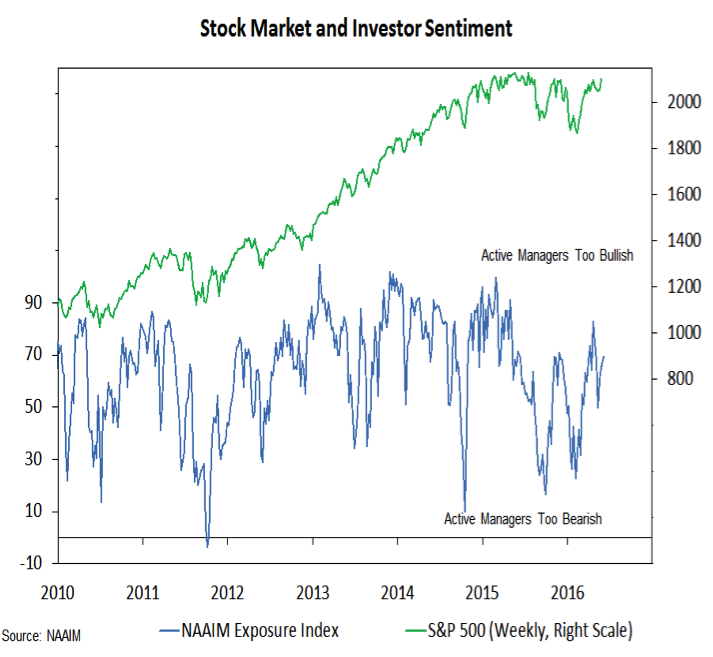

Market / Investor Sentiment

In recent weeks, we have watched optimism fade in the AAII and Investors Intelligence surveys. This has not been a story about excessive pessimism, but a notable lack of optimism so close to all-time highs on the S&P 500. This week, the noise in the investor sentiment surveys continued, with big increases in the bullishness being reported among both individual investors and advisory services. Active investment managers surveyed by the NAAIM have been steadier in their outlook, but here too, bullishness is rising (although it remains shy of the April peak).

A more comprehensive approach is to aggregate these surveys into composite indicators. That is what Ned Davis Research does with their Crowd Sentiment Poll and Daily Trading Sentiment Composite. As such these can offer more stable and reliable indications of investor sentiment. Both of these indicators have moved back into a neutral sentiment zone. What relative pessimism existed has faded and optimism is now increasing. An important, but often underappreciated tenet of sentiment analysis is that over the intermediate term (as represented by the Crowd Sentiment Poll), it only works to fade the crowd after extremes. A rise in optimism after excessive pessimism is the most bullish sentiment backdrop for stocks, until that is, optimism becomes excessive. We are not there yet on either of these indicators.

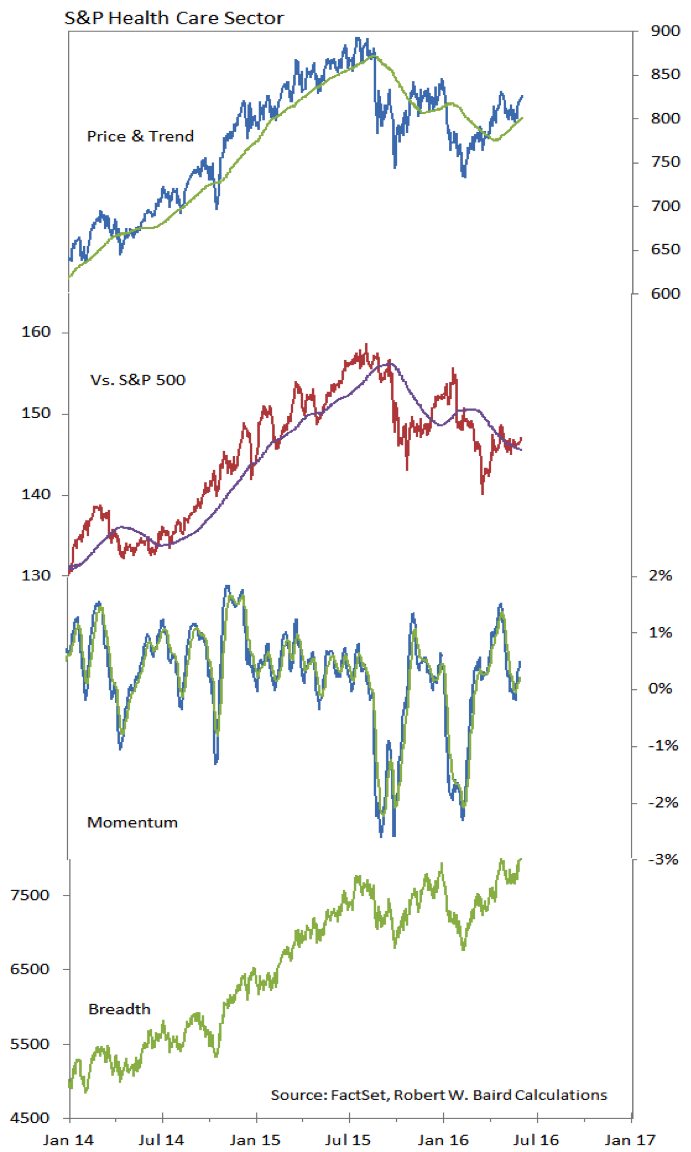

Health Care Sector

The Health Care sector has been near the bottom of the relative strength rankings, which is not a surprise when looking at the relative price line. More recently, however, conditions have started to improve – especially at the industry group and sub-industry level. While the sector has moved off its early-year lows on a relative basis, it has not broken the pattern of lower highs, and the false breakout suggest caution on the sector remains warranted. Breadth however is close to a new high and momentum is improving. While price is testing its down-trend, we need more evidence before concluding that a move into the leadership group is imminent.

Thanks for reading and check back next week for our weekly stock market outlook.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.