Traders are always asking me how to trade volatility.

Short volatility has certainly been the way to go this year with VIX Short-Term Futures (NYSEARCA:VXX) down 43%, Ultra VIX Short-Term Futures (NYSEARCA:UVXY) down 70% and Short VIX Volatility (NYSEARCA:SVXY) up 65%. Truly amazing returns in anyone’s language.

Over the weekend Russell Rhoads shared a trade that he spotted being placed by a large trader: VIX call spreads.

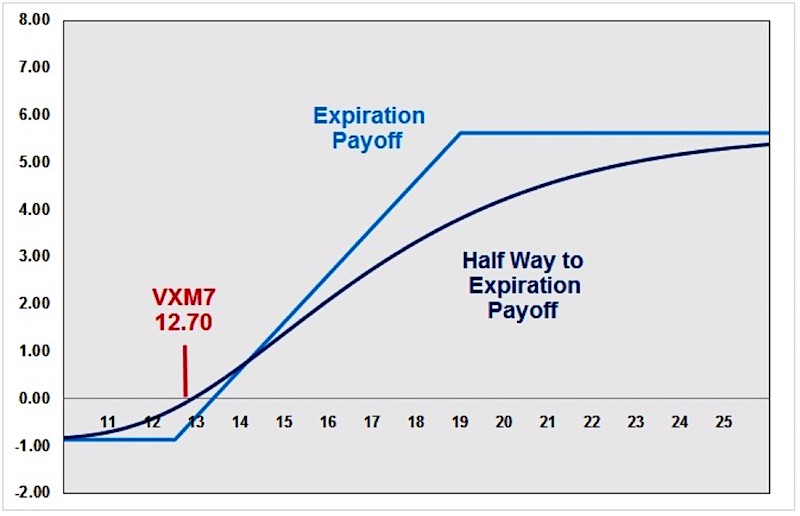

With the Volatility Index (INDEXCBOE:VIX) dipping briefly below 10 on Friday, a trader bought a large number of the June 21st $12.50 VIX calls and sold an equal number of June 21st $19 calls.

The trade cost $87 per contract with a maximum potential payoff of $563 per contract.

The payoff diagram is shown below. A spike in the VIX to anything above 13 over the next few weeks means this trade will be looking pretty good.

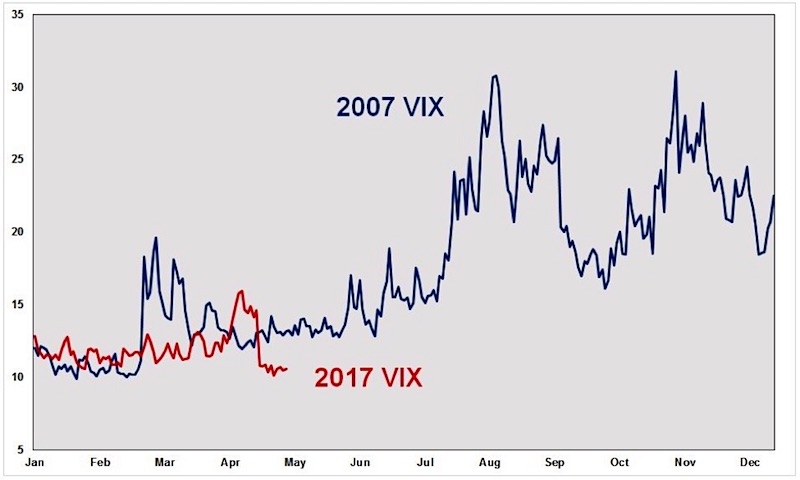

Short volatility is a very crowded trade right now and the VIX is at levels not seen since 2007. Perhaps now is finally the time to get long volatility?

Below you can see the comparison of VIX in 2007 to 2017.

We are coming into a time of the year when we have seen sharp corrections in the past (which would mean a higher VIX). Time will tell if we see the same again this year.

Catch more of my options trading analysis over at my site Options Trading IQ. Thanks for reading and trade safe!

ALSO READ: Is A Bull Market IN Volatility Nearing?

Twitter: @OptiontradinIQ

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.