Okay, even an armchair economist knew that used car prices, airfares, and car rentals couldn’t continue to go up by double digits, month after month for very long.

These were some of the bigger contributing categories to the spike in the U.S. Consumer Price Index (CPI), the favored measure for price inflation. In part because of compositional differences, the spike in Canada’s CPI has been less pronounced than in the U.S., where in June, the U.S. CPI was +5.4% — the highest since the early 1990s. Canada’s CPI touched +4.1% in August, its highest in two decades.

During this inflation run up, the common narrative has been: this is “transitory.” And rightly so, since that has been the chorus line from the Federal Reserve, other central banks, and just about every economist.

These price spikes have been caused by a combination of supply chain issues, abruptly changing consumer habits, strong demand, or if you prefer, the ripple effects from the pandemic. Airlines are a good example. They are accustomed to managing changing demand swings in the single digits, not a 50% decline in demand and then a 50% recovery. Good luck staffing and managing a complex business to meet those fluctuations.

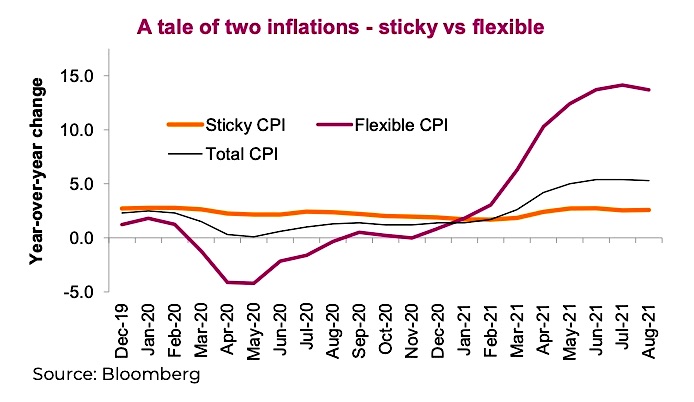

August U.S. CPI data showed that these transitory components of CPI are starting to come back down, or at the very least have stopped their ascent. Airline fares dropped 9% and car and truck rental prices fell by 8% compared with the previous month. However, some components still rose, and many remained elevated. Perhaps a more insightful framework for any longer-term impacts of this inflation spike is Atlanta Fed’s “Sticky” vs “Flexible” CPI measures. This separates CPI components based on how quickly the prices change in certain categories. For instance, airfares change really fast; home rent rates much less so.

As you can see in the chart below, total CPI has risen (as indicated by the thin black line), driven almost entirely by the flexible component. Also worth noting it was the flexible CPI categories that drove the deflationary pressures during the early days of the pandemic.

Inflation Is a Mindset

But this is all headline data for inflation — the real economic danger from inflation occurs when it changes behaviour. This can mean a companies’ decision to expand, individuals’ decisions on buying goods/services, employment, people’s savings patterns and of course investing choices. So far there hasn’t been much evidence of this, but it appears to be rising.

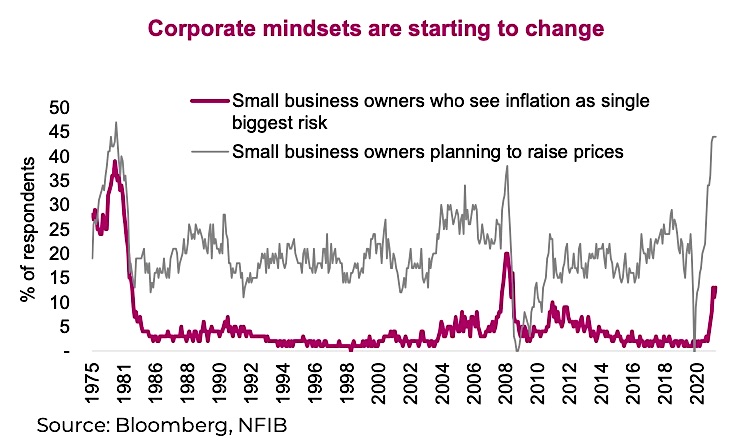

The National Federation of Independent Business surveys of small businesses say inflation is

increasingly becoming a concern. The fear is nowhere near where it was in the 1970s (see chart

right) but it’s certainly a rising risk in the eyes of entrepreneurs. Inflation raises uncertainty about the cost of projects, initiatives, and even steady state operations. A company could easily decide not to expand given inflation uncertainties, which has obvious broader economic implications.

Changing corporate mindsets are also evident in earnings transcripts. Mentions of rising inflationary costs were very prevalent in earnings conference calls during the Q2 earnings season, and for good reason. So far, rising top-line revenue has kept up or largely surpassed rising costs, driven by the recovery plus companies raising their prices. This has kept margins high and healthy. If revenue growth slows, as is forecast, rising inflationary costs at the corporate level could quickly take a bite out of margins. We believe this will become a hot topic in the months ahead and investors should tilt more towards those companies able to pass through rising costs or less at risk.

Inflation is also a tax, especially for individuals, as we can’t really pass through inflation like many corporations do. Let’s say your household enjoys an income of $250k, or $150k after tax (forgive us, we are generalizing). If inflation is rising at 5%, your after-tax and inflation household income would drop to about $130k after three years. Well, that sucks. Your options are then to demand a raise or switch jobs, just to keep up with inflation. This is the risk.

We all agree that much of the spike of inflation is transitory and as supply/demand balances get sorted out, this spike should come back down. However, behaviours are starting to change. This could cause the new base rate inflation to be higher than it has been for the past decade — especially if we start to see some rising price pressures in those sticky categories of CPI (remember the first chart).

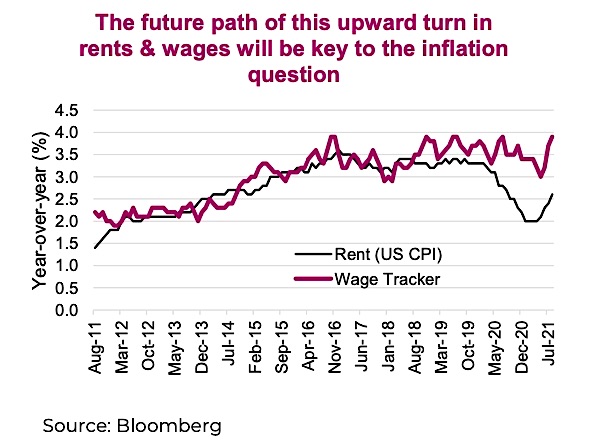

Rent is a big component of CPI and certainly is in the sticky category. In fact, historically, we have not seen sustained higher inflation without rent as a contributor. And while wages are not explicitly a category of CPI, wages flow through to the end price in most industries. Wages are also very sticky: have you ever tried to tell someone you will be paying them less? Really doesn’t go over well.

Investment implications

As the flexible CPI components stubbornly fall back to earth, the narrative around inflation may turn quieter. However, mindsets are starting to change, and those sticky CPI components are stirring a bit higher. Together with rising wages, inflation and cost pressures on corporate earnings are likely to become a topic for the coming year. The recipe for runaway inflation remains absent; however, a higher inflationary environment compared with the past decade appears likely. This could have impacts on yields, valuations, style, and margins. For now, keep a keen eye on rents and wages to see if this inflation spike is going to grow into a longer-term issue.

Source: Charts are sourced to Bloomberg L.P. and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.