Another week gone by and there is a lot of market news and price action to discuss.

In this week’s weekend market outlook we will discuss several topics, including seasonality and volatility. Below is a summary of what’s in the video below. Please feel free to comment or hit us up with any questions.

Market Outlook Video (August 18):

The two-day rally in equities has been fueled by weakness in U.S. Dollar. And the most oversold assets have outperformed while recently strong asset classes underperformed.

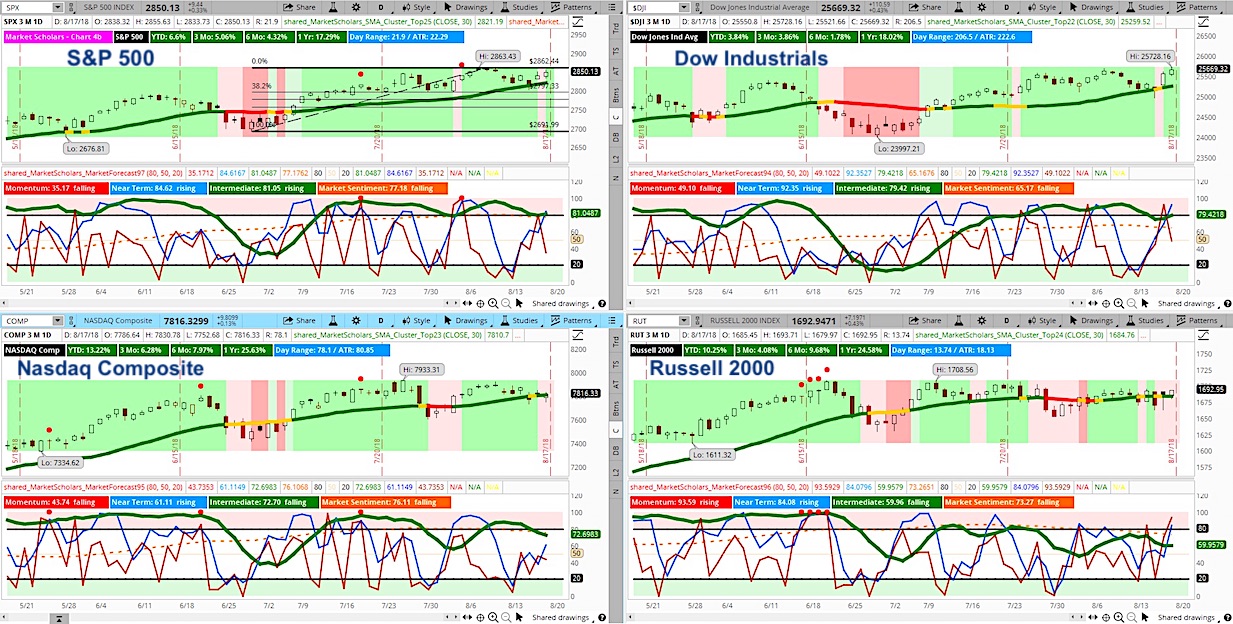

– S&P 500 (NYSEARCA: SPY) and Dow Jones Industrials (NYSEARCA: DIA) returned to strong bullish postures but NASDAQ Composite and Russell 2000 still lagging.

– Seasonality for the S&P 500 heading into a key period from mid-August to the end of the month stills suggests weakness ahead.

– Long-term chart for S&P 500 is still bullish but Heikin Ashi weekly candles showing a red flag. The stock index is trading down to 17-day SMA and looking for support with today’s volume and trading range above average but still easily in the lower half of their 52-week ranges.

– Volatility (INDEXCBOE: VIX) dropped sharply after quick spike that failed to reach 20 but is now setting up for higher lows.

– Sector Selector tool shows strength in “safe haven” sectors. Technology sector showing weakness.

Note that today’s trade idea highlights a bearish trade on a popular tech stock that broke down today after earnings and shows a potential head and shoulders pattern developing. Enjoy the video!

Twitter: @davidsettle42 and @Market_Scholars

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.