Folks are calling the FED opening swap lines on the entire US Banking deposit base to the tune of $17.6 trillion as QE infinity.

Moody’s cut its outlook on the banking system to negative, saying that it is a rapidly deteriorating operating envornment.

The market though, generally focused on one thing: CPI.

CPI came in as expected-6.0% and softer. Core CPI though came in a 5%-higher.

The chart shows you the areas of inflationary growth versus decline.

Nevertheless, the metals shone all around.

Our GEMS Global Macro or Global ETFS Stocks Macro and Sectors model signaled a buy in gold last week.

Now, gold miners, based on the strength of this sector, signaled.

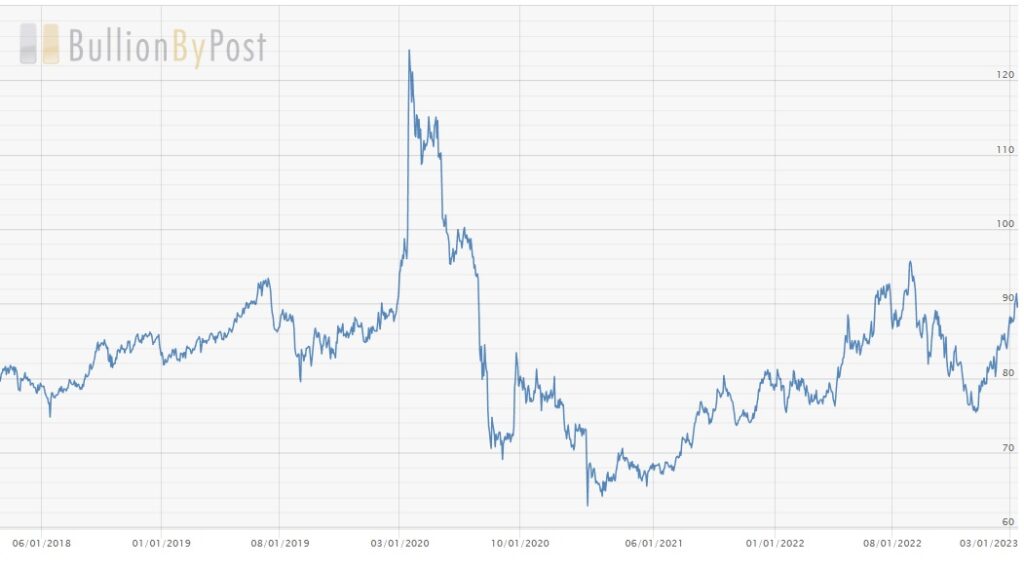

Monday’s Daily reported on the reasons to watch the gold to silver ratio.

A 5-year historical look at the gold to silver ratio shows a move over 90 (bullish) while our Leadership indicator shows silver equally performing the gold.

That tells us that the precious metals are getting ready to roar.

Even with oil prices falling today, GDX held steadfast.

GDX now outperforms the SPY.

Momentum has a positive divergence where the red dots are not inline with the 50-DMA (blue line).

Meanwhile, the price sits below its 50-DMA yet well above the 200-DMA or in a caution phase (improvement from a distribution phase.

Should the price clear the 50-DMA in price, then the phase returns to bullish.

Stock Market Trading ETFs Analysis & Summary:

S&P 500 (SPY) 390 remains highly pivotal especially on a closing basis

Russell 2000 (IWM) Calendar range support level at 172.00 and resistance 180

Dow (DIA) 310 support 324 resistance

Nasdaq (QQQ) 290 the 50-DMA support 294 the 50-WMA resistance

Regional banks (KRE) Tested near the 50 resistance level and colosed just slightly above 44 support

Semiconductors (SMH) 240 pivotal support-strongest yet still below the 2-yr biz cycle

Transportation (IYT) Confirmed Distribution Phase and weak close-under 219 trouble

Biotechnology (IBB) 126.50 moving average resistance

Retail (XRT) 60 big support and 64 big resistance

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.