Europe

Conditions in Europe are improving and stocks there appear poised to break through resistance and challenge the highs seen earlier this year.

Support near 3300 has held (this has been a key pivot point for over a year) and momentum has improved over the past month, allowing the Euro Stoxx 50 index to breakout above the downtrend line.

This action is constructive for European stocks.

Euro Stoxx 50 Chart

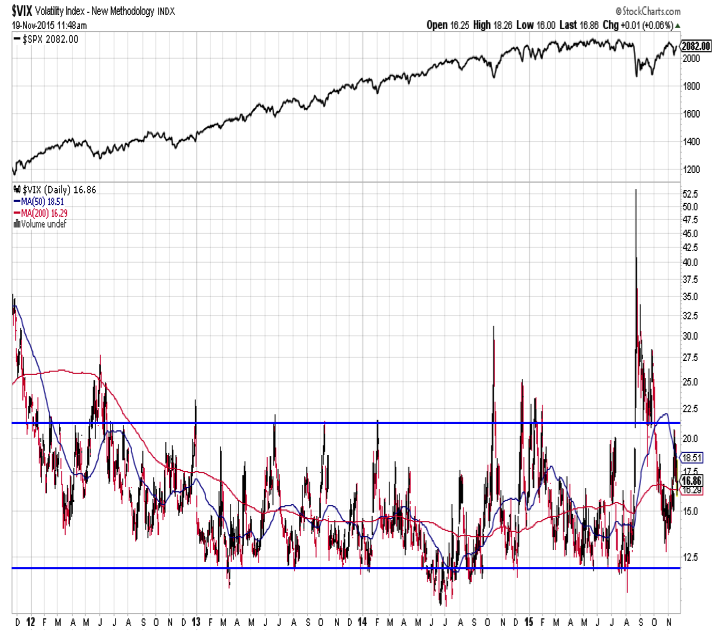

VIX Volatility Index

Last week’s sharp sell-off and continued concerns over the health of the broad stock market appear to be weighing on investors. The rise in geo-political tensions in the wake of the Paris terrorist attacks adds to the unsettled feeling among investors and combined these could help continue to fuel skepticism and provide a wall of worry for stocks to climb.

Even as stocks have rallied this week, the Volatility Index (VIX) has remained relatively elevated (not by historical standards, but within the context of the range that has persisted for the past several years). Demand of put options has also been robust.

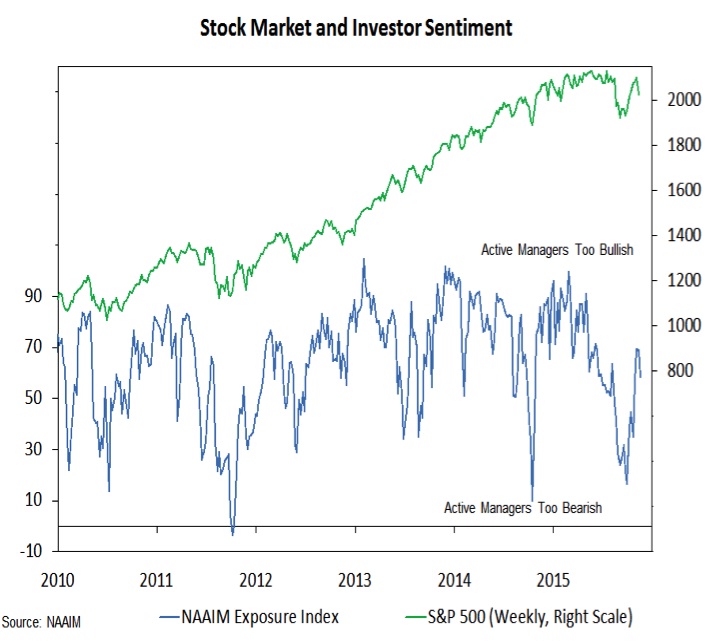

Market Sentiment

We have also seen some dampening in optimism in the investor sentiment surveys. This week’s NAAIM Exposure index dropped 11 points (from 69% to 58%) and the AAII survey shows parity between bulls and bears. Two weeks ago there were twice as many bulls as bears.

Given that optimism is usually high in December and January anyway, we may not need to see a significant dampening in investor spirits to keep market sentiment from becoming a headwind, and the concerns listed above could just do that.

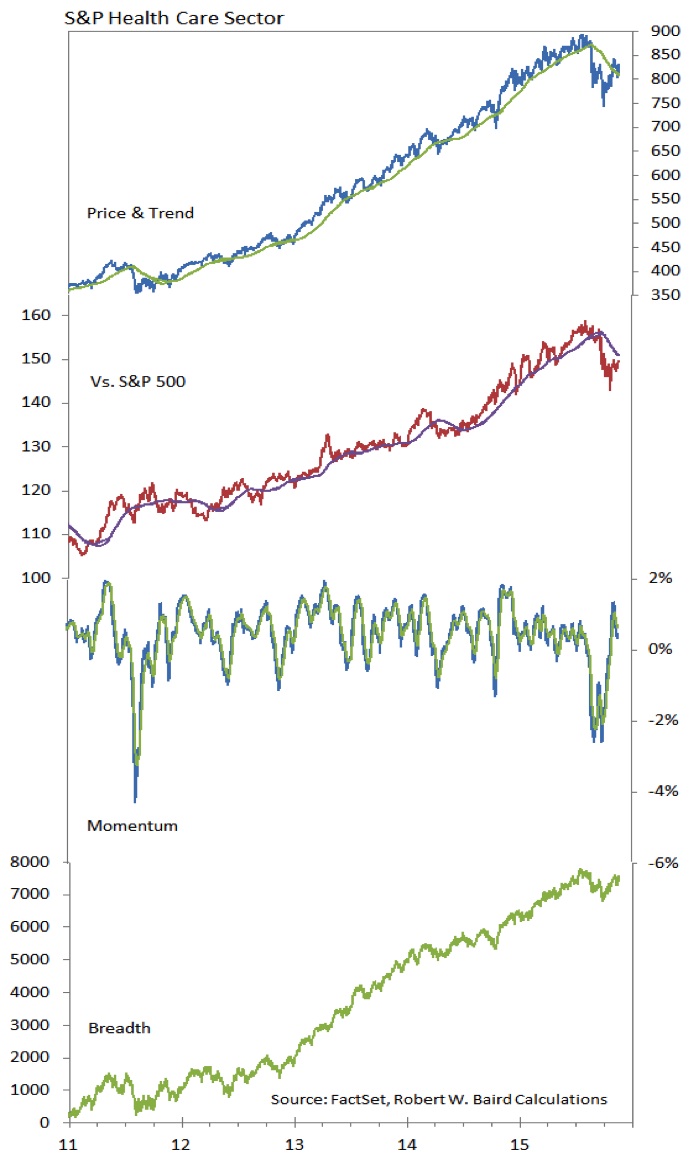

Health Care Sector

The Health Care sector has had trouble regaining its leadership form after stumbling in August. While there has been some improvement from an absolute price perpsective, the relative price lines has struggled to get back in gear. Breadth has not broken out and momentum appears to be fading. The sector could be in for a longer period of consolidation than seemed conceivable just three months ago (when a fifth consecutive year of outperformance relative to the S&P 500 looked virtually guaranteed).

Thanks for reading and have a great week.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.