I have been feeling a bit under the weather this week so this market commentary will be a bit shorter than usual. And I’ll keep the focus on the recent counter-trend moves in stocks and us treasury bonds.

In any type of market there can be trends and counter-trends. For instance, the US stock market indexes put in all-time highs around July of 2015. The fact that they have not surpassed those highs means that the longer-term trend since then has been down.

In the midst of that longer-term trend down, it is understandable that the markets can have counter-trend moves. Over time, if a counter-trend continues and surpasses the previous high then it can signal a change in trend for stocks (or whatever security you are evaluating).

The most recent low point in the S&P 500 was on February 11, 2016. Since then, the S&P 500 has surged 9.3%. Even after that surge, the S&P 500 is still down 2.2% year-to-date and down 6.3% from its all-time-highs.

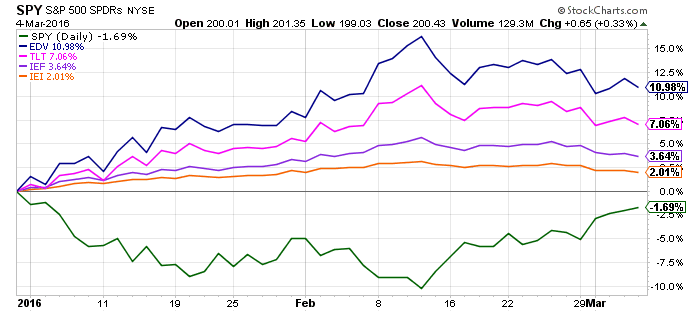

As I have written about many times, I have been heavily invested in US Treasury bonds for over a year now. UST’s continue to out-perform the S&P 500 year-to-date but they have declined a bit over the last few weeks during the stock market move higher.

Still, the 30-year UST ETF (Symbol EDV) is up 11.0% year-to-date. Symbol TLT is up 7.0%, IEF is up 3.6% and IEI is up 2.0%.

I personally am not concerned about the recent stock market counter-trend move higher. The economic data continues to show that growth is slowing. As long as the air is going out of the economic balloon I expect to remain bearish on stocks and bullish on US Treasury bonds.

Here is just one data point that shows that the US economy is slowing: US companies have reported lower sales and lower profits the last two quarters. In the most recent quarter, profits were down 8.2%. And the Wall Street Journal reports that “the gap between reported and pro-forma earnings last year reached its widest level since the financial crisis”.

I am using this counter-trend move higher in the stock market to position to profit as the down trend resumes in the future days and weeks. I have begun buying utilities, while selling short the financials index, oil and select market indexes. We have been successful preserving account values (and have even seen some gains) since the beginning of the year and if the down trend continues the current positioning should allow for further those gains.

Thanks for reading.

Twitter: @JeffVoudrie

The author holds positions U.S. Treasuries securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.