Investors and economists are getting awfully complacent about inflation, in my opinion. They seem to think that an escalating international war that we are printing money to support, and one that is disruptive to grain and metals trade is background noise.

Well, the latest inflation numbers have improved so I have to give them that. BUT should the war continue to escalate it will almost certainly keep up inflationary pressures.

And one area to be mindful of is grain. Namely, wheat.

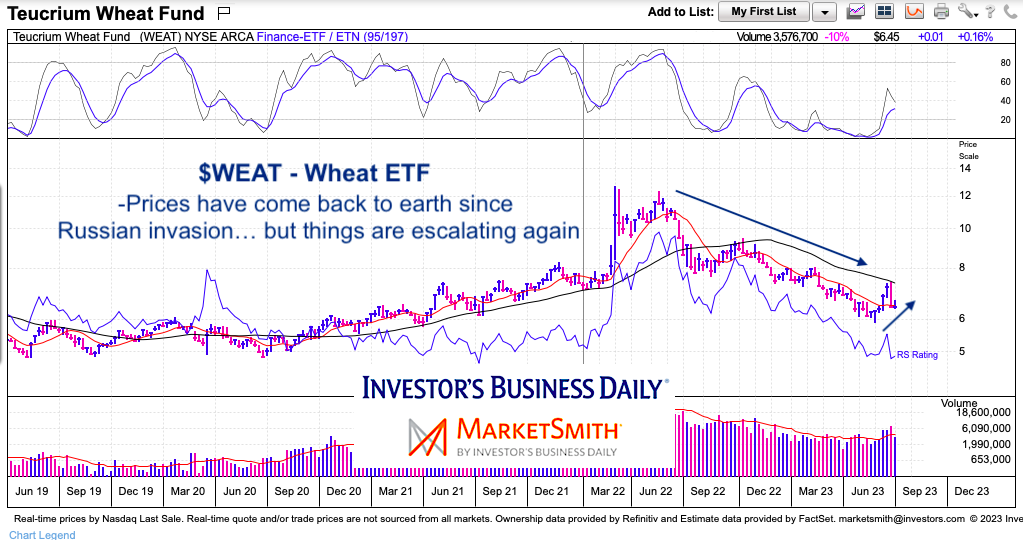

Today we look at the Wheat ETF (WEAT) simply as an indicator to watch for inflation and any escalation of the war abroad.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of tools, education, and technical and fundamental data.

Teucrium Wheat ETF (WEAT) “weekly” Chart

Here we can see the slide back to reality as investor fears about grain prices (and trade) have subsided. BUT the latest bump higher is a reminder that the war is still ongoing and Ukraine and Russia play a big role in the grain market. Worth watching.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.