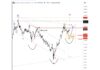

If you were contemplating an investment at the beginning of 2014, which of the two assets graphed below would you prefer to own?

In the traditional and logical way of thinking about investing, the asset that appreciates more is usually the preferred choice.

However, the chart above depicts the same asset expressed in two different currencies. The orange line is gold priced in U.S. dollars and the teal line is gold priced in Turkish lira. The y-axis is the price of gold divided by 100.

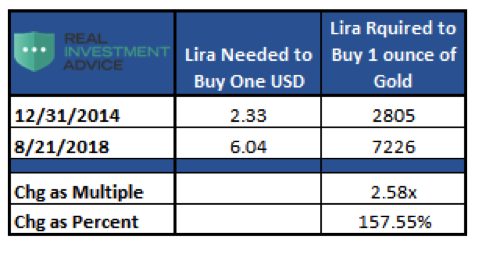

Had you owned gold priced in U.S. dollar terms, your investment return since 2014 has been relatively flat. Conversely, had you bought gold using Turkish Lira in 2014, your investment has risen from 2,805 to 7,226 or 2.58x.

The gain occurred as the value of the Turkish lira deteriorated from 2.33 to 6.04 relative to the U.S. dollar.

Although the optics suggest that the value of gold in Turkish Lira has risen sharply, the value of the Turkish Lira relative to the U.S. dollar has fallen by an equal amount. A position in gold acquired using lira yielded no more than an investment in gold using U.S. dollars.

This real-world example is elusive but important. It helps quantify the effects of the recent economic chaos in Turkey. Turkey’s economic future remains uncertain, but the reality is that their currency has devalued as a result of large fiscal deficits and heavy borrowing used to make up the revenue shortfall. Inflation is not the cause of the problem; it is a symptom. The cause is the dramatic increase in the supply of lira designed to solve the poor fiscal condition.

A Turkish citizen who held savings in lira is much worse off today than even two months ago as the lira has fallen in value. She still has the same amount of savings, but the savings will buy far less today than only a few weeks ago. Her neighbor, who held gold instead of lira, has retained spending power and therefore wealth. This illustration highlights the ability of gold to convey clear comparisons of various countries’ circumstances. It also illustrates the damage that imprudent monetary policy can inflict and the importance of gold as insurance against those policies.

Penalty

Using Turkey as an example also helps illustrate why we say that inflationary regimes impose a penalty on savers. Inflation encourages and even forces people to spend, invest or speculate to offset the effects of inflation. Investing and speculating entail risk, however, so in an inflationary regime one must assume risk or accept a decline in purchasing power.

Most people think of inflation as rising prices. Although that is the way most economists represent inflation, the truth is that inflation is actually your money losing value. Inflation is not causedby rising prices; rising prices are a symptom of inflation. The value of money declines as a result of increasing money supply provided by the stewards of monetary discipline, the Federal Reserve or some other global central bank.

This is difficult to conceptualize, so let’s bring it home in a simple example. If you live in a country where the annual inflation rate is a steady 2%, the value of the currency will decline every year by 2% on a compounded basis. At this rate, the purchasing power of the currency will be cut in half in less than 35 years.

Now consider a country, like Turkey, that has been running chronic deficits, printing money rapidly to make up a revenue shortfall, and begins to experience accelerating inflation. The annual inflation rate in Turkey is now estimated to be over 100% or 8.30% per month, a difficult number to comprehend. The value of their currency is currently falling at an accelerating pace so that what might have been purchased with 500 lira 9 months ago now requires 1,000 lira.

Put another way, for the prudent retiree who had 10,000 lira in cash stashed away nine months ago, the inflation-adjusted value of that money has now fallen to less than 5,000 lira. If inflation persists at that rate, the 10,000 will become less than 1,000 in 29 months.

Believe it or not, Turkey is, so far, a relatively mild example compared to hyperinflationary episodes previously seen in Germany, Czechoslovakia, Venezuela, and Zimbabwe. These instances devastated the currencies and the wealth of the affected citizens. Fiscal imprudence is a real phenomenon and one that eventually destroys the financial infrastructure of a country.

For more on the insidious role that even low levels of inflation have on purchasing power, please read our article: The Fed’s Definition of Price Stability is Likely Different than Yours.

Summary

There are over 3,800 historical examples of paper currencies that no longer exist. Although some of these currencies, like the French franc or the Greek drachma disappeared as a result of being replaced by an alternative (euro), many disappeared as a result of government imprudence, debauching the currency and hyperinflation. In all of those cases, persistent budget deficits and printed money were common factors. This should sound worryingly familiar.

Modern day central banks function by employing a steady dose of propaganda arguing against the risks of deflation and in favor of the benefits of a “modest” level of inflation. The Fed’s Congressional mandate is to “foster economic conditions that promote stable prices and maximum sustainable employment” but promoting stable prices evolved into a 2% inflation target.

The math is not complex but it is difficult to grasp. Any number, no matter how small, compounded over a long enough time frame eventually takes on a parabolic, hockey stick, shape. The purpose of the inflation target is clearly intended to encourage borrowing, spending and speculating as the value of the currency gradually erodes but at an ever-accelerating pace. Those not participating in such acts will get left behind.

In the same way that rising prices are a symptom of inflation attributable to too much printed money in the system, deflation is falling prices due to unfinanceable inventories and merchandise pushed on to the marketcausedby too much debt. Contrary to popular economic opinion, deflation is notfalling prices caused by a technology-enhanced decline in the costs of production – that is more properly labeled as “progress.” The Fed is either knowingly or unknowingly conflating these two separate and very different issues under the deflation label as support for their “inflation target”. In doing so, they are creating the conditions for deflation as debt burdens mount.

Gold, for all its imperfections, offers a time-tested, stable base against which to measure the value of fiat currencies. Accountability cannot be denied. Despite the unwillingness of most central bankers to acknowledge gold’s relevance, the currencies of nations will remain beholden to the “barbarous relic”, especially as governments continue to prove feckless in their application of fiscal and monetary discipline.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.