Over the past few years, the Euro currency just hasn’t been able to get out of its own way. The European Central Bank hasn’t helped the cause doling out massive amounts of stimulus and QE… all while the Euro Zone economy continues to sputter.

Recently though, we saw European banks perk up (from dead) and the US Dollar drop sharply, feeding life to the narrative that the Euro is on the mend.

Well, there’s still work to be done…

Surely, the US Dollar has been overbought for some time so its current back-and-filling action is overdue (and quite likely healthy). See fellow contributor Karl Snyder’s recent point and figure analysis of the US Dollar. And any weakness in the buck has been welcome to the Euro currency.

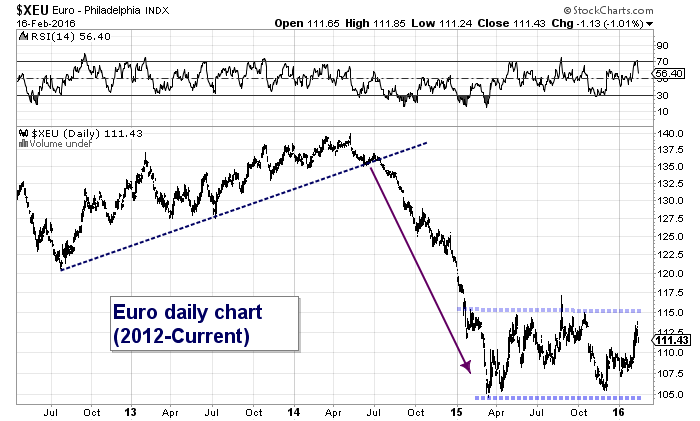

But looking at the chart below, we can see that the Euro has been moving sideways for the past year. In fact, it’s formed a clear channel that bears watching. The upper resistance is 115-117, while the lower support is at 105. Currently, the Euro sits at 111.4.

As well, economic news continues to highlight a lackluster economy that is non-responsive to the massive amounts of QE and stimulus. In fact, if we include the recent actions of the Bank of Japan, it’s a bit worrisome that Central Banks are failing to command an audience from the equities markets. This is still just an observation, but concerning to say the least.

I sum, I’m still skeptical of the Euro. It appears to be in ping-pong land until it can clear the 115-117 resistance band and hold a move over 70 on its RSI.

Euro Currency Chart

Thanks for reading.

Further reading from Andy: This Isn’t The Stock Market That You Imagined

Twitter: @andrewnyquist

The author does not hold a position in mentioned related securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.