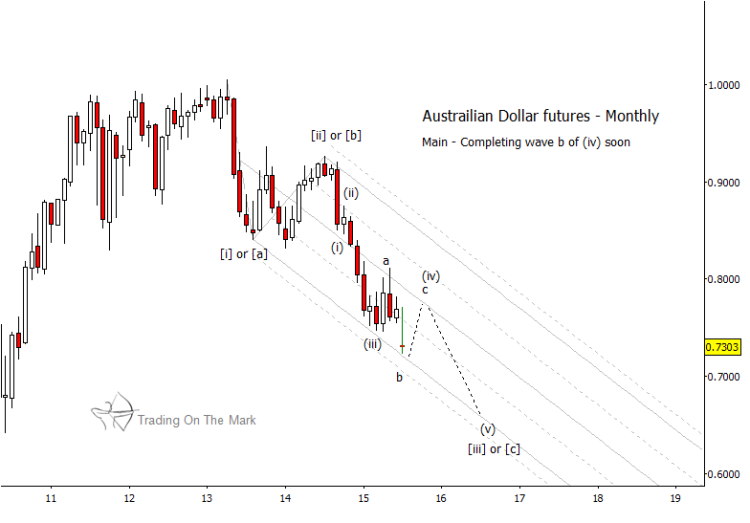

The continued advance in the U.S. Dollar since 2011 has made short positions with several paired currencies attractive for investors with a multi-year perspective. However, the Australian Dollar (AUDUSD) appears poised for bounce soon. This sets up the possibility of a countertrend trade for a few months, as well as a lower-risk attempt at downward continuation later in summer or autumn. Here we present a big-picture analysis of the futures contract, as well as a more detailed close-up the Guggenheim CurrencyShares Australian Dollar ETF (FXA).

When complete, the Australian Dollar’s decline from its 2014 intermediate high should consist of five waves, with the middle wave (iii) likely to be the strongest. It appears that wave (iii) may have completed in early 2015, followed by a bounce and decline as part of corrective wave (iv). The channel on the monthly chart provided support to end wave (iii), and it may also provide the base for the next upward segment of wave (iv).

On a faster chart, wave (iv) appears to need at least one more upward segment, which probably would test the resistance marked by the center line of the channel we have drawn on the monthly chart below. From there, we would expect the larger decline to resume, probably leading to lows not seen since 2010.

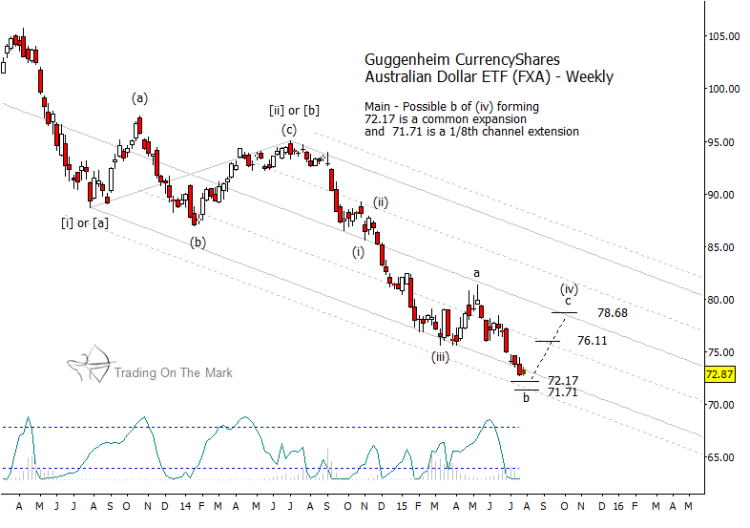

A weekly chart for the Australian Dollar ETF (FXA) tracks fairly well with the futures contract. Here we see how well it has been obeying the channel boundaries. (Both the weekly and monthly charts present essentially the same channel.)

It is reasonable to watch for the ETF to bounce from near the lower channel boundary. Support at 72.17 represents a standard Fibonacci expansion of wave ‘a’ of (iv), and the 1/8 channel harmonic could provide next support if needed, perhaps near 71.71 depending on time.

We will be able to refine the resistance targets more precisely after the bounce has begun. Those would represent potential profit-taking on a moderate-risk long trade, as well as possible areas for entry into a new short position with the currency pair. Consider becoming a subscriber to follow these developments and gain an edge in a wide range of markets.

Twitter: @TradingOnMark

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.