This post was written by Derek Benedet of Richardson GMP.

And it never failed that during the dry years the people forgot about the rich years, and during the wet years they lost all memory of the dry years. – John Steinbeck, East of Eden

This quote reminded me of the endless boom / bust cycle in the energy complex. It’s nothing new, in fact it taps into human nature and how capital drives all markets. When times are good, the money flows. When times turn bad, the money taps stop. The energy markets struggle with themes like depravity, and the capacity for self- destruction, we also see surpluses and a capacity to be resurrected. It’s these themes that provide a sense of optimism when times are bad. And the dance continues. Of course the big question is where we are in this dance and for that is comes down to supply and demand.

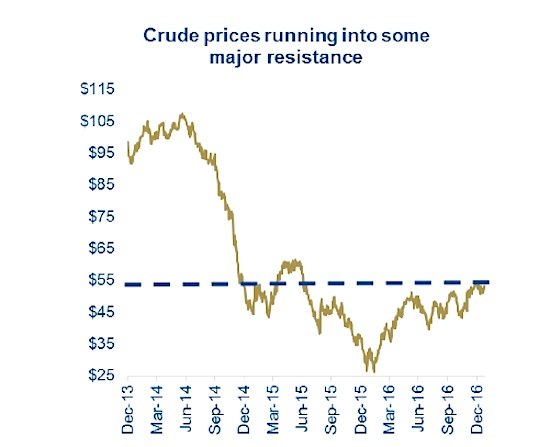

From a commodity price perspective, it absolutely seems as if the oil market has been resurrected over the past year. Crude oil has doubled from trough prices experienced last February. But have remained range bound in the low $50s for the past couple of months. Technically, oil appears to have run into some strong resistance in and around $53.

The next move, as always, will be driven by up or downside surprises on demand and supply.

Supply

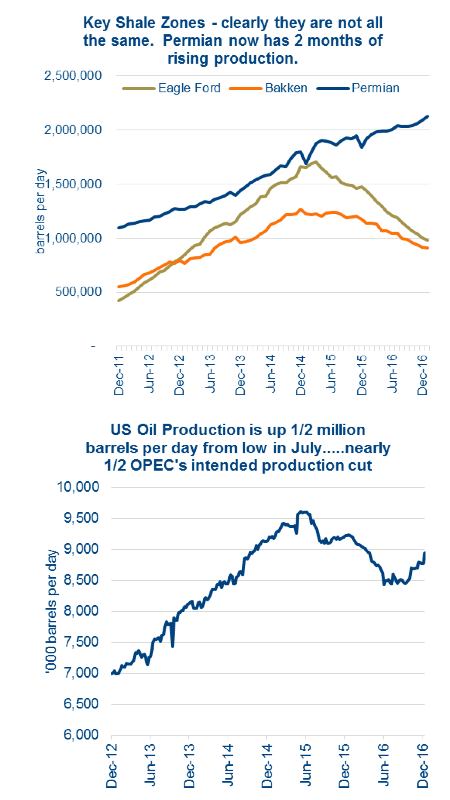

On the supply side, at a very high level there are two very important matters – OPEC compliance with their stated 1.2 million barrels per day (bpd) production quota cut and the path of U.S. shale production. Oil rallied after the announced production cut, but as always with OPEC there can be differences between announcement and actual cuts. So far the market is giving OPEC the benefit of the doubt. This is more of a wait and see story, but it’s one of the key reasons for our continued hesitancy to add to energy. With a sector up 30% over the past year, the temptation is there for investors to chase performance. We advise patience.

U.S. oil producers are ramping up spending. Optimism certainly seems to be trumping nervousness right now for oil producers. The quote from Dave Lesar sums this shift in attitude nicely. Is the market perhaps getting a little too optimistic? We maintain a balanced view, noting that producer optimism may come back to bite them.

So we have rising U.S. production, with a focus on the Permian Basin. U.S. rig counts rose by 18 this week and 35 the previous week. Last week’s rise was a 5.3%, increase the largest week over week increase in over five years. If rigs continue growing at this two-week pace, they will reach the 2014 peak of 1931 in less than a year. The U.S. is quickly re-adding production to at least partially fill the vacancy caused by OPECs production cut.

Demand

On the demand side, we do see improvements for the global economy, which should drive further demand growth. While changing behaviors, efficiency and renewables has made the connection between global economic growth and oil demand less certain these days.

Portfolio Implications

Making the right call is important for Canadian investors. The energy sector is a large part of our both our economy and publically traded markets. The TSX Energy sector weighting has gone through a wild ride. At 22%, it’s a hefty component, which still appears too hefty for most investment portfolios.

Looking at the various sub-sectors, it’s interesting to see that integrateds are very close to pre-crisis levels, while energy service names have the most room to make up. Breaking down the sectors we’ll also note that the correlation between E&P’s and oil is beginning to deteriorate as well as the disparity within the sector. Picking the right names, makes more of a difference, which leaves potential for active managers to stand out.

Our positioning

Within our portfolios we’re currently underweight energy with a 8.7% weight in our Core Income fund. We have exposure to integrateds, pipes, as well as energy services. Integrateds because they provide some income, and have a degree of safety. Pipes, specifically TransCanada, are benefiting from volume flow as well as some encouraging developments south of the border regarding the Keystone XL pipeline. Energy services because it gives more exposure to the micro market in North America vs. the global macro. The industry is seeing increased demand for drill rigs, pressure pumpers and sand not to mention labour. Cost inflation is hitting the industry, and energy service firms will be the largest beneficiaries.

Charts are sourced to Bloomberg unless otherwise noted.

Thanks for reading.

Twitter: @sobata416 @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.