There has been a lot of buzz surrounding the recent weakness in the Biotech stocks as traders try to digest the recent bouts of selling pressure. After overheating back in March, the Biotech sector sold off hard before staging a rally into April. But that rally failed to reach new highs and has since seen selling pressure return to the market.

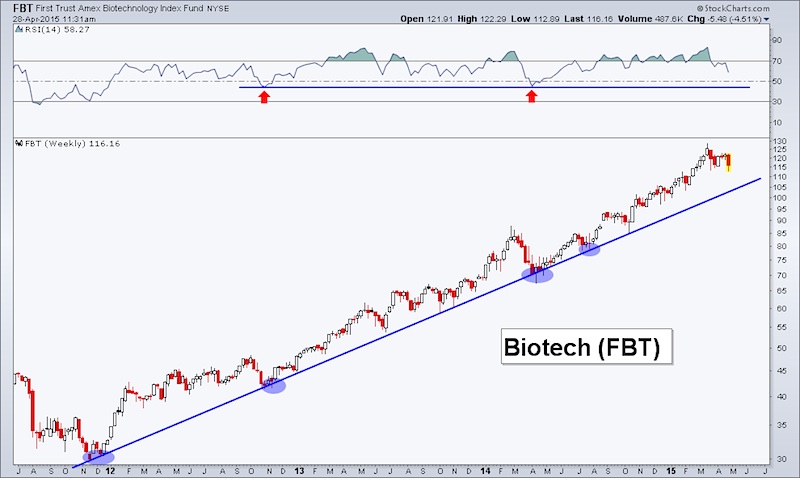

As an active investor, it’s easy to get caught up in the short-term moves of the market. So it’s often a good idea to step back and zoom out for some perspective. Below is a weekly chart of the First Trust Biotechnology Index Fund (FBT), a well rounded ETF of Biotech stocks. Two things that interest me here are Price and Momentum.

1. Price has been respecting the rising trend line during the multi-year uptrend. The trend is intact, but at the same time, there’s still a bit more room to the downside before it is tested. Other Biotech ETFs like the SPDR Biotech Index ETF (XBI) and the Biotech iShares ETF (IBB) are also holding above this key multi-year trend line.

2. Momentum has been in a bullish range for the last several years with well-defined support. Can Biotech stocks regain their momentum in time to keep the uptrend in price going?

Biotechnology Index Fund (FBT) Chart

Thanks for reading.

The information contained in this article should not be construed as investment advice, research, or an offer to buy or sell securities. Everything written here is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned.

Follow Andrew on Twitter: @AndrewThrasher

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.