The S&P 500 had its second sharp drop in the past three weeks. Markets don’t turn until we get a long lower shadow with a new low at the bottom of the shadow.

This candlestick pattern represents a sharp extreme change in investor sentiment. Friday’s doji is a good sign.

There is a bullish near-term divergence still in play for S&P 500 with target at 2800.

The S&P 500 closed below its previous intermediate low. The last two times – Brexit and 2016 election – were fakeouts. Next week’s close either above or below 2700 will tell us if this week’s drop is a fakeout or change in trend.

It’s rare for S&P 500 to close this low below the 200-day moving average when long-term momentum is so bullish.

Enjoy this week’s video. See further below for highlights.

Weekend Market Outlook Video – October 27:

Below are additional bullet points of market items discussed in this weekend’s video. Learn more about our service over at Market Scholars.

- Russell 2000 showed more oversold clusters again. This is the highest concentration of oversold clusters since March 2009.

- All the major stock market indexes are trading below the 3rd standard deviation channel below its linear regression trendline on their 1-year chart

- S&P’s 8-day EMA finished sharply below its 17-day EMA with bullish divergence setup on Stochastic.

- S&P’s 4-week range exceeded 10% this week, which is a sign of extreme volatility that usually leads to moderation. This week’s volume hit extreme levels again for the second time in the past 3 weeks.

- ATR is approaching 52-week highs on absolute and relative basis

- Volatility jumped as expected but usually doesn’t follow through after one surge with another volatility surge. Look for gradual volatility moderation

- Interest rate hike odds are dropping as yield curve still moves higher. Inflation expectations are falling and did not show the same spike that markets saw during this year’s previous bout with high equity volatility

- Today’s top sectors were not the typical safe haven areas. In fact, Technology and Discretionary outperformed broad market this week, despite weak earnings results for bigger names.

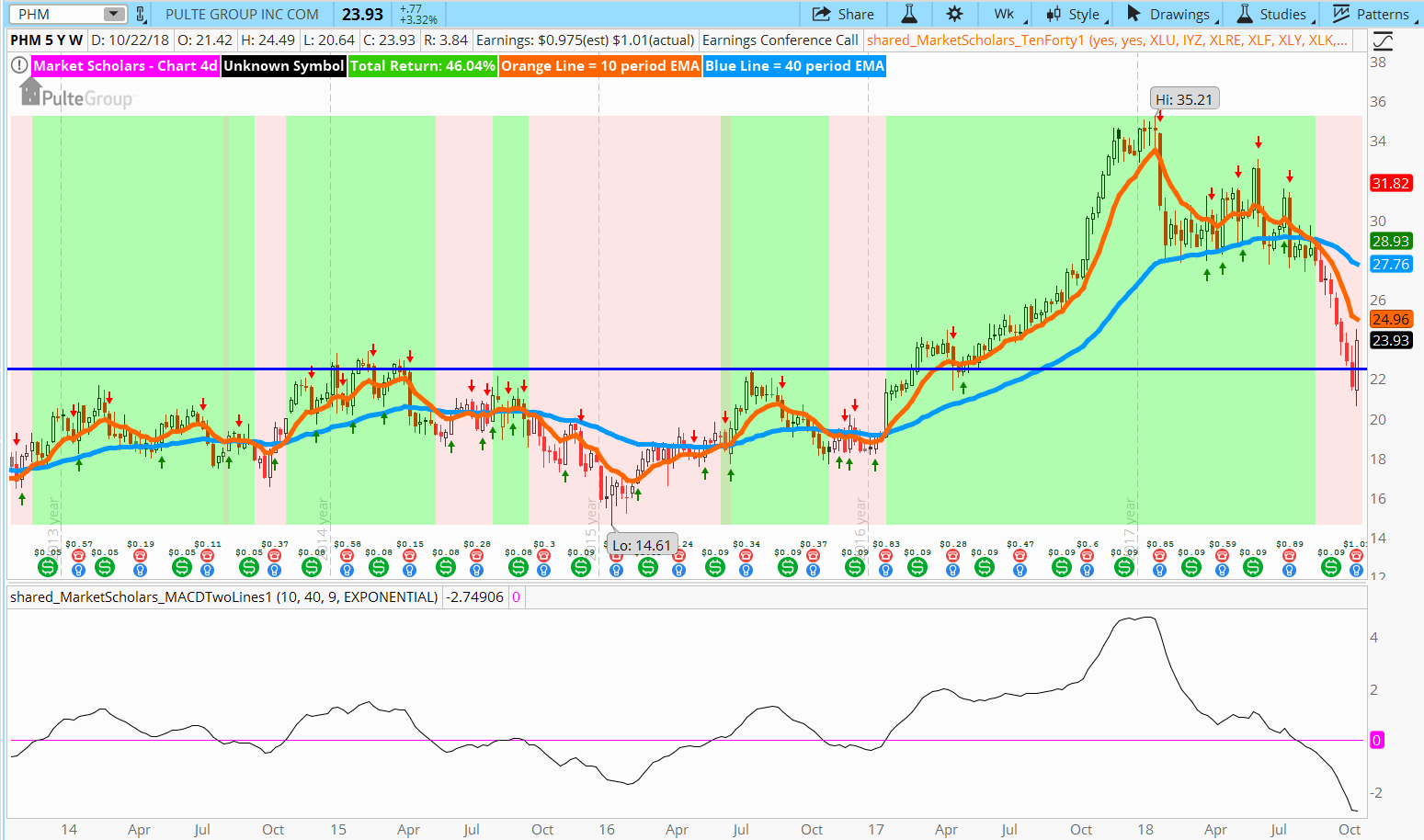

- Bullish trade idea in beaten up Real Estate sector that showed some beaten-up areas are already starting to show signs of bouncing.

Twitter: @davidsettle42 and @Market_Scholars

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.