Since the September low point last year US 10-Year treasury bond yields have risen 90bps, this compares to 125bps from the low point in July 2016 through to March 2017, or if you count it as one big move they’ve gone up 158bps.

What ever way you put it the move in treasury bonds has been substantial, so a logical question to ask is “have bond yields gone too far too fast?”

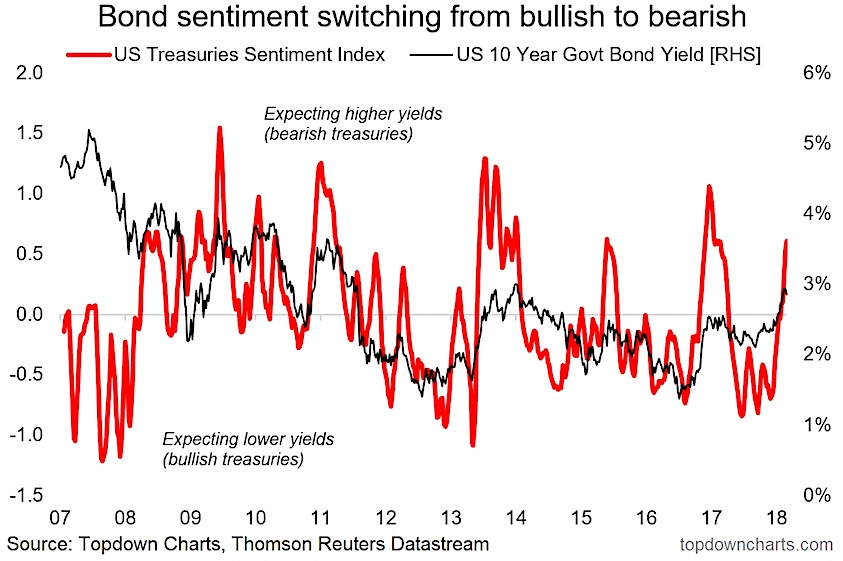

I talked about the tactical outlook for treasury bond yields a couple of weeks ago in the Weekly Macro Themes report, and a key chart from that was the one below – bond market sentiment.

The chart below shows our composite treasuries sentiment index. The index derives signals from bond market implied volatility, bond fund flows, speculative futures positioning, and sovereign bond market breadth. The combined signal has provided some truly insightful leads on the market, particularly when it reaches an extreme.

Note that I have lined it up with the US 10 year treasury bond yield to give an intuitive display of the swings in investor sentiment.

When it comes to sentiment indicators and incorporating them into a broader process, my view is that sentiment indicators typically contain ‘momentum information’ through the range, and ‘contrarian information’ at extremes. Thus I would say at this point we are swiftly transitioning from momentum to contrarian information, and the risk of a stabilization or pullback in yields is elevated at this point.

My medium term view remains that bond yields go higher. This view is informed by bond valuations still being at expensive levels, a positive growth/inflation outlook (strong cyclical picture), and a turning of the tides in monetary policy (specifically, with quantitative easing being gradually phased out globally and the Fed starting QT). Short-term, seasonality is also consistent with higher bond yields (through until about May-June).

So if I had to guess, I would say there is a decent risk of a short-term pull back in bond yields (i.e. rebound in bond prices), but that this will be a brief interlude as the medium-term trend will likely resume shortly thereafter.

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.