Value investing is an active management strategy that considers company fundamentals and the valuation of securities to acquire that which is undervalued.

The time-proven investment style is most clearly defined by Ben Graham and David Dodd in their book, Security Analysis.

In the book they state, “An investment operation is one which, upon thorough analysis promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.”

There are countless articles and textbooks written about, and accolades showered upon, value investing and the Mount Rushmore of value investors (Graham, Dodd, Berkowitz, Klarman, Buffett, et al.).

Yet, present-day “investors” have shifted away from the value proposition these greats profess as the time-tested secret to successful investing and compounding wealth.

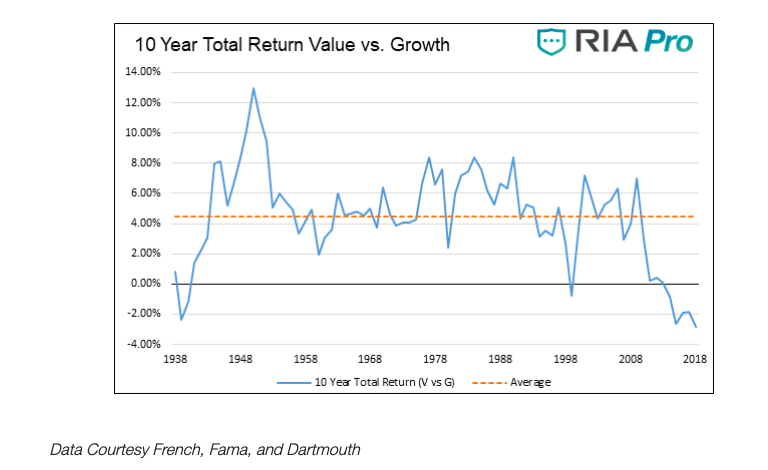

The graph below shows running ten year return differentials between value and growth stocks. Clearly, as shown, investors are chasing growth at the expense of value in a manner that is quite frankly unprecedented over the last 90 years.

In the 83 ten year periods starting in 1936, growth outperformed value investing only eight times. Five of those ten year periods ended in each of the last five years.

Value Investing and the Current Contrast

Value stocks naturally trade at a discount to the market. Companies with weaker than market fundamental growth leads to discounted valuations and a perception among investors that is too pessimistic about their ability to eventually achieve a stronger growth trajectory.

Growth stocks are those that pay little or no dividends but promise exceptional revenue and earnings growth in the future.

The outperformance of growth over value stocks is natural in times when investors become exuberant. Modern-day market participants claim superior insight into this Fed-controlled, growth-friendly environment. Based on the media, it appears as if the business cycle is dead, and recessions are an archaic thing of the past. Growth stocks promising terrific streams of cash flow at some point in the future rule the day. This naturally leads to investors becoming too optimistic and extrapolate strong growth far into the future.

Meanwhile, value companies tend to retain an advantage by offering higher market yields than growth stocks. That edge may only be 1 or 2% but compounded over time, it is significant. The problem is that when valuations on the broad market become elevated, as they are now, that premium compresses and diminishes the income effect. The problem is temporary, however, assuming valuations eventually mean-revert.

One other important distinction of value companies is that they, more commonly than growth companies, end up as takeover targets. Historically, this has served as another premium in favor of value investing.

Over the course of the past 12 years, however, corporate capital has uncharacteristically been more focused on growth companies and the ability to tell their shareholder a tale of wild earnings growth that accompany their takeover targets. This is likely due to the environment of ultra-low interest rates, highly accommodative debt markets, and investors that are not focused on the inevitability of the current business cycle coming to an end.

Active versus Passive

Another related facet to the value versus growth discussion is active versus passive investment management. Although active management may be involved in either category, value investing, as mentioned above, must be an active strategy. Managers involved in active management require higher fees for those efforts. Yet, as value strategies have underperformed growth for the past 12 years, many investors are questioning the active management logic.

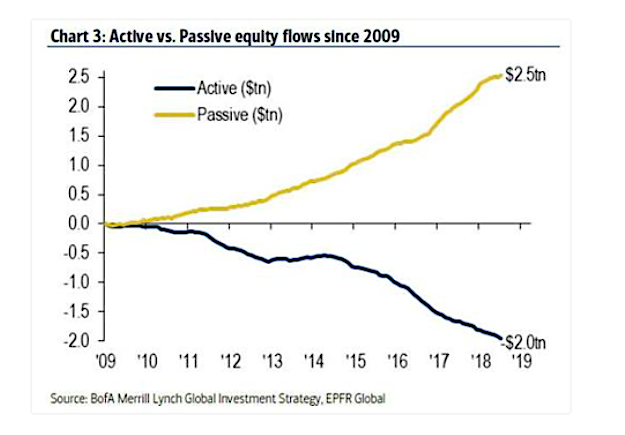

Why pay the high fees of active managers when passive management suffices at a cost of pennies on the dollar? But as Graham and Dodd defined it, passive strategies are not investing, they are speculating. As the graph below illustrates, the shift out of active management and into passive funds is stark.

Overlooking the historical benefits and outperformance of value investing managers, current investors seek to chase returns at the lowest cost. This behavior is reflective of a troubling lack of discipline and suggests that investors are complacent about the possibility of having their equity wealth cut in half as it was in two episodes since 2000.

Pure passive investing, investing in a mutual fund or exchange-traded fund (ETF) that mimics an index, represents a low-fee approach to speculation. It does not involve “thorough analysis,” the promise of “safety of principal,” or an “adequate return.” Capital received is immediately deployed and invested dollars are weighted most heavily toward the most expensive stocks. This approach represents the opposite of the “buy-low, sell-high” golden rule of investing.

Active management, on the other hand, involves analytical rigor by usually seasoned managers and investors seeking out opportunities in good companies in which to invest at the best price.

Definition of Terms

To properly emphasize the worth of value investing, it is important first to define a couple of key terms that many investors tend to take for granted.

Risk – Contrary to Wall Street marketing propaganda, risk is not a number calculated by a formula in a spreadsheet. Risk is simply the likelihood of a substantial and permanent loss of capital with no ability to ever recover. Exposure to risk cannot be mitigated by blind diversification. Real risk cannot be quantified by processing the standard deviation of historical returns or the sophisticated variations of Value-at-Risk. These calculations and the many assumptions within them lead to misperceptions and misplaced confidence.

Wealth – Wealth is savings. It is that which is left over after consumption and is the accumulation of savings over time. Wealth results from the compounding of earnings. Wealth is not the net value of assets minus liabilities. That is a balance sheet metric that can change dramatically and suddenly depending on economic circumstances. An investor who seeks to sell high and buy low, like a business owner who prudently waits for opportunities to buy out competitors when they are distressed, uniquely illustrates proper wealth management and are but two forms of value investors.

Economic Worldview

Understanding these terms is important because it affects one’s economic worldview and the ability to make prudent investment decisions consistently. As Dylan Grice of Edelweiss Holdings describes it:

“Language is the machinery with which we conceptualize the world around us. Devaluing language is tantamount to devaluing our ability to think and understand.” Grice continues, clarifying that point, “linguistic precision leads to cognitive precision.”

Value investors understand that compounding wealth depends on avoiding large losses. These terms and their proper definitions serve as a rock-solid foundation for sound reasoning and analytical rigor of market forces, central bank policies, and geopolitical dynamics that influence global liquidity, asset prices, and valuations. They enable critical foresight.

Proper definitional terms clarify the logical framework for an investor to benchmark their wealth, net of inflation, rather than obsessing with benchmarking returns to those of the S&P 500 or other passive indexes. Redefining one’s benchmark to inflation plus some excess return properly aligns target returns with life goals. Comparisons to the returns of the stock market are irrelevant to your goals and induce one to be dangerously urgent and speculative.

Value investing is having the courage to be opportunistic when others are pessimistic, to buy what others are selling, and to embrace volatility because it is in those times of upheaval that the greatest opportunities arise. That courage is derived from clarity of goals and a sturdy premise of assessing value. This is not an easy task in a world where the discounting mechanism itself has become so disfigured as to be rendered little more than a reckless guess.

Properly executed, value investing seeks to find opportunities to deploy capital in such a way that reduces risk by acquiring assets at prices that are sufficiently below intrinsic value. This approach also extends to potential gains and creates a desirable performance asymmetry.

In the words of famed investor and former George Soros colleague, Jim Rogers, “If you buy value, you won’t lose much even if you’re wrong.” And let’s face it, everybody in this business is wrong far more than they’re right.

Summary

Analytically, safety, and profits are rooted in buying assets with abnormally large risk premiums and then having the patience to wait for mean reversion. It often requires the rather unconventional approach of identifying those areas where there is distress and misguided selling is occurring.

As briefly referenced above in the definition of wealth, a value investor manages money as a capitalist business owner would manage his company. A value investor is more interested in long-term survival. Their decisions are motivated by investing in companies that are doing those things that will add to the substance and durability of the enterprise. They are interested in companies that aim to enhance the cash flow of the operation and, ideally, do so with a very long time-preference and as a habitual pattern of behavior.

Unlike a business owner and an “investor,” most people who buy stocks think in terms of acquiring financial securities in hopes of selling them at a higher price. As a result, they make decisions primarily with a concern about what other investors’ expectations may be since that will determine tomorrow’s price. This is otherwise known as speculation, not investing, as properly defined by Graham and Dodd.

Although value investing strategies have underperformed relative to growth strategies for the past decade, the extent to which value has become cheap is reaching its limit.

I leave you with a question to ponder; why do you think Warren Buffet’s Berkshire Hathaway is sitting on $128 billion in cash?

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.