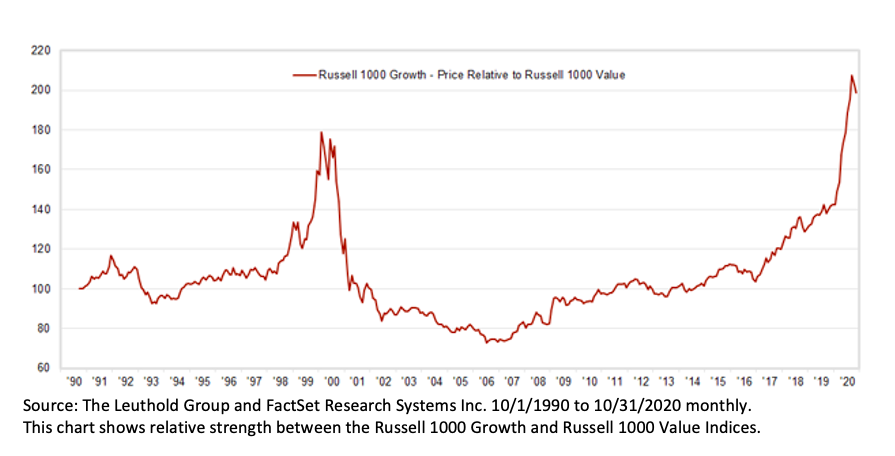

The past few weeks have offered a vivid look at the risks caused by the decade-long outperformance of “Growth” stocks over “Value” stocks, as well as potential rewards for long-suffering value investors.

For too long, the playbook has been the same: bid up large Tech stocks on the belief that earnings growth for the rest of the market would be lackluster.

Historically low interest rates reinforced the view and made the promise of outsized earnings growth in the future appear more valuable in today’s dollars. The news that COVID-19 vaccines may be available in the coming months, has flipped that approach on its head.

Pessimism has turned to economic optimism.

The new outlook has led to painful results for Growth investors who saw share prices drop.

For Value investors who remained steadfast in their belief that the price paid remains the cornerstone of prudent investing, the reversal was a welcomed affirmation of a commonsense approach.

We don’t expect the Growth/Value dynamic to reverse in a straight line, but we do believe the last few weeks offers a valuable lesson to investors who may have been lulled into complacency.

This post was written by Bill Nasgovitz, Chairman and Portfolio Manager at Heartland Advisors.

Disclosure: Past performance does not guarantee future results.

Investing involves risk, including the potential loss of principal.

There is no guarantee that a particular investment strategy will be successful.

Growth and value investing each have unique risks and potential for rewards and may not be suitable for all investors. A growth investing strategy emphasizes capital appreciation and typically carries a higher risk of loss and potential reward than a value investing strategy; a value investing strategy emphasizes investments in companies believed to be undervalued.

Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

The statements and opinions expressed in the articles or appearances are those of the presenter. Any discussion of investments and investment strategies represents the presenters’ views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. Any forecasts may not prove to be true.

Economic predictions are based on estimates and are subject to change.

Definitions:

The Russell 1000® Growth and Value indices consist of stocks within the Russell 1000® index with respective value and growth characteristics as determined by Russell Investments. Russell 1000® Growth Index measures the performance of those Russell 1000® companies with higher price/book ratios and higher forecasted growth characteristics. All indices are unmanaged. It is not possible to invest directly in an index. Russell 1000® Value Index measures the performance of those Russell 1000® companies with lower price/book ratios and lower forecasted growth characteristics. All indices are unmanaged. It is not possible to invest directly in an index.

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.