What a week!

CPI, PPI, Retail Sales, Fed Speak, Earnings, Tariffs on then Postponed, China, Yields rise then fall, the Dollar rises then falls, Gold makes a new all-time high, Growth outperforms value.

If I were a slam poet, that list could be the start of a great beat.

What does it all mean? And what does it all mean to the Economic Modern Family?

Consumers fear inflation yet they are divided between buying vacations, health and beauty products, while a “No Buy” Challenge grows.

Powell says there is no rate cut until he sees weakness in jobs, yet yields have fallen, and long bonds could be on the verge of a breakout.

The dollar is breaking down.

Plus, with the potential huge federal job cuts happening, the employment numbers could turn ugly for March.

We see a lot of variables in the narrative, and bifurcation in price.

Many growth stocks did extraordinarily well last week.

We even saw some beat-up names emerging from the doldrums.

However, the Economic Modern Family remains muted.

Let’s look..

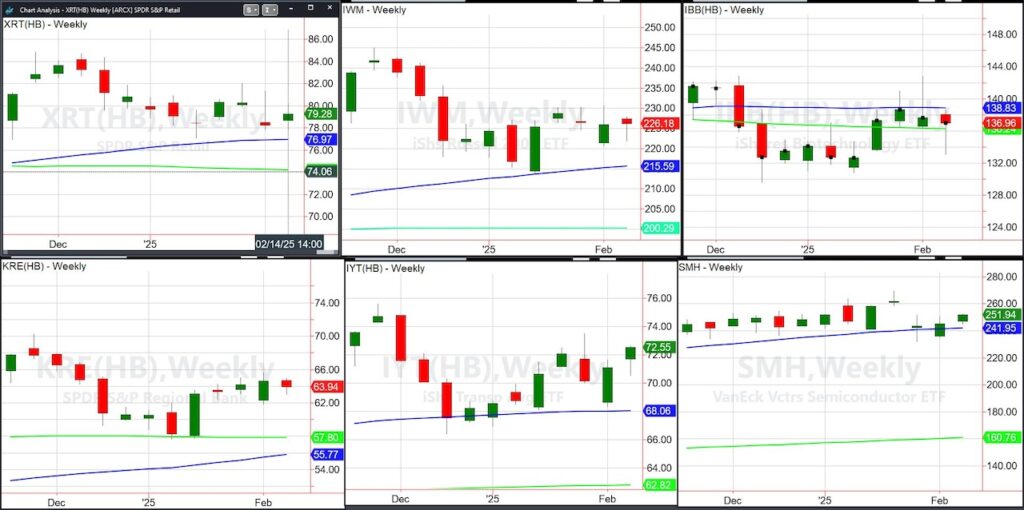

Nothing screams wildly bullish or horribly bearish in the weekly charts.

Individually, Retail XRT is holding key support. Yet, the ETF has a lot of work to do. I would get a bit excited if XRT clears 80 and much more so if it clears 82.

The Russell 2000 IWM had an inside week (range stayed within the range of the week before). Are we surprised?

With all the talk of bringing industry back to the US (reshoring) small caps are neutral.

Biotechnology IBB managed to hold the 200-WMA (green line). Again, price dictating the narrative, a move over the 50-WMA (blue line) would mean higher prices likely.

Regional Banks KRE also had an inside trading week. There is not a whole lot to conclude other than that this sector looks as neutral as small caps do.

Transportation IYT looks the best. Nonetheless, while the S&P 500 reached new all-time highs, this sector is far from its all-time highs.

Like the consumer, the economic picture very much depends on how robust air, freight, and truck traffic remains.

While we saw big moves this week in a few growth stocks connected to AI,

Semiconductors SMH closed better than the week before, but not enough to get anywhere near all-time highs set in July at 280.

Nvidia reports earnings on February 26th. Many eyes will be watching.

The weekly chart of Bitcoin shows leadership over everyone else in the Family.

What can we conclude from that?

Faith in alternative currency feels safer to investors than the basic US economic sectors do.

Sideways consolidation could lead to either a big breakout over 100k or a more sustained correction under 92k.

When analysts say this is a stock picker’s market, they mean that the macro is muddy and it behooves investors to find the pearls.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.