Market Trends & Investor Sentiment

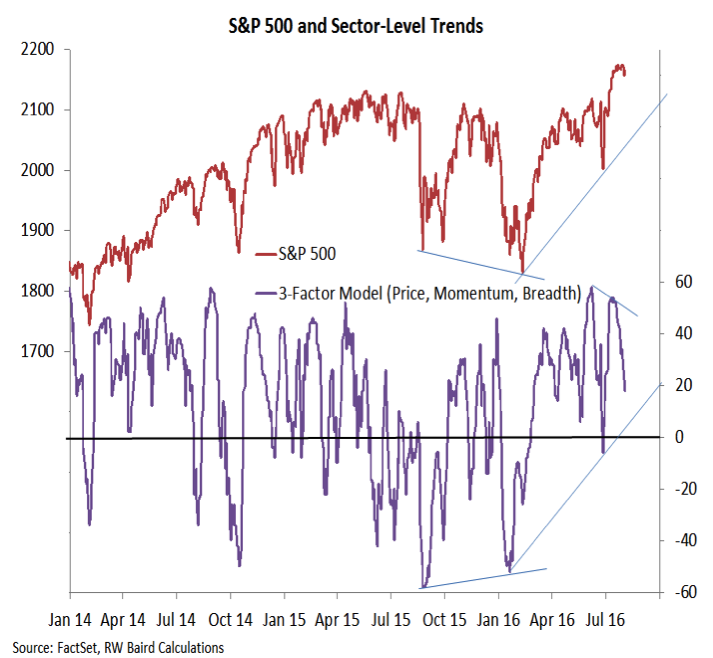

Evidence that the consolidation phase is not yet complete comes from our sector-level trends indicator. Short-term sector-level trends continue to deteriorate. This is in contrast to our longer-term industry-group trend indicator which shows still robust breadth trends. Seeing an upswing in sector level trends would be good evidence that stocks are getting back in gear.

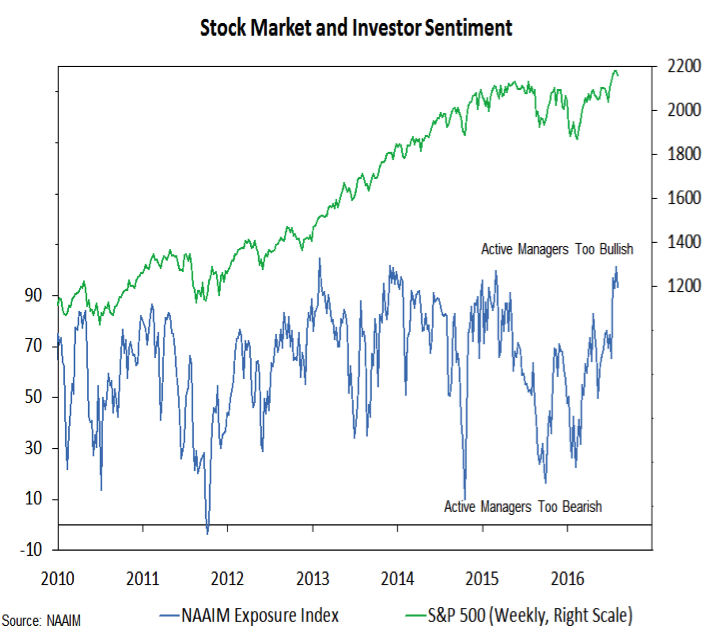

While the consolidation phase is ongoing, we will also be watching our sentiment indicators for evidence that the surge in optimism that accompanied the rally to new highs is dissipating. The NAAIM Exposure index moderated somewhat this week (dropping from 101 to 93) but active managers are still pretty giddy and the bearish contingent remains in hiding. We’ve also seen evidence that interest in inverse ETFs has waned significantly (h/t @JLyonsFundMgmt). A rebuilding in skepticism and decline in complacency could help make rally attempts more sustainable.

US Treasury Yields

A well-defined down-trend in the 10-year T-Note yield remains intact, and would not even be seriously challenged until 1.7%. However, the most recent decline found support near 1.45%. This is a higher low than was seen in early July. Momentum in yields is starting to move higher. If yields are going to start to trend higher, the first level of resistance would be the July high near 1.6%.

S&P Information Technology

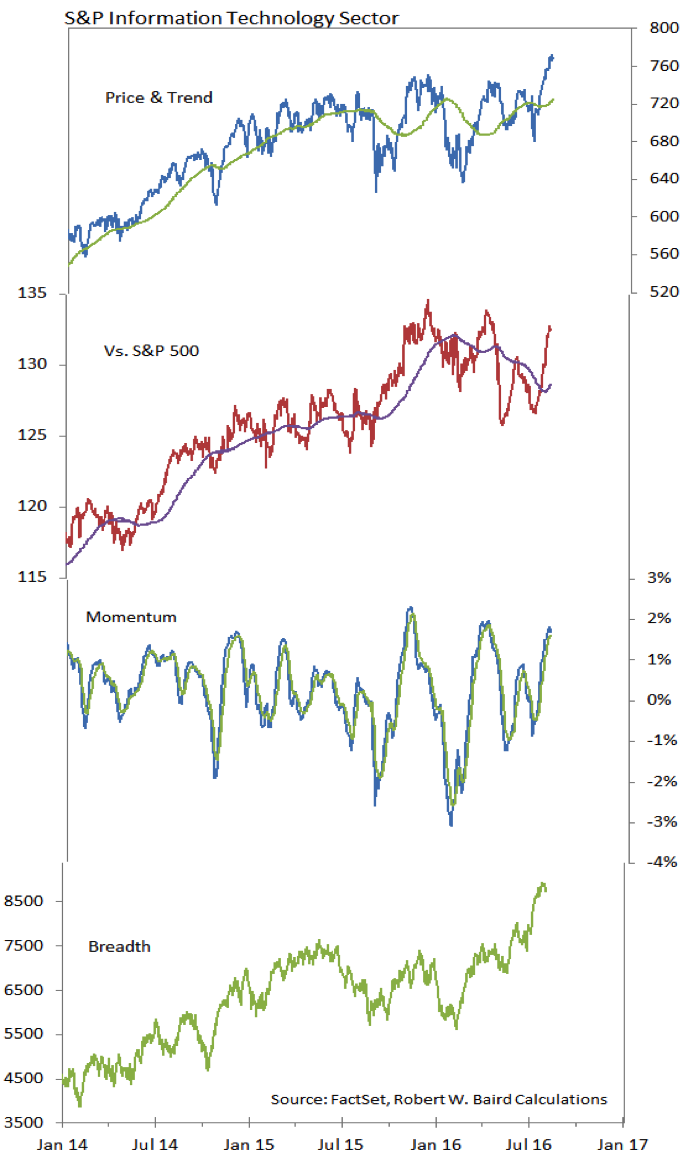

The Information Technology sector made a big jump in this week’s relative strength rankings (moving from #7 to #3). As can be seen, the sector level price, breadth and momentum indicators are all moving higher together and this is bullish for the sector. Overhead resistance lies just ahead from a price perspective. One other caveat is that the sector is not seeing much support at the sub-industry level. The exception would be semi-conductors, which have broken out to the upside on both an absolute and relative basis.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.