Back in March, I issued a long research report on the state of the Gold bear market. In that report, I shared how a number of reasons why Gold was out of favor (and remain out of favor). But I also looked at sentiment, seasonality, and technicals to make a point that Gold had an opportunity to rally.

Here’s an excerpt from that post:

Headwinds included: US Dollar strength, slowing global economies, deflation fears, and being an out of favor asset class. Tailwinds included: geopolitical tensions, a pullback in the US Dollar, Europe, and sentiment.

The headwinds have continued to weight heavy on the Gold bear market. But the yellow metal is closing in on new lows and sentiment is tanking so it’s probably a good time to evaluate…

Since that post, Gold prices rallied over 7 percent but weren’t able to hold onto the gains. And even with tailwinds like a pullback in the US Dollar and another bout of Greek drama, Gold is finding its way back to lows. And that’s concerning.

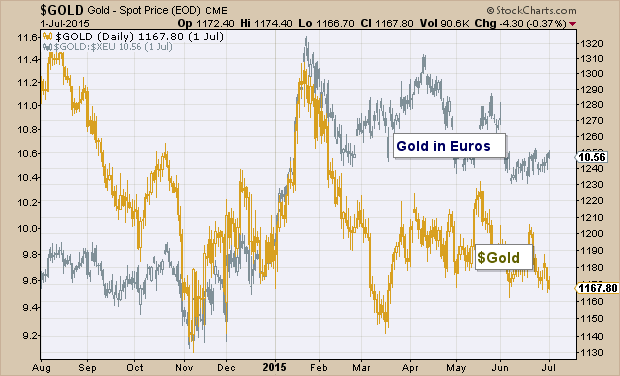

Here’s a chart of Gold as measured in US Dollars and Euros:

The issue here is that Gold can’t hold a bid. Although Gold is doing better priced in Euros, it’s still well off the January highs in terms of both Dollars and Euros. It appears that Gold bulls are slowly being ground out. And perhaps one more leg lower will be enough to trigger the “I give up” stage and find a bottom.

But that may not be today’s business, especially if Gold can remain above its lows.

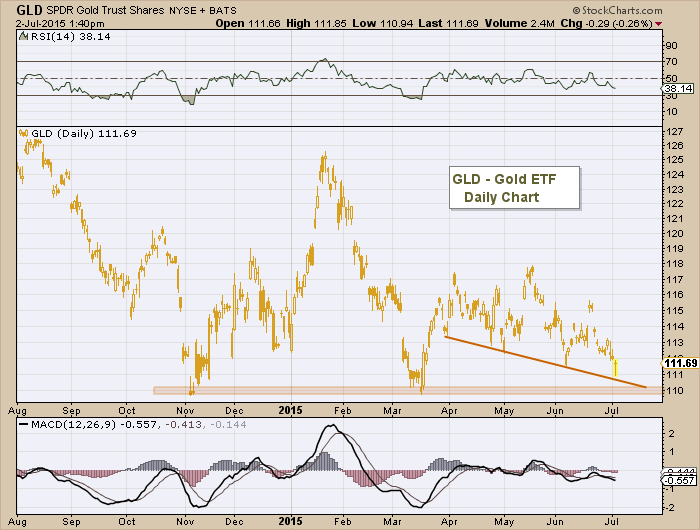

From a trading standpoint, Gold is nearing its line in the sand for the third time in 8 months. As you can see in the chart of the Gold ETF (GLD) below, Gold is nearing a trading crossroads. Can it rally? Will it be more than a dead cat bounce?

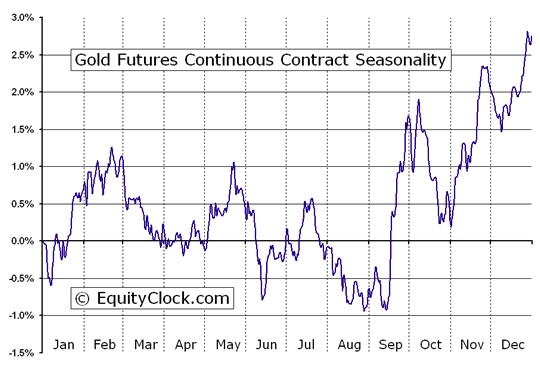

One thing we do know is that Gold needs to show us more than it has thus far. So what do bulls need to see now? Plain and simple: a reaction higher. Support needs to hold because only a rally back above the recent highs (1208 Gold and 115.50 on GLD) will neutralize the selling pressure. As well, according to a chart from EquityClock, Gold tends to see strong seasonality in early to mid-July, so perhaps there’s a window for a rally. But equally as bearish, seasonal trends fall off until September…

Trade safe and thanks for reading.

Twitter: @andrewnyquist

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.