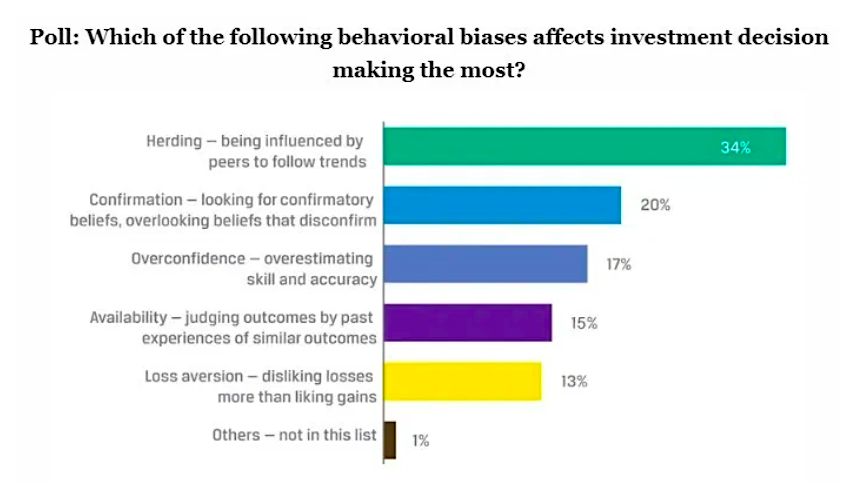

In a poll administered by the CFA Institute of America {Link}, readers, many of whom are professional investors, were asked which behavioral biases most affect investment decisions. The results are shown in the chart below.

We are not surprised by the results, but we believe a rational investor would put these in reverse order.

Compounding wealth, which should be the primary objective of every investor, depends first and foremost on avoiding large losses. Based on the poll, loss aversion was the lowest ranked bias.

Warren Buffett has commented frequently on the importance of limiting losses. His two most important rules are: “Rule #1 of investing is don’t lose money. Rule #2 is never forget rule #1.”

At Real Investment Advice, we have covered a lot of ground on investor behavioral biases.

In 5 Mental Traps Investors are Falling In To Right Now, Lance Roberts lucidly points out, “Cognitive biases are a curse to portfolio management as they impair our ability to remain emotionally disconnected from our money. As history all too clearly shows, investors always do the “opposite” of what they should when it comes to investing their own money.”

Lance’s quote nicely sums up the chart above. These same biases driving markets higher today also drove irrational conduct in the late 1920s and the late 1990s. Currently, valuations are at or near levels reached during those two historical market peaks. Current valuations have long since surpassed all other prior valuation peaks.

One major difference between the late 1920s, the late 1990s, and today is the extent to which the Federal Reserve (Fed) is fostering current market conditions and imprudent investor behavior. To what extent have investors fallen into the overconfidence trap as the herd marches onward?

This “ignorance is bliss” type of behavior raises some serious questions, especially in light of the recent changes in Fed policy.

Not QE

As predicted in QE By Any Other Name, the Fed recently surprised investors with a resumption of quantitative easing (QE). The announcement of $60 billion in monthly Treasury bill purchases to replenish depleted excess reserves and another $20 billion to sustain existing balances was made late in the afternoon on Friday October 11. With a formal FOMC meeting scheduled in less than three weeks, the timing and substance of this announcement occurred under unusual circumstances.

The stated purpose of this new round of QE is to address recent liquidity issues in the short-term funding markets. Up to this point, the Fed added additional liquidity through its repo facility. These are actions not taken since the financial crisis a decade ago. The liquidity problems, though not resolved, certainly have largely subsided.

So why the strange off-cycle announcement? In other words, why did the Fed seemingly scramble over the prior few days to announce a resumption of QE now? Why not wait to make this announcement through the normal FOMC meeting statement and press conference process? The answer to those questions tells us more about current circumstances than the actual policy change itself.

The Drowning Man

As is always the case with human beings, actions speak louder than words. If you observe the physical behavior of someone in distress and know what to look for, you learn far more about their circumstance than you would by listening to their words. As an example, the signs of drowning are typically not what we would expect. A person who is drowning can often appear to be playing in the water. When a person in the water is in distress, their body understands the threat and directs all energy toward staying alive.

People who drown seldom flail and scream for help as is often portrayed on television. If you ask a drowning person if they are okay, you might not receive a response. They are often incapable of producing the energy to speak or scream as all bodily functions are focused on staying afloat.

Since the Financial Crisis, investors, market analysts, and observers are helplessly watching the Fed, a guardian that does not realize the market is drowning. The Fed, the lifeguard of the market, is unaware of the signs of distress and unable to diagnose the problem (see also The Voice of the Market – The Millennial Perspective).

In this case, it is the global banking system that has become so dependent on excess reserves and dollar liquidity that any shortfall, however temporary, causes acute problems. Investor confidence and Fed hubris are blinding many to the source of the turbulence.

Lifeguards

Fortunately, there are a few other “lifeguards” who have not fallen into the behavioral traps that prevent so many investors from properly assessing the situation and potential consequences.

One of the most articulate “lifeguards” on this matter is Jeff Snyder of Alhambra Investments. For years, he has flatly stated that the Fed and their army of PhDs do not understand the global money marketplace. They set domestic policy and expect global participants to adjust to their actions. What is becoming clear is that central bankers, who more than anyone else should understand the nature of money, do not. Therefore, they repeatedly make critical policy errors as a result of hubris and ignorance.

Snyder claims that without an in-depth understanding of the dollar-based global lending market, one cannot grasp the extent to which problems exist and monetary policy is doomed to fail. Like the issues that surfaced around the sub-prime mortgage market in 2007, the funding turmoil that emerged in September was a symptom of that fact. Every “solution” the Fed implements creates another larger problem.

Another “lifeguard” is Daniel Oliver of Myrmikan Capital. In a recently published article entitled QE for the People, Oliver eloquently sums up the Fed’s policy situation this way:

“The new QE will take place near the end of a credit cycle, as overcapacity starts to bite and in a relatively steady interest rate environment. Corporate America is already choked with too much debt. As the economy sours, so too will the appetite for more debt. This coming QE, therefore, will go mostly toward government transfer payments to be used for consumption. This is the “QE for the people” for which leftwing economists and politicians have been clamoring. It is “Milton Friedman’s famous ‘helicopter drop’ of money.” The Fed wants inflation and now it’s going to get it, good and hard.”

We added the emphasis in the quote because we believe that to be a critically important point of consideration. Inflation is the one thing no one is looking for or even considering a possibility.

Summary

Today, similar to the months leading up to the Financial Crisis, irrational behavioral biases are the mindset of the market. As such, there are very few “lifeguards” that know what to look for in terms of distress. Those who do however, are sounding the alarm. Thus far warnings go largely unheeded because blind confidence in the Fed and profits from yesteryear are blinding investors. Similar to the analogy James Grant uses, where he refers to the Fed as an arsonist not a firefighter, here the Fed is not the lifeguard on duty but the invisible undertow.

Investors should frequently evaluate a list of cognitive biases and be aware of their weaknesses. Humility will be an enormous asset as this economic and market expansion ends and the inevitable correction takes shape. We have attached links to our other behavioral investing articles as they may be helpful in that difficult task of self-evaluation.

Finally, we must ask what asset can be a life preserver that is neither being chased higher by the herd nor providing any confirmation bias.

Gold is currently one of the most hated investments by the media and social media influencers. The only herd following gold are thought to be relics of ancient history and doomsday preppers. Maybe, as we saw in the aftermath of the prior valuation peaks, those who were ridiculed for their rigor and discipline will once again come out on top.

Gold provides ballast to a portfolio during troubling times and should definitely be considered today as the distress becomes more pronounced and obvious.

Please find below links to some of our favorite behavioral investing articles:

Dalbar 2017: Investors Suck at Investing and Tips for Advisors

8 Reasons to Hold Some Extra Cash

The 5-Laws Of Human Stupidity & How To Be A “Non-Stupid” Investor

The Money Game & the Human Brain

The Definitive Guide to Investing for the Long Run

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.