Wendy’s Company (ticker: NYSE: WEN) declined sharply on Tuesday after the company announced lower earnings guidance resulting from its plans to offer breakfast.

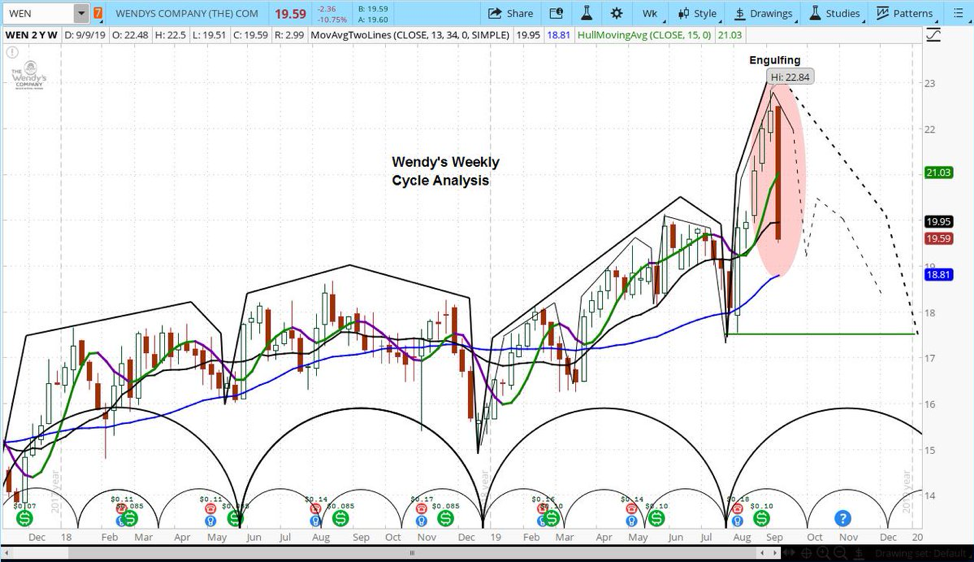

Based on its market cycles, we believe the stock will face more risk in the intermediate term.

The company announced that it would start offering breakfast to customers in 2020. This will be accompanied by hiring 20,000 new employees and a new $20 million investment. Management projected that the near term impact on earnings will lower its guidance by 3.5% to 6,5%.

Nonetheless, CEO Todd Penegor pointed out that, “Launching breakfast nationwide provides incredible growth opportunities. We put Wendy’s fan favorites on our breakfast menu to set us apart from the competition.”

Our approach to stock analysis uses market cycles to project price action.

While it is notable that the stock remains above the point at which it started the cycle, this move creates a bearish engulfing candle.

Combined with negative momentum and a gap on the daily chart, our analysis is for continued risk in the months ahead.

The Wendy’s Company (WEN) Stock Weekly Chart

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.