It’s always nice to see bank stocks leading the market higher… but it doesn’t always work out that way.

Which is why we always let the price action (and patterns) dictate our investment choices.

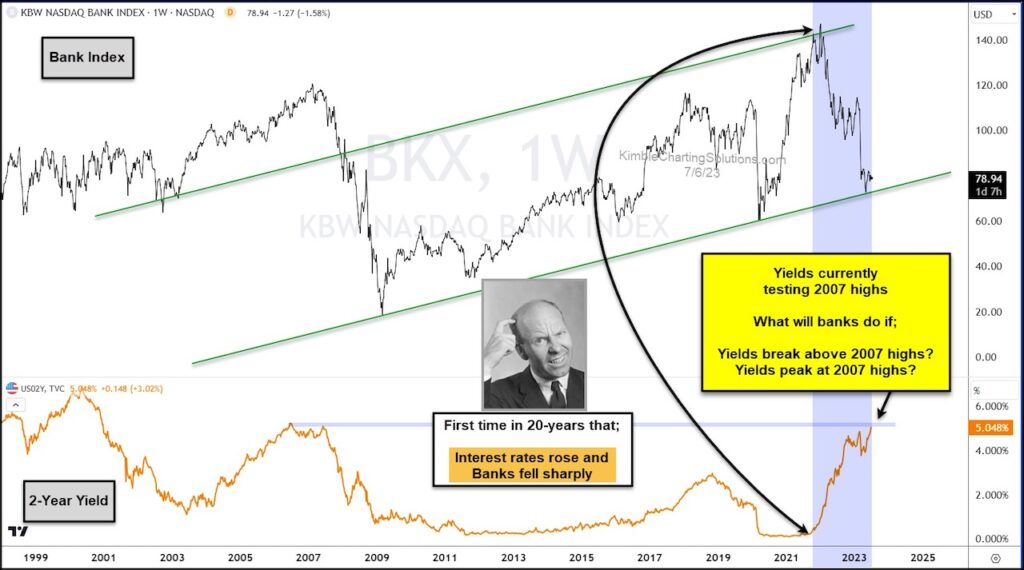

For most of my career, though, bank stocks have liked rising interest rates. BUT for the past 2 years, interest rates have risen nearly 5 percent and the all-important KBW Bank Index (for bank stocks) has declined nearly 50%.

I have not seen this in my 43-year career.

You can see this in today’s chart, where we compare the Bank Index to the 2-Year Treasury Bond Yield.

As you can see, the 2-year yield is testing its 2007 highs.

As this occurs, a couple of questions come to mind… what if interest rates peak here, what will banks do? What if rates breakout, what will banks do???

This dynamic is definitely worth watching. Add it to your trading radar… and stay tuned!

KBW Bank Index vs 2-Year Treasury Bond Yields Chart

Note that KimbleCharting is offering a 2 week Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.