The Big Picture:

If we were sitting around at dinner right now, I’d be satisfied with the appetizer and ready for more. As many faithful readers know, I’m frequently bearish and almost always like it when we get red candles. At the same time, we all know that the entire investment industry is built on buying stocks and even I can recognize that they’ve gone up in price over time.

Occasionally readers like to call into question my bearish nature and strong aversion to carrying positive delta. As many of you know, I’m most comfortable when I’m positive theta and short delta. While those Greeks could certainly be taken as an indication of “Bearishness” (whatever the hell that is), they really just represent the characteristics of a position. Frankly, I try to stay positive theta, short delta even when I’m short term “bullish” the market. All that means is that I’m moving the curve and sitting around waiting for a pause or pullback for stocks.

I’d love to carry positive delta at times (well, maybe not, but I’ll humor you), but the implied market volatility of out of the money calls makes it less favorable. Additionally, for various reasons it doesn’t fit well with my psychology and that’s completely okay. It’s not that I’m a pessimist, it’s just that I’m too skeptical to get puffed up in excitement over stocks going up and, honestly, I prefer to hold contrary views. I recognize those traits and they’re probably another long conversation better suited for a black leather couch and well beyond the scope of this site.

The reality is that there are no right or wrong ways to trade. There’s what works for you, what doesn’t work for you, and, most importantly, positive expectancy. Nothing works 100% of the time and anyone who tells you otherwise is selling you something you really shouldn’t buy.

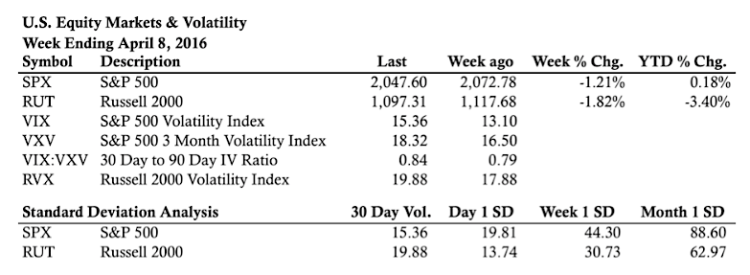

The markets chopped about this week and came in slightly, but you probably already know that. On a short term basis, it’s too early to get overly excited about the downside or, frankly, the upside. The stock market can move up, down, and sideways and traders tend to base their expectations (less confident word for predictions) on the most recent movements. Right now both the S&P 500 and Russell 2000 are moving sideways and market volatility remains relatively low in confirmation of that movement. For now there’s nothing to do but wait.

Market Volatility:

We saw a slight increase in implied volatility and the VIX:VXV ratio this week, but that movement wasn’t enough to get overly excited about the market moving lower. For now market volatility seems to be reacting as we’d expect with a slight pullback in stocks.

On a historical basis, the VIX:VXV ratio is still very low and well below the 0.92 ratio that accompanies more significant declines.

Market Stats:

Levels of Interest (S&P 500 Daily Chart)

Thanks for reading and best to you in the week ahead.

Twitter: @ThetaTrend

The author holds positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.