I believe that event would be on October 1st. And digging in deeper, there was one good post from Urban Carmel (@ukarlewitz) on Twitter. When I look through this chart and his comment, I see that the stock market rose actually in the following month after the last 3 shutdowns. Having said that, this is something to keep in mind but possibly just another data point more than anything else.

Equities rose during the 3 prior government shutdowns (incl 2013), but overall it’s been close to random $SPX pic.twitter.com/RTVwu1oNrz

— Urban Carmel (@ukarlewitz) September 23, 2015

Alright, let’s see what the the market breadth indicators are saying.

Market Breadth Indicators:

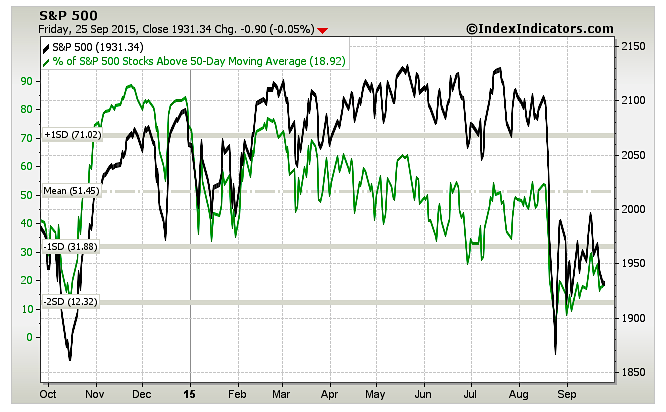

Market breadth has been getting slightly better but still is pathetic. The 21 day Weighted Equity Only Put/Call ratio has started to trend downwards. Plus the market volatility (VIX) is probing the 20 mark every now and then. The breadth readings below are back to oversold or near oversold levels. The rally on Friday probably could have opened up possibilities for a breadth buy signal. Another sign for sharp rallies but one has to be quick and nimble as these will be highly short-lived.

NYMO (McClellan Oscillator):

To start the week NYMO was positive until Thursday when it moved lower. Friday, it ended at -10.22 after trying to stay positive. A lot of gyration there. With the sort of action on Friday, very possible to get a flush lower in the indices on Monday and $NYMO gets pushed lower. This will make it more bearish than bullish but any more towards 0 or above will bode well for equities.

TRIN & TICK:

TRIN ended the week at 1.03 but was elevated throughout the week. Something to watch out for as if the equities go much lower, this can spike big. TICK has crossed down below the 10 EMA to make things look more bearish.

% of S&P Stocks Above 50-Day Moving Average – down to 18.92. Was 22.11 last week.

You can read more of my weekly analysis on my website. Thanks for reading.

Twitter: @sssvenky

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.