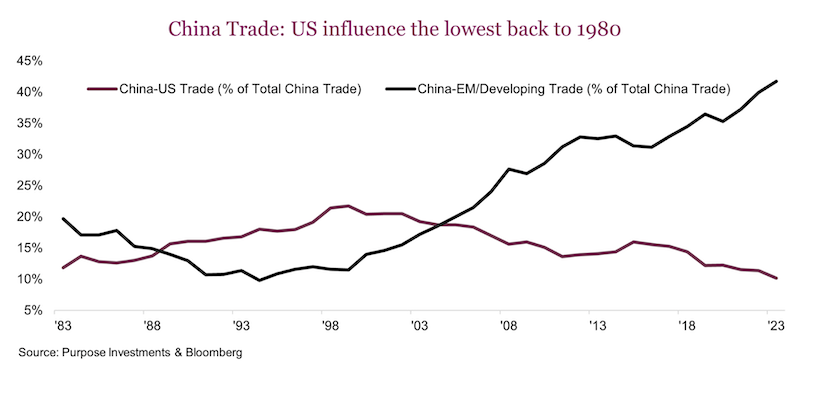

Last year, the largest trade partners with the U.S. were Canada and Mexico; therefore, it is no surprise that President-elect Trump has dialled in on tariff threats to those economies first. In the end, tariffs on China on top of existing ones will likely be the heaviest. However, no opining here … these policies are not 100% guaranteed. While there will be some economic impact if tariffs are increased, we expect the reaction to be slightly more muted from an equity perspective for a few different reasons.

First off, China has diversified away from much of its trade with the U.S. Keep in mind that the U.S. is still the largest country they exported to last year. Still, when looking at the percentage of China’s total trade, we have seen a meaningful increase in China’s trading with other EM and developing nations. Only 10% of China’s total trade is currently with the U.S., while a meaningful 42% is EM. This trend has been happening for a while but certainly took a meaningful uptick at the start of Trump’s first term in 2016. On top of that, China has injected a recent round of stimulus, and if we get more stimulus measures in China, this may outshine any bad news inflicted by American tariffs.

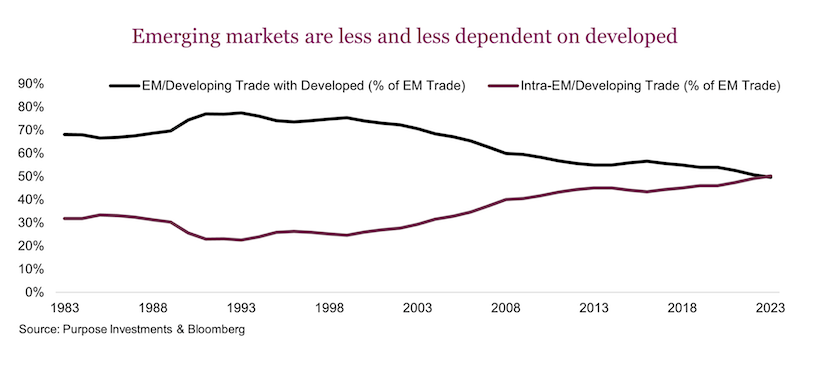

Looking more broadly at the emerging markets, we have seen a much more balanced approach to trade than we have seen over history. What used to be largely about the emerging market’s dependency on trading with developed nations, has now shifted to accommodate growing demand within these markets themselves. The exciting part? A large part of this shift is fueled by long-term trends like rising incomes and youthful, growing populations – factors that are expected to keep the momentum going.

Yes, this is the classic demographic argument, but this increased trading amongst emerging market economies is proof this demographic trend is strong.

While tariffs remain a risk to international equities, their impact may not be as meaningful as they were in the past. More diversified supply chains paired with global trade being less dependent on the US could lessen the blow. As we look ahead to 2025, the combination of attractive valuations, strong earnings growth, and an improving global economy encourages an overweight position in international equities. By staying focused on our economic indicators and monitoring the evolving landscape, we aim to capture the international growth that lies ahead.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

The author or his firm may hold positions in mentioned securities. Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.