A Gordian Knot comes from Greece during Alexander the Great’s march.

It has become a metaphor for a problem solvable only by bold action.

Every investor is waiting for the next stat and the next stat.

Each one is perceived as the key to what the Fed will do next.

And that the market action/reaction will be bold.

Will the market head to new highs as we are seeing in certain areas?

Or will the weaker sectors/indexes drag down the mighty?

We already know what a Fed long pause looks like.

Until something unties the knot, the market continues to cautiously hold up on low volume, wonky breadth with a huge divergence between small caps and growth stocks.

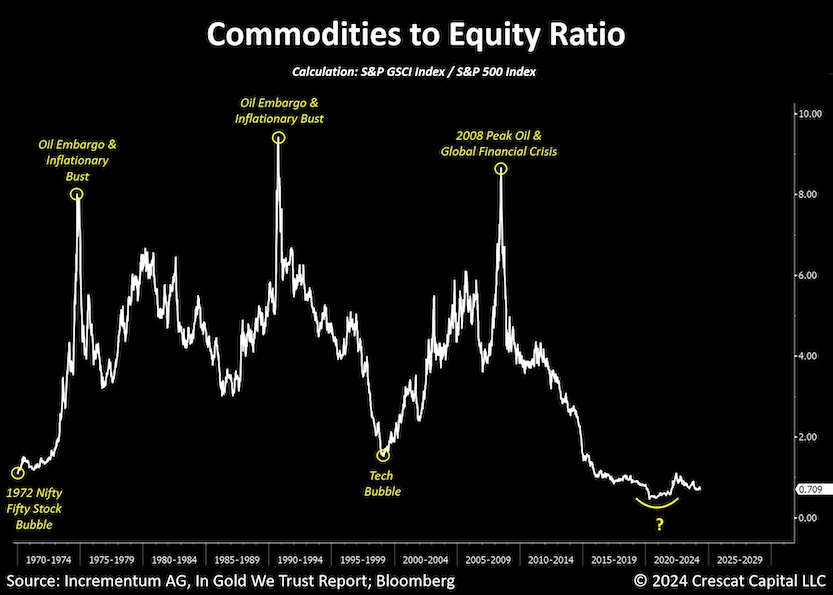

And then there are the commodities.

This week I did a segment for stockpick.app on commodities and the Gordian Knot.

On Thursday, I will do a presentation for the Money Show on how to invest in the current environment which could resolve as:

Expansion

Stagflation

Recession.

And right now, I am not sure anyone knows for sure how the knot unties and who or what rules as a result.

What I do know is this-the ratio between commodities and equities remains unsustainably low, which means opportunities are emerging.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.