There is a large cohort of investors that loves gold, and a large cohort that dislikes gold; we are neither. Our opinion on the yellow metal and gold mining companies changes over time.

This is evident in gold allocation in our fundamentally driven North American dividend-focused portfolio over the past five years, from less than 3% to over 9% and currently sitting at 7%.

The gold weighting in the TSX Index also has seen some pretty big swings, ranging from less than 3% to over 16% over the past 15 years (Chart 1). That is a pretty big swing for one of the larger components of the index.

The reason we decided to discuss gold in this week’s market news article is that we are seeing some odd pricing behavior in the yellow metal of late. The price of gold is often heavily influenced by a number of factors, including:

Inflation – since gold is a real asset, it is often viewed as a hedge against inflation. Higher inflation, higher gold.

Nominal yields – given gold has no distribution, higher nominal yields on government bonds makes that competing defensive asset class relatively more attractive. High yields, lower gold.

U.S. dollar hedge – Gold is quoted in USD, so a falling USD is typically positive for gold prices. Lower USD, higher gold.

Trust – gold often does well as a hedge against uncertainty, including trust in the financial system. Lower trust, higher gold.

There are other factors as well. Bitcoin has become a competing asset class to some degree for those desiring a non-fiat currency alternative. Central bank buying or selling gold, flows into gold ETFs, consumer demand especially from developing economies … the list goes on. But the four we listed are usually big and more consistent factors.

To make matters a bit more complex, the influence of these factors changes over time. For instance, sometimes gold reacts to inflation but ignores currency or nominal yield moves. Sometimes currency moves matter the most for gold, and other factors don’t matter. Nobody ever said investing would be easy.

Gold misbehaving

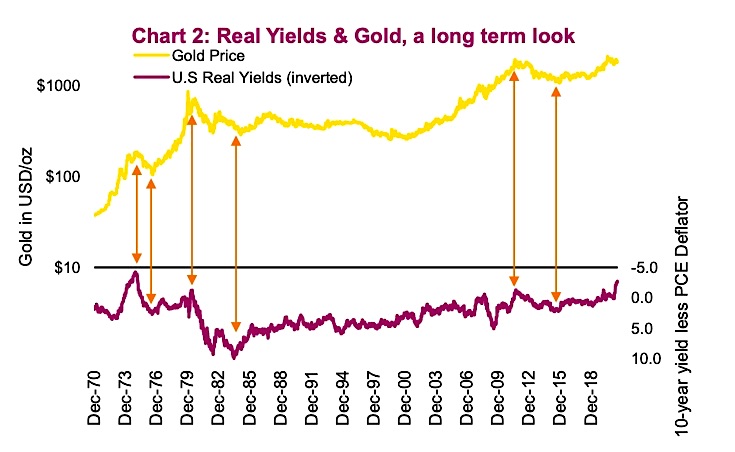

Real yields, which is the nominal 10-year U.S. Treasury yield less inflation, captures both nominal yields and inflation factors listed above. There has been a very strong connection between gold bullion prices and real yields for the past decade. In addition, peaks and troughs in real yields have often coincided with troughs and peaks in gold prices going back to the 1970s (Chart 2). Turning points in the direction of real yields has marked turning points in gold. Plus, when real yields are trending in one direction, gold is often trending in the opposite [note: real yields are inverted in the

charts].

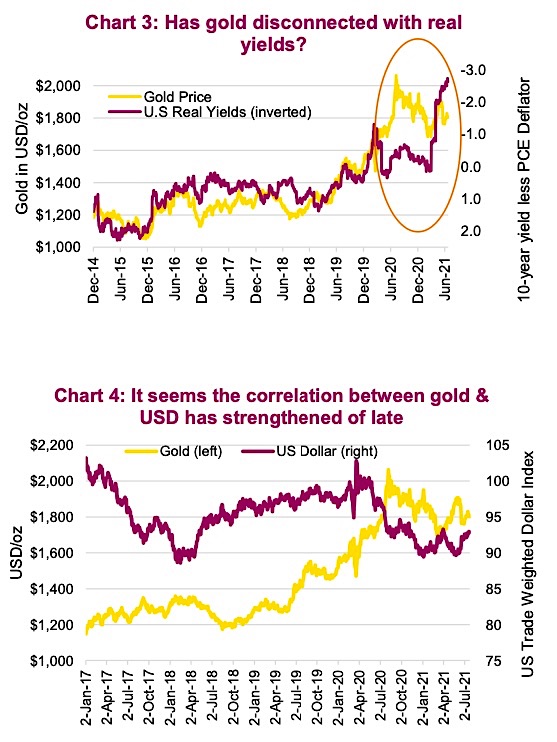

This relationship has been very strong in the past few years (Chart 3). However, the recent drop in real yields (see rise in the purple line) due to rising inflation and falling nominal yields has not been reciprocated by a rise in gold. Ok, perhaps the gold market also buys into the view that this inflation impulse we are experiencing is 100% transitory.

However, gold should have also risen as 10-year nominal yields fell from 1.7% to 1.3%. But it didn’t. That has us worried that the path of least resistance for gold may be lower from here out.

For the other factors we are not sure how to measure ‘trust’ in the system, but we will point out that currency appears to be having a stronger influence on gold in the past few months. Normally, when the U.S. dollar declines, gold rises and vice versa. This relationship has been very soft or even moving against the norm since 2019 and into early 2021, for the most part. Gold started rising in 2019 despite a rising USD. In late 2020, gold continued to rise as the USD started to weaken (normal), but the USD continued to weaken and gold reversed course. The past few months though, we have seen them moving in opposite directions again (Chart 4).

Gold Market Implications

If you believe this bout of inflation is temporary and/or bond yields are set to rise, gold will likely suffer from headwinds for a while. We believe this situation may persist in the near term. Afterwards, our expectations are for inflation to settle at a higher level than the market is expecting, which should be positive for gold. From a currency protection perspective, we welcome the return of a strong negative correlation between gold and the USD. Overall, we are still constructive on gold for a portfolio diversifier but with a more sombre view in the coming months.

Source: Charts are sourced to Bloomberg L.P. and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.