European Stocks

Looking overseas, the near-term situation in Europe has improved slightly while the U.S. has marked time. Longer-term trends in Europe, however, remain challenged. The rally off of the late-June lows has carried European stocks above one down-trend resistance line, but the 200-day average and the pattern of lower highs since last year’s peak remain obstacles. Both price and momentum indicators suggest the recent rally in Europe could carry somewhat higher, but there is also little evidence that a sustained long-term up-trend has emerged, either on an absolute basis or relative to the U.S.

Utilities vs Energy Ratio

We are seeing evidence of a change in leadership at the sector level in the U.S. The trend showing strength in Utilities versus Energy is being challenged after the most recent rally in Utilities failed to produce a new high. After two years of persistent strength in Utilities, a breaking in this up-trend could open the door for a significant reversal. This could be exacerbated if fund flows continue to shift from Utilities and into Energy.

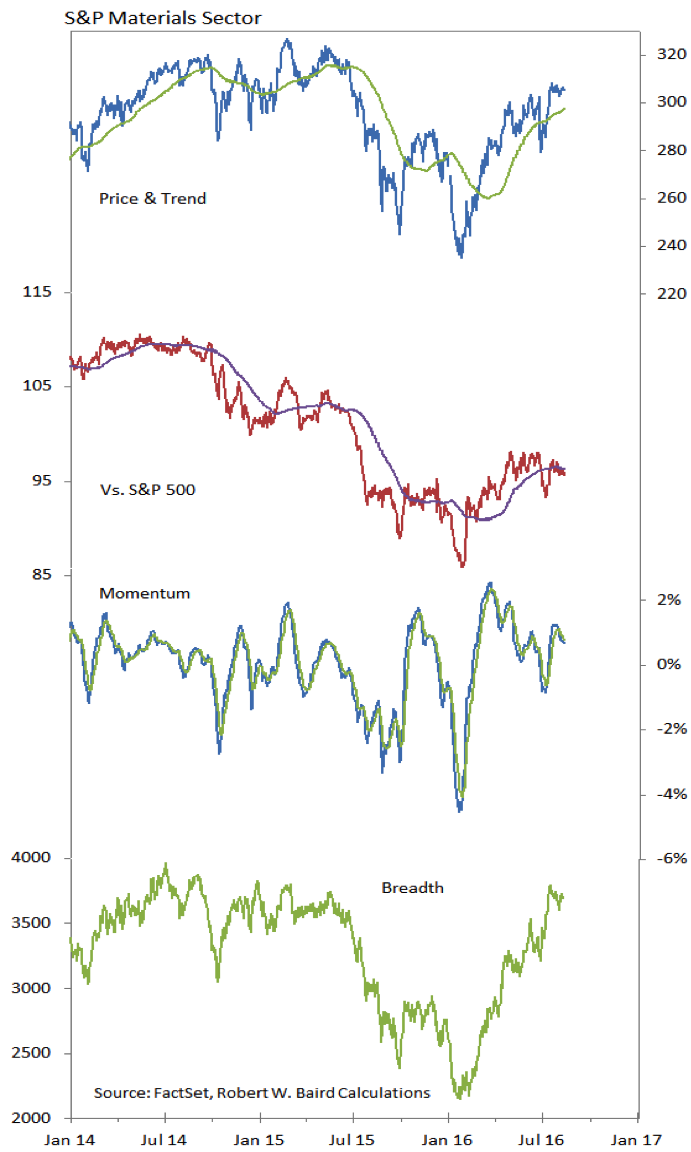

Materials Sector

Materials continue to rebound from the absolute and relative price weakness that was seen in the second half of 2015. Not only is price rebounding, but sector-level breadth has also improved dramatically.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.