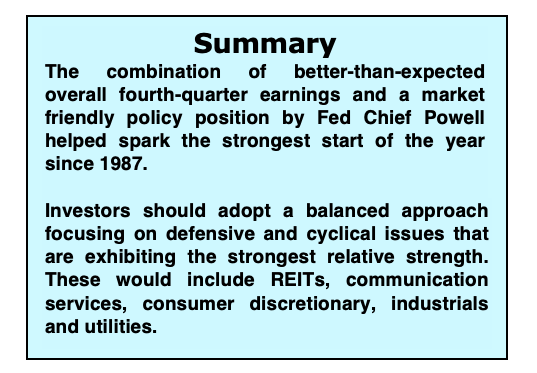

The equity markets closed out the month of January with the best start of a new year in more than 30 years.

The S&P 500, Nasdaq, Dow Industrials, and other broad based indices have been driven by stronger-than-expected earnings from a number of companies and the Federal Reserve’s statement that interest rate increases are on hold.

At this juncture, all the things that investors have worried about still remain. This includes deteriorating global economic conditions, a slower pace of earnings growth, unresolved issues with China and uncertainty surrounding a dovish Fed policy with job creation remaining exceptionally strong.

If the Fed’s assessment is correct, that the economy is slowing faster than expected, this could cause additional markdowns to 2019 earnings forecasts.

On the other hand, if the Fed was too quick to adopt a dovish stance and the labor markets continue to strengthen, Powell would be placed in the difficult position of having to raise interest rates later this year. This argues for a cautious approach in the short term.

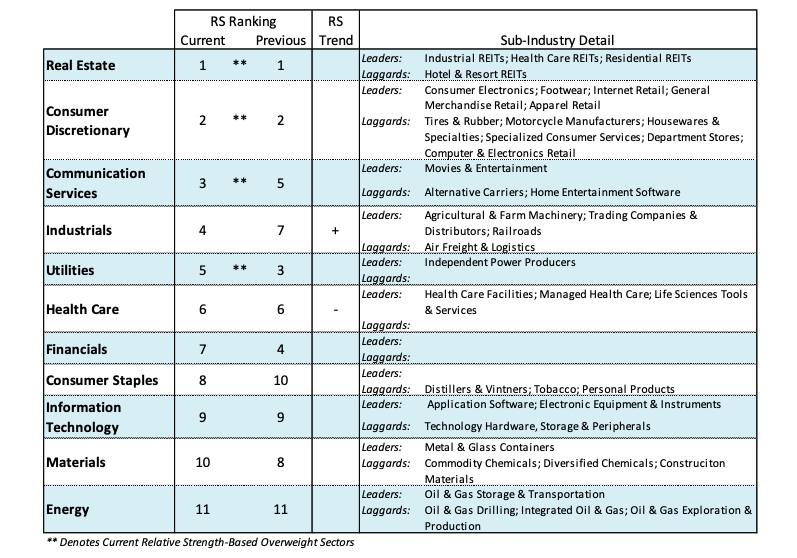

In the current environment, we recommend a balanced portfolio approach that includes defensive sectors along with cyclicals. This is echoed by our relative strength studies that show within the 11 sectors that make up the S&P 500 Index the top five in terms of relative strength include REITs, consumer discretionary, communication services, industrials and utilities. Investors should focus on this mix of defensive and cyclical areas of the market that are currently outperforming.

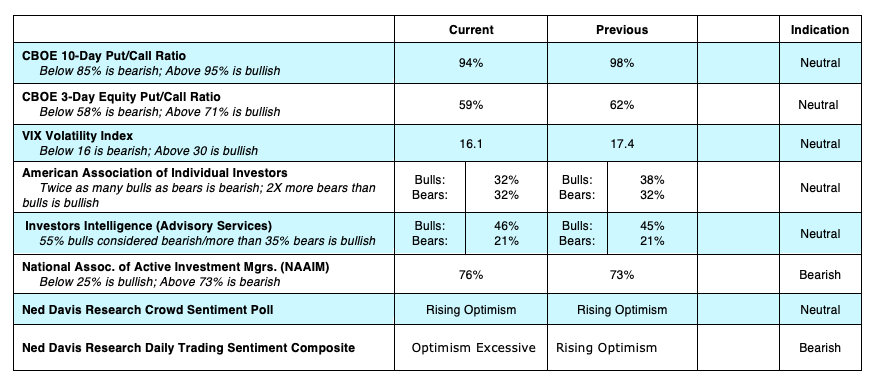

From a technical standpoint, stocks entered January from a deeply oversold condition in December, brought on by recession fears and global economic concerns, to a currently overbought condition. Sentiment reversed in January as measured by the Ned Davis Daily Trading Sentiment Composite which moved last week from extreme pessimism to optimism as financial concerns have eased.

From a contrary opinion perspective, the current optimism bodes for short-term caution. Other measures of investors sentiment that have reversed from pessimism to optimism include the survey from the American Association of Individual Investors (AAII) and data from Investors Intelligence, which tracks the opinion of Wall Street letter writers.

Additionally, since the December peak in the CBOE Volatility Index (VIX), which is widely used as a measure of investor psychology, the VIX has fallen more than 50% to levels last seen in early October just as the fourth-quarter decline was getting underway. This indicates that the mood of investors has shifted from fear to complacency.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.