The following article is a part of my Gone Fishing Newsletter that I provide to fishing club members each week to identify macro inflection points and actionable micro trade set-ups.

Back in Mid-December (2018), I had a theory, a strong one, and I wanted to get my clients’ attention so my article title – uncharacteristically – was total click-bait: Why Do I See A Flash Crash Coming?

It was a market timing call for a correction/drawdown/flashcrash … FOR IDES OF MARCH 2019, even though it was only December 12th at the time of my writing. You may think I misread the December 10% correction for March. Nope, I called that too. And the “rip your face off rally” that followed.

Here’s what I wrote – again December 12, 2018:

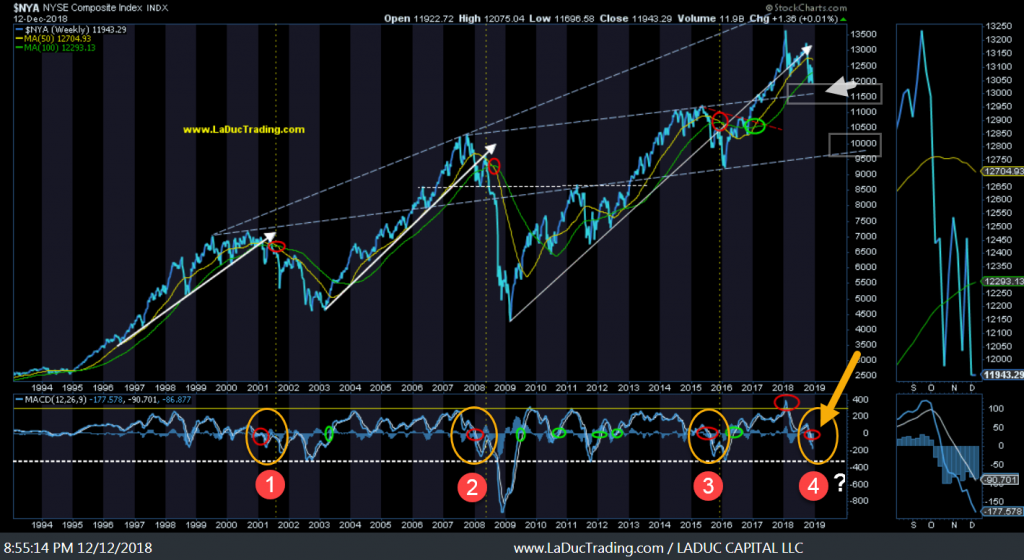

This is the NYSE Composite Index – on a Weekly timeframe. Look carefully at the red circles – both top panel red circles which indicate a 50/100 EMA crossover and bottom panel which indicates a MACD rollover below the zero line. Oh, except for that one EXTREMELY OVERBOUGHT spike in early January which is what I used to call the January Swoon ;-).

Point of this exercise is to have you focus in on the yellow dotted lines that follow the red circles in the MACD box. Do you see how the 50/100 EMA crossover occurs with a severe market drawdown or waterfall? And how the MACD rollover below 0 foretells the danger? ALL THREE TIMES?! What about the 4th?

Ah, that hasn’t happened yet….But the patterns leading into 2000, 2008 and 2015 strongly suggest a 4th significant market drawdown event is forming.

Here is the chart I presented 12/12/18:

How’d I do?

The market exactly hit Red Bullet #4 dotted-white-line on that fateful Christmas Eve Massacre. And we crashed down into $10,724 white-box-arrow on the NYSE composite.

So then what did I predict after predicting we would drop – and before we even dropped? That we would have a “potentially violent” bounce.

CHECK! Just so happens we have bounced 19.9% in two months. I would call that violent!

Where did I predict we would bounce – after crashing to my Red Bullet #4 that is?

“then bounce back into a 50/100W crossover

Did I give a level of price target for NYSE?

I wouldn’t be surprised if we bounce back into the 12,400 area which is 10/21 Mo EMA crossover

And Here We Are:

So Now What?

Let’s go back to the above soundbite all written December 12, 2018 and finish the sentence:

I am projecting we pull down into that trendline support below the 100W EMA (white box and arrow) then bounce back into a 50/100W crossover BEFORE POTENTIALLY AND VIOLENTLY CRASHING LOWER IN Q1 OF THE NEW YEAR.

Possible Crash Timing?

Remember the Ides of March: Bank Reserve Ratio Reports, FOMC Meeting, Trade Tariff Deadlines, Trump, Fed, China, BREXIT … point is, I will be watching the Macro, Fundamental, Intermarket and Technical background very closely to see how a trigger can justify my market timing call for a “Flash Crash” in Q1. just like I saw, alerted and traded with you in January and again in October of this year!!

Three months after this client post, we are approaching March 15th and I expect the Ides of March to be eventful. Clients of LaDucTrading will receive my market-timing calls with both my macro narrative and technical levels to trade against.

If you were a client during my market timing calls for the 20% drawdown from Oct 3rd to December 24th, and rally from December 26th to now, you are very happy that you were. If you are not receiving at a minimum my entry-level membership ($150/month), then I strongly urge you to consider.

- Gone Fishing Newsletter – my macro-themed reports that present what is moving and my perspective on why.

- Intermarket Chart Attack – my selective relational study work that identifies trend reversals (like this) for low-risk entries.

- The Week Ahead – key market-moving events for the upcoming week and how to trade them.

Thanks for reading and please consider joining me in the LaDucTrading LIVE Trading Room where I take macro and market-moving news, give it context, and recommend trade ideas from it. For additional education, I provide my LIVE Trade Alerts from Interactive Broker to clients interested in my Value and Momentum stock and option plays.

Twitter: @SamanthaLaDuc @LaDucTrading

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.