Can the stock indices make another recovery after the past two weeks? We think the expected top might finally be in. Today’s post shows how the S&P 500 Index could provide a nice setup for longer-term equity bears, although there should be some short-term bullish trades coming soon too.

In a trading environment like this, it’s important to put market sentiment and personal bias aside. Traders can prosper in bullish and bearish conditions by using a more objective method for making trade decisions.

For example in March 2020 the market dropped abruptly amid fears about the pandemic, and for a time popular sentiment was quite negative. At that time we were describing the decline as merely corrective in the Russell 2000 Index, the Nasdaq 100 Index, and the S&P 500 Index based on our Elliott wave analysis (each link takes you to our article on that index). The bullish case turned out to be correct.

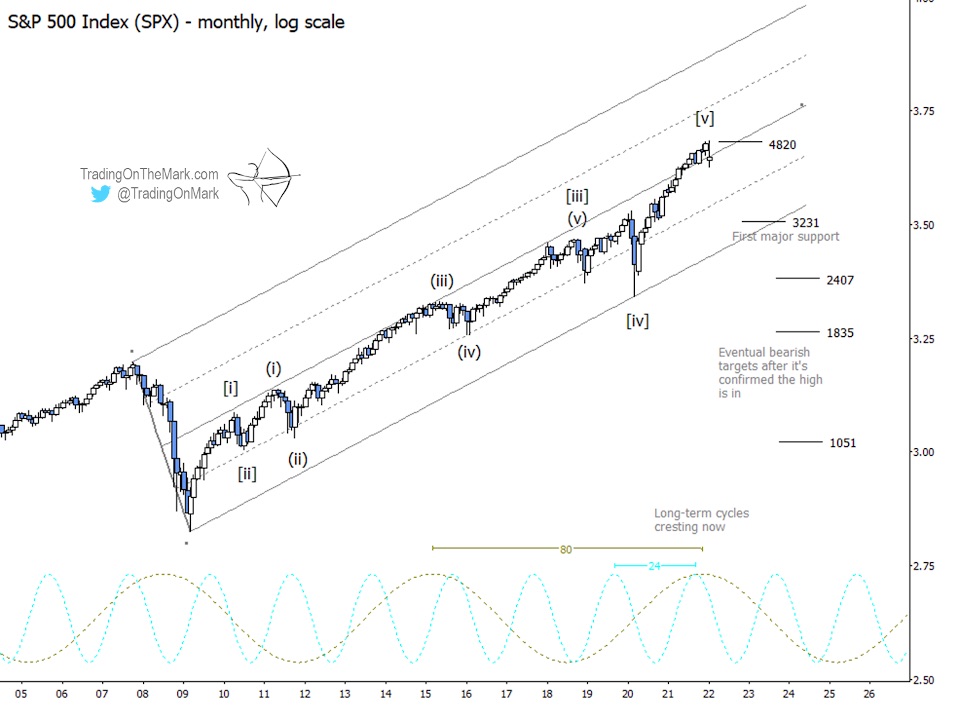

This year we believe the downward turns have more significant implications, mainly because the wave counts that have worked so well during the past several years suggest the upward moves on all time frames are complete or nearly so.

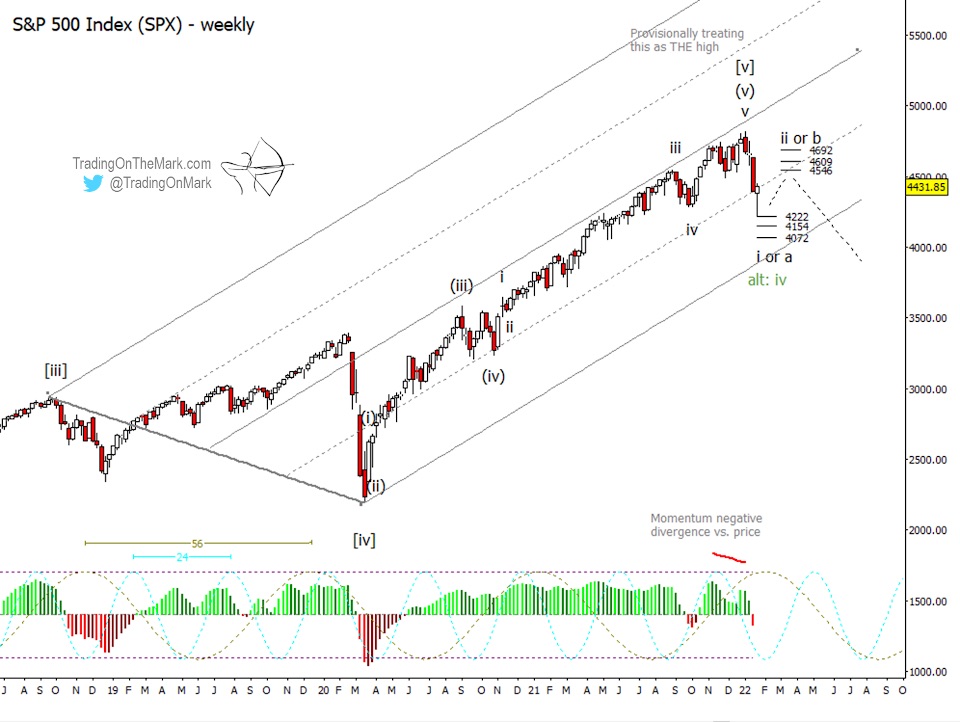

The weekly chart for the S&P 500, presented below, shows wave counts on three orders of magnitude. All of them appear complete, although there is some uncertainty about the smallest-magnitude count. Specifically there’s still a possibility that the decline in recent weeks represents yet another fourth wave, and we have indicated that as the alternate scenario on the chart.

Some arguments in favor of the top being in:

- We can count five waves up with all three orders of magnitude shown on the chart, so the entire decade-long rally might be complete.

- The decline from January 4 broke through important geometric and Fibonacci-related supports in a way that suggests a real loss of confidence in the prospect of new highs.

- The market has not rebounded as quickly as it has after previous scary corrections. It didn’t have that “V” shape.

- There was prominent divergence between price movement and our most reliable momentum indicator (the adaptive CCI) at the recent high.

- The 56-week price cycle is near a peak.

Our main scenario has price moving downward from the January 4 high, with this month’s decline representing just the first part of a larger move. We will be able to refine the wave count when more price bars are on the chart. The recent downward move has already tested important support at 4222 and showed some indication of bouncing from there. However, the move could also try for lower supports at 4154 or 4072, and that development might even clarify the situation.

Even with our main bearish main scenario though, we’re expecting a substantial bounce into early February. Likely targets for the bounce await at 4546, 4609 and 4692, assuming the recent low holds firm. You might notice increased interest by long-term bears if SPX moves up into that resistance zone.

There’s still a way SPX could reach another marginally higher high this spring, and it’s important for traders to keep that scenario in mind. An advocate of this alternative scenario would note that the structure of the move up from the October 2021 low was not ideal for a top. The move was not clearly impulsive, and it could represent the corrective middle part of wave iv. This “slightly bullish” scenario would take over if our main bearish scenario is proved wrong, and we’ll be watching the resistance levels on the weekly chart closely.

In the bigger picture, we expect SPX to reach for targets considerably lower in 2022 and beyond. The logarithmic scale monthly chart presented above shows those approximate targets at 2407, 1835 and 1051, with 3231 being the support that would need to break.

You can get daily charts and updates for this and other highly traded markets via our subscription page on Substack and on Twitter. Take advantage of our 2022 price special and save 20% on any type of subscription.

Twitter: @TradingOnMark

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.