A Shot Of Absolute: Fortifying a Traditional Investment Portfolio

In the seven years since the financial crisis, most asset prices have experienced significant appreciation, allowing for even the most inexperienced of investors to increase their wealth. As the saying goes, “a rising tide lifts all boats”. For investment managers, assessing the tide of financial momentum and making fitting allocation decisions are extremely important. Accordingly, we have warned on numerous occasions, most recently in “Dear Prudence” and “Price to Sales Ratio – Another Nail in the Coffin”, that valuations in the equity markets are extreme, economic growth is stagnating, and corporate earnings are declining. These warnings are not an emotional reaction to a “feeling” we have, they are a quantitative assessment based on analytical rigor and durable historical precedence. In simple terms, we believe the tide may be turning and considering new investment strategies would be wise.

In this article we highlight the benefits of an Absolute Return strategy and discuss how this alternative strategy can help protect a portfolio when traditional strategies offer poor expected returns. We also explain how investment managers can utilize an Absolute Returns strategy as part of a traditional stock/bond portfolio to limit risk and potential loses.

What is an Absolute Return Portfolio?

The primary goal of investing is to increase wealth or purchasing power. Warren Buffet is quoted as saying “Rule number 1 of investing is never lose money. Rule number 2 is never forget rule number 1.” The hidden message in these seemingly obvious statements is that building wealth depends much more on preventing large losses than it does on achieving large gains. If you need a reminder on the value of limiting your losses please read “Limiting Losses”.

While all investment strategies aim to make money, most investment managers employ different variations of a passive approach commonly known as a “relative return” or Modern Portfolio Theory (MPT) model. Under this approach, managers diversify investments between asset classes and sub-classes (typically stocks and bonds) and then hope for the market to deliver positive returns. In the end, however, they get the return the market provides. The performance of a relative return manager is largely dependent upon the general direction of the market.

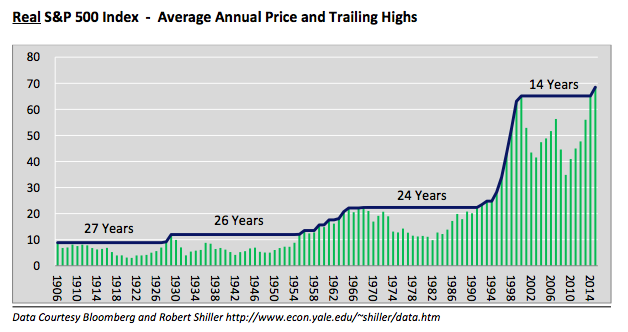

Investors in passive investment strategies expect a market-based return with the hope for additional gains, otherwise known as alpha. The embedded assumption, whether the investor realizes it or not, is that the market will continue to rise indefinitely and at a rate greater than inflation. As we know, and were reminded of in 2000 and again in 2008, this is not always the case. The 2000-2002 and 2007-2009 declines reduced the stock market value by over 50% in both instances. It can be difficult to build wealth with such a strategy in an environment like the last 15 years, as one’s net worth routinely gets impaired significantly. While true that the stock market, as a long term investment, has generally delivered relatively good returns, there have been long stretches of time where this has not been the case. The graph below highlights such periods where the real, or inflation-adjusted, price of the S&P 500 (INDEXSP:.INX) stagnated.

An alternative, action-based strategy to investment management is an Absolute Return strategy (AR). It is “action-based” because the returns of the portfolio are derived primarily from the actions of the investment manager. The manager is not beholden to a pre-determined, model-based asset allocation but rather is continually engaged in finding cheap securities to own or over-valued securities to sell. AR managers also tend to use a wider variety of asset classes than relative value managers. In short, an AR manager seeks to generate positive returns without regard for whether the market trend is bullish or bearish.

An Absolute Return strategy typically seeks return objectives based on a spread over the rate of inflation as opposed to passive strategies which base returns on historical assumptions that the market will return say 8%, just because “it always has”. AR managers use sound logic to arrive at a reasonable target that, if achieved, guarantees an increase of real wealth and therefore purchasing power. Their objective truly is geared toward avoiding losses over some reasonable time-frame at all costs. For them, being down 25% when the market is down 50% is not success.

An example of an Absolute Return strategy goal may be CPI + 3% for a retiree. At that rate, the retiree can potentially sustain their lifestyle without eroding their capital base. An endowment with a 6% spending policy would aim for a target return of CPI + 6% on a similar premise. Achieving or exceeding the targeted return, CPI, ensures that wealth and purchasing power are, at a minimum, sustained. This approach also affords a clear and specific benchmark against which a manager may be held accountable.

An Absolute Return strategy requires more knowledge, skill and rigor than traditional passive investment strategies, which make them inherently more difficult to execute. This helps explain why so many investment managers choose to pursue market-dependent, passive strategies. After all, who wants to be held accountable if, in bad years, they can simply throw their hands up and say “who knew the market would fall 50%?” Your clients deserve more.

Blending an Absolute Return Strategy with a Traditional Asset Mix

Many investment managers do not have the flexibility or a mandate to enact a pure Absolute Return strategy. However, despite these limitations, many managers have the ability to employ an Absolute Return strategy within a traditional relative value portfolio. While we could certainly make a convincing argument that an Absolute Return strategy with a performance benchmark/objective tied to a client’s cost of living is more appropriate than a strategy and benchmarks tied to the equity market, we are aware of “how the business operates” and the reluctance for investment managers and their clients to change.

For managers and clientele benchmarked to market returns, an allocation to an Absolute Return strategy can be a valuable risk management tool, especially when equity and fixed income valuations are expensive and their expected returns are poor. In this vain we analyze expected future returns for the U.S. equity and fixed income markets to help assess the suitability of an allocation to AR. We then take a look at the last 16 years to show how different strategic allocations between traditional and AR strategies performed.

Expected U.S. Equity Returns: While there are many ways to forecast equity returns, we prefer a simple cash flow model. In 720 Global’s model, ten years of expected cash flows (purchase, dividends and sale) are generated based on numerous assumptions. The two most important assumptions are that the Price to Earnings ratio regresses to its historical average and that earnings and dividends grow 2% a year. With said expectations, our model currently calculates expected equity returns of 1.48% based on the last 12 months of earnings and 0.42% when we base returns on 10 year average earnings (CAPE10 – P/E ratio based on 10yr average earnings). The expected returns are stated in nominal terms and could easily turn out to be negative if inflation is the same or higher than it has averaged over the last 10 years.

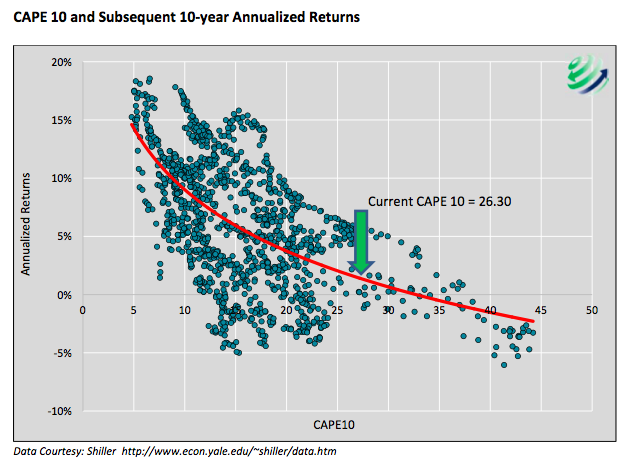

We share the graph below to help affirm our model’s expectations. The scatter plot below matches the monthly CAPE10 ratio and the subsequent 10-year annualized returns (inflation adjusted and dividends included) since 1900.

The slope of the red trend line moves from the upper left of the graph to the lower right as one would expect highlighting that cheaper valuations/lower CAPE10 readings tend to result in higher future returns and vice versa. Currently, at a CAPE10 of 26.30, the expected inflation adjusted annualized return for the S&P 500 over next 10 years is 2.20%, a far cry from the average, inflation-adjusted, annualized return of 6.10%.

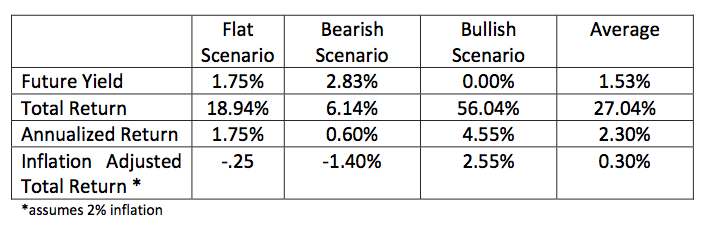

Expected Fixed Income Returns- To predict future fixed income returns for the next ten years, we use the current yield on a 20-year Treasury bond, a ten year investment horizon and three equally weighted scenarios. The three scenarios are as follows:

1) Status quo – 20-yearTreasury bond yields stay static at 1.75%.

2) Bearish – Bond yields rise to 2.83% as forecasted by the forward curve. To calculate this number, solve for the expected yield as implied by the current rate of a 10-year bond, 10 years from now. This is also known as the 10-year forward rate or the 10×10. Keep in mind this scenario is very optimistic as bond yields could rise significantly higher, inflicting great losses on bond holders.

3) Bullish – Bond yields go to zero. While seemingly unfathomable, many sovereign bonds of lesser credit quality are trading at or below a zero yield to maturity, so we cannot rule out such a bullish scenario.

As shown in the table above, the most extreme, bullish scenario we can logically arrive at provides a respectable annualized, inflation adjusted yield of 2.55%. The average of the three scenarios delivers an inflation adjusted return of just .30%. If rates rise from today’s unprecedented low levels, inflation adjusted returns will most likely be negative.

Expected Returns for Traditional Stock/Bond Portfolios and AR Portfolios

Based on the meager expected returns calculated above, any combination of stocks and bonds, whether evenly distributed or heavily biased towards either asset class, could produce a total return of 2% or less, again adjusted for inflation over the next ten years. However, in the short term there is a distinct possibility of losses as markets tend to experience acute downside after trading at high valuations.

Given the potential for historically poor returns, we evaluate three sample portfolios to highlight why one might want to consider an Absolute Return strategy. The portfolio returns detailed in this analysis are modeled over the last fifteen years in their entirety and also segmented for each bullish and bearish cycle within the 15 year term. The three sample portfolios are detailed below:

- A simplified traditional portfolio which is invested 75% in the S&P 500 and 25% in 10-year U.S. Treasury bonds.

- A 100% Absolute Return (AR) portfolio which assumes a return of CPI +3%.

- A combination of the traditional and AR portfolios listed above with a 65% traditional allocation and 35% AR allocation.

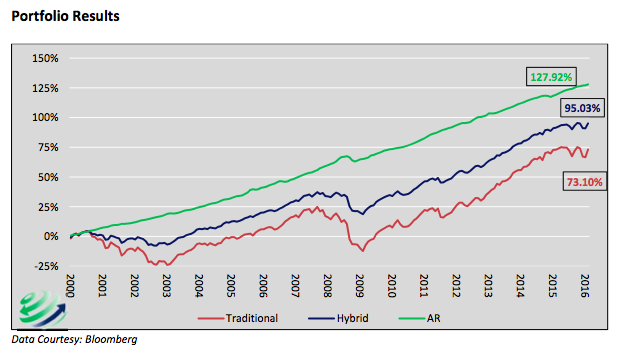

The following graph plots each portfolio’s running total returns.

The AR (CPI+3%) portfolio (green) was clearly the best performer over the entire period, followed by the hybrid portfolio (blue) and lastly the traditional portfolio (orange). Interestingly, the traditional portfolio outperformed the hybrid portfolio and the AR portfolio during the large majority of years (as shown in next table), however, the bear market losses of 2000-2002 and 2008-09 inflicted serious damage that was insurmountable.

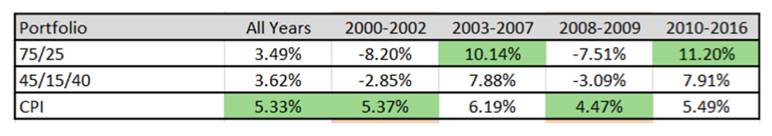

Earlier, we noted that rotating between strategies based upon expected market returns is a reasonable approach for a traditional portfolio manager looking to fortify returns and limit drawdowns when expected returns are not favorable. The table below details annualized portfolio returns for the entire 15 year period as well as each bullish and bearish episode during this era. The best performing portfolio for each period is highlighted in green.

As one would expect, the traditional portfolio clearly outperformed during the longer, bullish periods which comprised the majority of the 15 years. However, despite the long stretches of outperformance, the Absolute Return strategy and the hybrid strategy outperformed over the entire period.

As we wrote in “Limiting Losses”:

Growing wealth through investing typically occurs over a long time horizon that includes many bullish and bearish market cycles. While making the most out of bull markets is important, it is equally important to avoid letting the inevitable bear markets reverse your progress.

Summary

Taking a passive stance and assuming the next seven years will be the like the last seven years is a perilous bet. Historically, equity valuations at current levels have produced very disappointing future returns. Fixed income with incredibly low yields provide little income, limited upside and a lot of negative price risk. We think that those looking to outperform their competition and help their clients grow real wealth, even during what may likely be lean years, should carefully consider an allocation to AR.

Thanks for reading.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.