Most investors are aware that stocks tend to perform well into year-end. It’s that time of year and stocks have definitely upheld their billing. But with such a big rally already behind us, it’s logical to wonder if we will still see a typical santa claus rally.

As well, the rally has lead pushed the VIX Volatility Index to new 3 month lows, hanging around the 11-12 area. We have seen a tendency for mini-VIX spikes in early December as the markets unload some complacency before a light volume santa claus rally.

But it’s December 8 and investor complacency (as measured by the VIX) is alive and well. So what do we make of VIX lows December stock market performance.

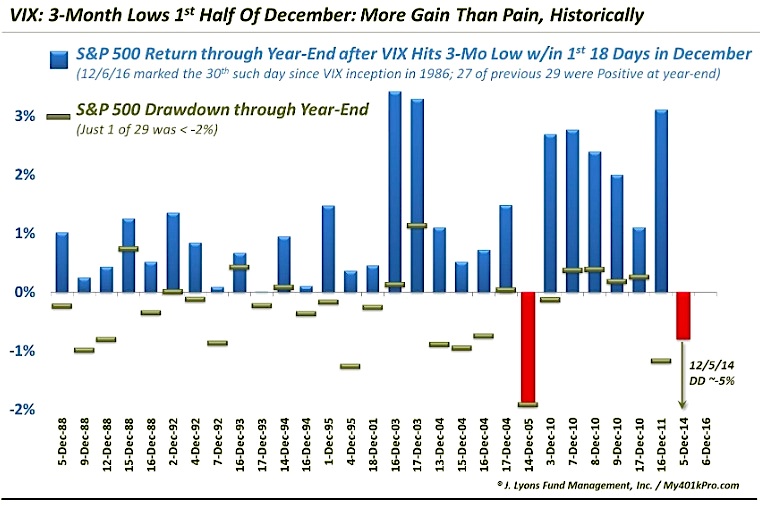

Today I took a look at what market returns into year-end looked like when the VIX made new lows in December. The chart below include market performance as well as subsequent drawdown levels. Historically, there’s been more gains than pains. That’s no reason to be complacent, but perhaps the santa rally is still on schedule.

Low market volatility recordings are a good reason to raise your investor antennae, but not necessarily a sell indicator by itself. I tweeted this out on December 6:

“$VIX: 3-Month Lows In 1st Half Of December: More Gain Than Pain, Historically $SPY”

Thanks for reading and best of luck into year-end.

Twitter: @JLyonsFundMgmt

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.