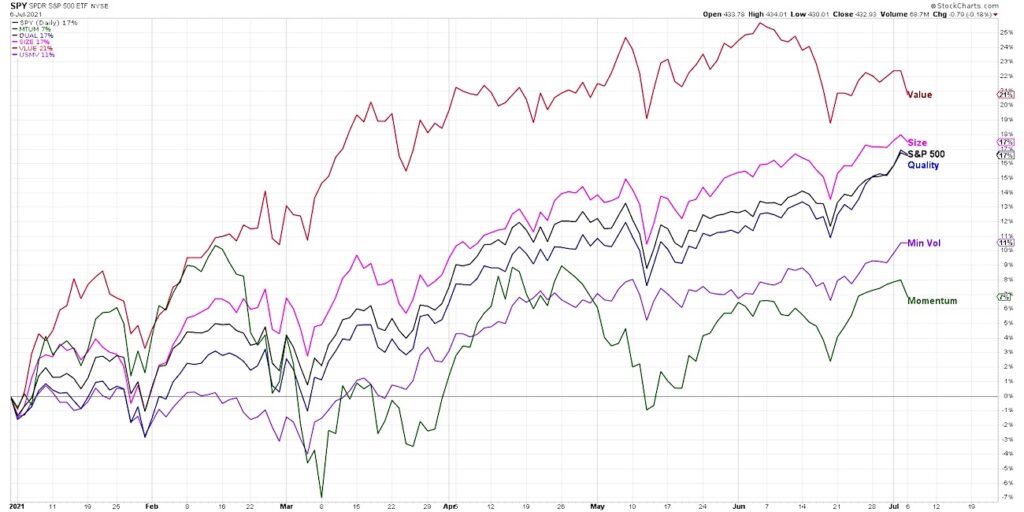

The momentum factor is the well-researched phenomenon which shows how stocks that have outperformed over the previous 6-12 months tend to outperform going forward.

So why is the Momentum Factor ETF (MTUM) underperforming?

It all lies in the rebalancing process. A momentum model has to change holdings frequently enough to recognize changes in leadership, but not change so frequently that there is unnecessary and costly turnover. When you look under the hood, you’ll find that the MTUM does provide exposure to stocks that performed strongly through May 2021, but unfortunately those are not the names that have done well in the last six weeks.

At the end of the day, ETFs like MTUM perform well when trends are persistent. But during periods of leadership rotation (as we are currently experiencing), active investors could use technical analysis techniques to better anticipate momentum shifts.

In today’s video, we’ll discuss the construction of this popular momentum ETF, why its current holdings are causing a drag on performance, and how active investors can use technical analysis to better capture price momentum.

What is the largest sector weighting in MTUM, and why is that contributing to negative performance in recent weeks?

How is a momentum model constructed, and what can we learn from the limitations of rebalancing strategies?

What charts appear most attractive now using traditional momentum techniques?

For deeper dives into market awareness, investor psychology and routines, check out my YouTube channel!

[VIDEO] One Chart: $MTUM Momenutum ETF

$MTUM Momentum ETF Chart (performance versus broader market)

Twitter: @DKellerCMT

The author may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.