There has been a great deal of discussion regarding whether the Fed is going to continue down the path of ZIRP [Zero Interest Rate Policy] or if we will begin to see interest rates begin to tick higher. It is an important topic and most writings are attempting to predict when the interest rates are going to take off. Here is a related interest rate article from SeeItMarket that is one of the few willing to contemplate if rates are going up. I would like to add to this alternate viewpoint that doesn’t get enough airplay. Interest rates could stay near zero for a much longer time than most would forecast. Here’s why.

There has been a great deal of discussion regarding whether the Fed is going to continue down the path of ZIRP [Zero Interest Rate Policy] or if we will begin to see interest rates begin to tick higher. It is an important topic and most writings are attempting to predict when the interest rates are going to take off. Here is a related interest rate article from SeeItMarket that is one of the few willing to contemplate if rates are going up. I would like to add to this alternate viewpoint that doesn’t get enough airplay. Interest rates could stay near zero for a much longer time than most would forecast. Here’s why.

Interest Rates – The price of borrowed funds

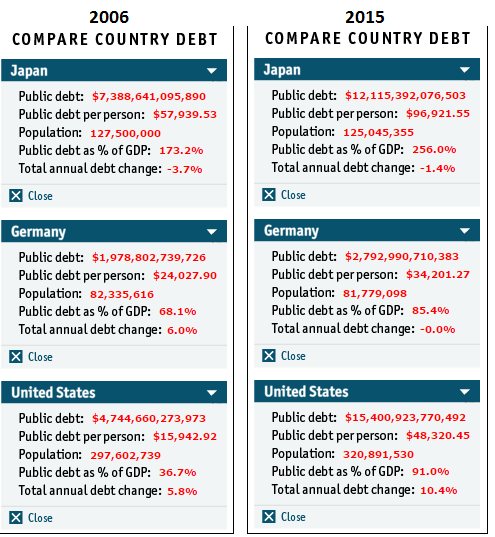

In very simple terms, borrowed money has a price similar to all tradable commodities. Supply and demand forces should be at work finding an efficient clearing price and stable equilibrium point. However, simple economic fundamentals might not apply in these odd times of ZIRP. What if the pricing distortion caused by massive debt purchasing from central banks around the world creates an environment that requires the distortion continue lest the pain be too great from the shift? The major developed economy governments in US, Japan, & Europe have drastically increased public debt as a response to the 2008 financial crisis. The artificially low cost of debt facilitates that massive increase. I’ll ask whether the central bank planners have the courage to raise interest rates which could squash economic growth and inflict pain on the ability of the governments to collect the funds necessary to pay back borrowers. Here are some quick stats from the Economist comparing public debt, debt per person, and debt as % of GDP.

There are certainly other issues underlying the debt statistics and a country’s ability to pay off debt – current account flows, net savings rates, foreign exchange rate movements, etc… but the simple message is that with the governments needing to step in to support the economy when there is an absence of growth, there is a possibility of the government having to continue the support for a very long time. Japan has been stuck in a zero growth deflationary state for the last 25 years. Hopefully Europe hasn’t already fallen down the same slippery slope of Japan’s ZIRP trap where herculean QE efforts desperate to create growth haven’t moved the needle. This past spring, Europe’s short term bond interest rates went negative. How far out of whack are things when German banks charge customers to keep money in their accounts? In spite of that extraordinary stimulus, growth and inflation are nowhere to be seen on the European horizon. Logic follows then, that just like in Japan, interest rates could also stay extremely low while the condition persists.

US Situation – How is outlook for growth and inflation here?

Let’s then swing our focus back onto the US economic statistics to see if the last several years of ZIRP have put upward pressure on prices across the board (other than inflating investment assets like stocks and bonds). From economic text books we would expect that ZIRP and excessive stimulus to create a decent stretch of growth in the economy. Sustained periods of growth had always previously run into labor and/or factory output constraints thus creating inflationary pressure which ultimately led to higher interest rates. To the contrary today, the following graphs show none of these dominoes beginning to topple.

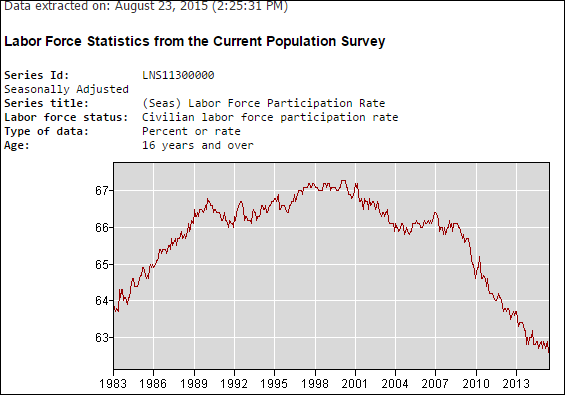

Labor Utilization from US Dept of Labor:

Labor participation rates are lower than any other time in the last 30 years. There is ample supply and probably won’t be any wage and compensation inflation for a while.

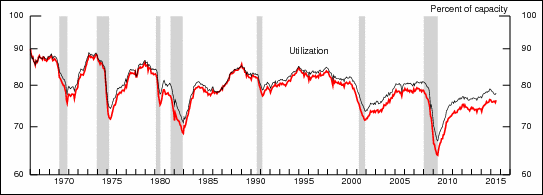

Industrial Capacity Utilization from Federal Reserve Data:

Industrial production (manufacturing = red & total = black) is up quite a bit from 2008 but still hovering below 80% of capacity which seems to be an important threshold where inflationary forces may be seen. Factories running well under full production won’t raise prices. Instead they have huge incentives to lower prices in order to entice sales up to the level where they bump against the capacity ceiling.

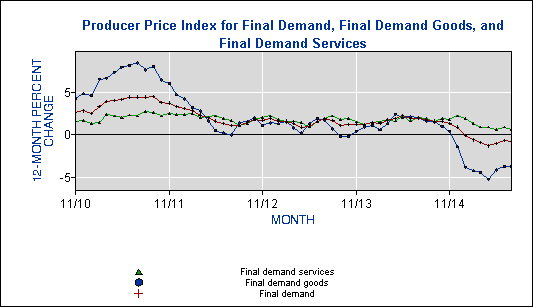

The combination of excess labor capacity and production capacity is reflected in the Producer Price Index statistics. Since last fall the trend has clearly been downward.

PPI from US Dept of Labor:

No growth, no signs of inflationary pressure, no reason for interest rate increases.

If you were sitting on one of the Fed seats while seeing these negative PPI trends, would you be in any hurry to raise interest rates? Would you be willing to greatly increase the cost of government borrowings and at the same time risk shunting already anemic growth? These are the main reasons I’m beginning to believe that economic policy makers are trapped within a sticky no growth environment. The easiest path forward is to continue to encourage high levels of federal government spending and borrowing while central bankers buy massive amounts of the debt in order to keep rates low. Japan has been at this string pushing game for the last 25 years. Europe looks to be settling into the same pattern of long term ZIRP. What are the odds that the US can avoid the pitfalls? I’ll suggest they are low until we see real economic growth and at least the hint of upward pricing pressure.

Sign up and receive our investing research and trading ideas in your inbox. No strings; it’s free.

Twitter: @BBTompkins

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.